Every insurance agent knows the feeling. You get a notification for a new lead, your heart skips a beat with potential, and you dial the number only to find it’s disconnected, a wrong number, or someone who has already been called by ten other agents. The promise of a growing pipeline quickly turns into the reality of wasted time and money.

Table of Contents

The market is flooded with vendors promising the world, but the quality gap is massive. To truly scale your business, you need a system for identifying the best insurance leads and filtering out the rest. This isn’t about finding the cheapest option; it’s about finding the provider that delivers the highest return on investment.

This checklist is your guide to vetting lead vendors in 2025. It moves beyond flashy marketing and focuses on the five core criteria that separate professional lead generation partners from simple data brokers.

The Anatomy of a High-Converting Insurance Lead

Before we dive into the checklist, let’s redefine what a “good lead” is. It’s more than just a name and a phone number. A high-quality lead has three key components:

- Clear Intent: The prospect actively sought out information and willingly provided their details.

- Verifiable Accuracy: The contact information is correct and has been validated.

- Exclusivity & Timing: You are the first and only agent to receive their information, and you receive it instantly.

Anything less is a gamble. Now, let’s use these principles to build our evaluation framework.

Your 2025 Checklist for Evaluating Insurance Lead Vendors

Use these five questions to analyze any lead provider you’re considering. Honest answers to these will give you a clear picture of the quality you can expect.

Criterion 1: Are the Leads Exclusive?

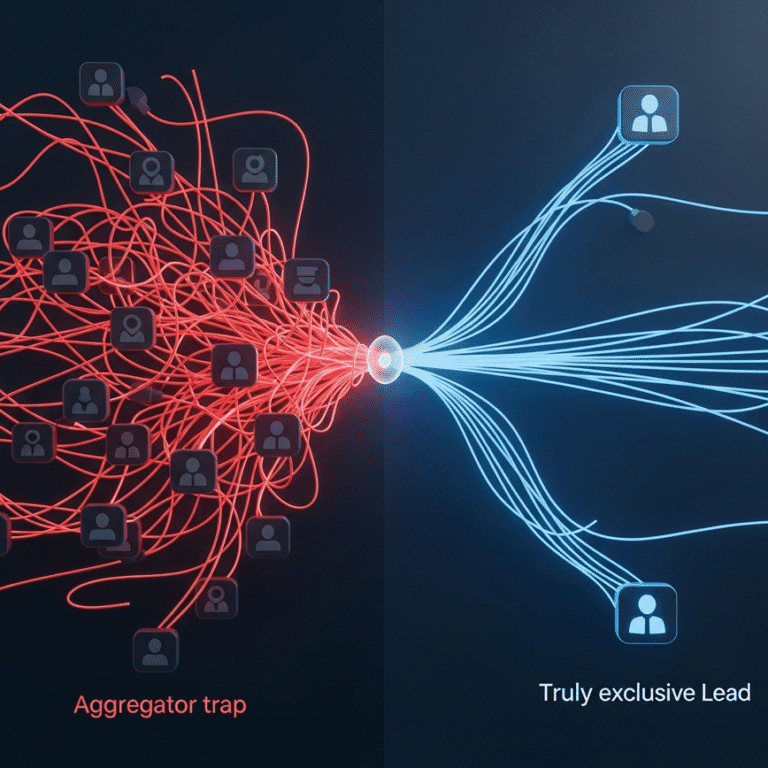

The single biggest factor that kills conversion rates is competition. When a lead is sold to five, ten, or even more agents, it creates a race to the bottom. The prospect gets overwhelmed with calls, becomes frustrated, and you’re forced to compete on price instead of value.

Demand 100% exclusivity. The best life insurance lead vendors understand that your success depends on a clean, one-on-one introduction. When you conduct insurance leads reviews, make this your first non-negotiable question. A lead should be yours and yours alone.

Criterion 2: Is Every Lead Verified?

How many times have you dialed a number only to find it’s fake? Unverified leads are a massive time sink. They clog your CRM and demoralize your sales team. A modern lead provider must have systems in place to validate data before it ever gets to you.

Look for providers that use multi-step verification, such as real-time SMS confirmation codes. This simple step confirms the phone number is active and the prospect is genuinely engaged. At Stallion Leads, we use an automation stack built on Twilio to ensure every phone number is real, preventing fake data from ever entering your pipeline.

Criterion 3: Can the Vendor Prove Compliance?

In today’s regulatory environment, compliance isn’t optional. Violating the Telephone Consumer Protection Act (TCPA) can result in crippling fines. A reputable vendor must be able to provide clear, documented proof of consent for every lead.

Ask potential vendors if their leads come with a TrustedForm certificate or a similar record of consent. This documentation should include a timestamp, IP address, and the exact language the prospect agreed to. A vendor who can’t provide this is exposing you to significant legal and financial risk.

Criterion 4: Is the Lead Generated in Real-Time?

A lead’s value decays exponentially. The odds of making contact with a lead drop by over 10 times in the first hour. If you’re receiving leads that are hours or even days old, you’re starting with a massive disadvantage.

The best insurance leads are delivered to your CRM or inbox the second the prospect hits “submit.” This requires a sophisticated, automation-first system that captures, verifies, and routes the lead instantly. Anything less, and you’re working with stale data.

Criterion 5: What is the Pricing Model?

The vendor’s business model tells you everything about their priorities.

- Pay-Per-Click/Impression: The vendor gets paid whether the leads are good or not. Their incentive is to generate traffic, not results for you.

- Pay-Per-Lead: This is better, but only if the quality is high.

- Pay-Per-Verified-Lead: This is the gold standard. The vendor’s success is directly tied to yours. They only win when they deliver a compliant, verified, and exclusive lead that meets quality standards.

A true performance partner operates on a pay-per-result model. You shouldn’t have to pay for fake numbers, duplicate submissions, or bad data.

Beyond the Checklist: Finding a Partner, Not Just a Vendor

A checklist can help you vet the technical aspects, but the best lead generation relationships are partnerships. Does the vendor offer support after the sale? Do they provide scripts, follow-up frameworks, or integration assistance to help you convert the leads they send?

A vendor sells you data. A partner invests in your success. They understand that their growth is tied directly to your ROI, creating a powerful alignment of incentives. They don’t just build lead lists; they help you build a predictable sales pipeline.

The Stallion Leads Difference: Where Quality Meets Performance

Evaluating vendors can be exhausting. That’s why we built Stallion Leads to check every box on this list from day one. Every lead we deliver is 100% exclusive, SMS-verified, and TCPA-compliant with a full TrustedForm certificate. Our pay-per-lead model means you only ever pay for qualified results, eliminating wasted ad spend and risk.

If you’re tired of sifting through low-quality lists and want to see how a true performance-based partnership works, it’s time to stop chasing dead ends. It’s time to get insurance leads that actually convert.

By holding your lead providers to a higher standard, you’re not just buying better data. You are investing in a more efficient, profitable, and scalable future for your insurance business.