The search for the best final expense leads can feel like a never-ending battle. For every promising prospect, there are a dozen dead ends: disconnected numbers, wrong information, and people who have no idea why you are calling. This constant grind doesn’t just waste your ad spend; it drains your motivation and stalls your agency’s growth. In a competitive market, relying on outdated lead sources or “cheap” lead lists is a direct path to burnout.

Table of Contents

- What Actually Defines the “Best” Final Expense Leads?

- The Hidden Costs of “Cheap” Final Expense Leads

- A Deep Dive into Final Expense Lead Generation Methods

- The Technology Stack Behind High-Converting Insurance Leads

- Choosing the Right Partner: Evaluating Insurance Lead Generation Companies

- How to Maximize ROI on Your Final Expense Leads

- Why Stallion Leads is the Future of Final Expense Lead Generation

- The Final Word on Finding the Best Leads

The truth is, the lead generation landscape has fundamentally changed. What worked five years ago is now inefficient and, in some cases, a serious compliance risk. Prospects are more discerning, and regulations like the TCPA (Telephone Consumer Protection Act) have become stricter. To succeed in 2025 and beyond, you need more than just a name and a phone number. You need a predictable pipeline of high-intent, fully-compliant, and verified prospects who are actively seeking the solutions you provide.

This guide cuts through the noise. We will deconstruct what truly makes a final expense lead valuable, explore the technology that separates winning agencies from the rest, and provide a clear framework for choosing from the many insurance lead generation companies promising the world. Prepare to move beyond chasing dead ends and start building a scalable, profitable final expense business.

What Actually Defines the “Best” Final Expense Leads?

The term “best” is subjective, but in the world of insurance sales, it boils down to one thing: return on investment (ROI). A lead is only as good as its ability to convert into a policy. The best insurance leads are not defined by a low price tag but by a specific set of non-negotiable qualities that directly impact your close rate.

High Intent: The Prospect is Actively Searching

Intent is the foundation of a quality lead. A high-intent prospect has actively taken steps to find information about final expense insurance. They didn’t just stumble upon an ad; they searched for terms like “burial insurance for seniors” or “final expense policy costs” and filled out a form requesting a quote. This active behavior signals a recognized need and a desire for a solution, making your first call a welcome conversation rather than a cold interruption. This is a world away from a lead generated from a contest entry or a generic survey.

Exclusivity: The Lead Belongs to You and You Alone

Imagine dialing a new lead only to find out you’re the fifth agent to call them that day. This is the reality of shared leads. When lead vendors sell the same information to multiple agents, it creates a brutal race to the bottom. The prospect gets frustrated, your credibility plummets, and your chances of closing the deal are slashed with every competitor’s call. The best final expense leads are 100% exclusive. When that lead hits your CRM, you are the only agent who has it, giving you the time and space to build rapport and properly serve the client.

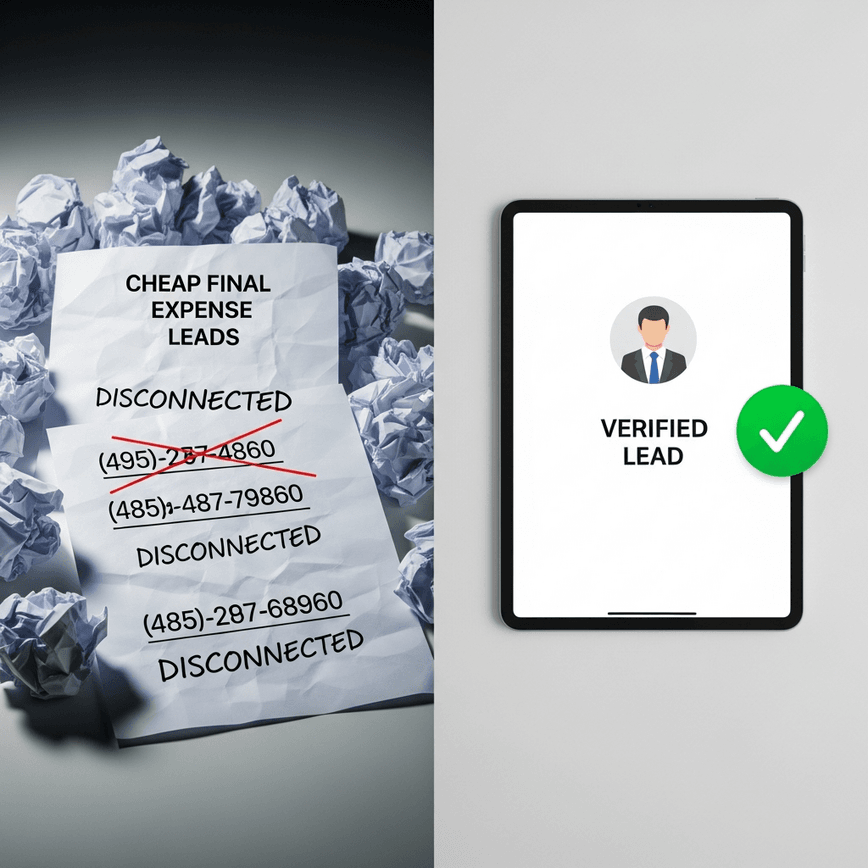

Verifiability: The Data is Real and Accurate

How much time do you waste on fake numbers, misspelled names, and bogus email addresses? Low-quality lead funnels are plagued with bad data. A premium lead generation system uses technology to validate information in real time. This often involves an SMS verification step where a prospect must enter a one-time code sent to their phone to confirm their number is real and in their possession. This simple step eliminates a huge percentage of junk data, ensuring that every lead you pay for represents a real person you can actually contact.

Compliance: The Consent is Documented and Provable

In today’s regulatory environment, compliance isn’t optional. A single TCPA violation can result in devastating fines. Every lead you contact must have a clear, documented record of consent. This is where technologies like TrustedForm come in. A TrustedForm certificate provides undeniable proof of consent, capturing a video of the user’s screen as they agree to be contacted. It records the timestamp, IP address, and exact language they agreed to. Working with a vendor that provides this level of documentation protects your business and ensures you are building on a foundation of trust and legality.

The Hidden Costs of “Cheap” Final Expense Leads

The allure of a $5 or $10 lead is strong, especially when you’re trying to manage a tight budget. But these seemingly low-cost options carry steep hidden costs that can cripple your business over time. Understanding these costs is crucial to appreciating the value of investing in quality.

Wasted Time and Morale Drain

Your time is your most valuable asset. Every minute spent dialing a disconnected number, leaving a voicemail for a non-existent person, or trying to win over a frustrated prospect who has already been called by three other agents is a minute you could have spent closing a deal. This isn’t just inefficient; it’s demoralizing. A constant stream of rejection from poor-quality final expense leads erodes an agent’s confidence and can lead to high turnover and burnout.

Damaged Reputation and Brand

When you call someone who didn’t explicitly ask to be contacted, you aren’t just an agent; you’re an interruption. When you are the fifth agent to call, you are a nuisance. Using low-quality, non-exclusive leads associates your name and your brand with a negative, spammy experience. This damages your reputation and makes it harder to earn trust, even when you eventually connect with a legitimate prospect.

The True Cost of a Bad Dial

Let’s break down the math. A “cheap” lead costs more than its sticker price. You have to factor in the cost of your dialer, your CRM, and most importantly, your time (or your agent’s salary). If it takes 50 cheap leads to make one sale, while it only takes 10 high-quality leads to make a sale, the “expensive” leads are profoundly more profitable. The upfront cost is higher, but the cost-per-acquisition is significantly lower, leading to a much healthier and more scalable business model.

A Deep Dive into Final Expense Lead Generation Methods

Not all final expense leads are created equal. The method used to generate a lead has a massive impact on its quality, intent, and conversion potential. Let’s examine the most common types.

Aged Leads: The Illusion of Value

Aged leads are old leads that were sold to another agent weeks, months, or even years ago. Vendors resell them at a steep discount, promising a cheap way to fill your pipeline. The problem? These prospects have either already been sold a policy, are no longer in the market, or are tired of being contacted. While the cost per lead is minimal, the conversion rate is often abysmal, making the ROI nearly impossible to justify.

Shared Leads: A Race to the Bottom

As mentioned earlier, shared leads are sold to multiple agents simultaneously. The business model for the vendor is to maximize their revenue from a single lead capture. For the agent, it’s a nightmare. You are in a high-pressure race to be the first to call, and even then, the prospect is likely to shop you against the other agents who are about to contact them. It turns a professional consultation into a frantic price war.

Direct Mail Leads: The Traditional (and Slow) Approach

Direct mail has been a staple of final expense marketing for decades. It can produce high-intent leads because the prospect has to take the physical action of filling out a card and mailing it back. However, the process is extremely slow and expensive. You have significant upfront costs for design, printing, and postage with no guarantee of a return. It can take weeks to see results, making it difficult to scale quickly or adjust your strategy on the fly.

Digital Leads: The Modern Gold Standard (When Done Right)

Digital leads, generated through platforms like Google, Facebook, and native ad networks, offer the best combination of speed, scale, and intent. When executed by experts, digital campaigns can pinpoint specific demographics and target users who are actively searching for final expense solutions.

The key phrase here is “when done right.” A top-tier digital lead generation process involves:

- Hands-On Media Buying: Campaigns aren’t just set and forgotten. They are managed within a master ad account where performance data compounds, allowing for constant optimization and scaling.

- Conversion-Optimized Funnels: Every element of the landing page and form, from the headline to the button color, is rigorously A/B tested to maximize the number of high-quality submissions. The questions asked are designed to pre-qualify the prospect and increase their engagement.

- Niche Specialization: The best results come from agencies that specialize exclusively in a single vertical, like Final Expense Insurance. This deep industry familiarity allows for more resonant ad copy, better targeting, and a deeper understanding of the prospect’s mindset.

The Technology Stack Behind High-Converting Insurance Leads

In 2025, the best insurance lead generation companies are not just marketing agencies; they are technology companies. A sophisticated and transparent tech stack is what separates compliant, high-intent leads from risky, low-quality data.

Real-Time Verification: Why SMS and Voice Matter

The first line of defense against bad data is verification. The most effective method is using an API from a service like Twilio to send a one-time password (OTP) via SMS to the prospect’s phone. To complete the form, they must enter that code. This instantly confirms they have provided a valid, working mobile number that they currently possess. This single step dramatically increases the quality and contact rate of the leads you receive.

TCPA Compliance and TrustedForm Certification

We cannot overstate the importance of compliance. A lead is worthless if contacting it puts your business at legal risk. Every lead must be accompanied by a TrustedForm certificate or equivalent proof of consent. This certificate is your legal shield, providing a clear, verifiable record that the individual knowingly requested to be contacted. Any vendor who cannot provide this level of documentation should be avoided at all costs.

AI-Powered Scoring and Instant Routing

The moment a lead is generated, the clock starts ticking. Modern lead generation systems use automation platforms (like n8n or Zapier) to process data instantly. This workflow can analyze lead data, score it based on specific criteria (like answers to qualifying questions), and route it directly to your CRM in seconds. This AI-powered efficiency ensures you get the lead while their intent is at its peak, maximizing your chance of a successful connection.

Conversion-Optimized Funnels and A/B Testing

The journey a prospect takes before they become a lead is critical. Sophisticated lead generators don’t use generic templates. They build custom funnels engineered to educate and pre-qualify prospects. Every question sequence is deliberately designed to filter out low-intent individuals and increase the commitment of those who complete the form. This meticulous A/B testing process results in a prospect who is not only qualified but also more prepared for your call.

Choosing the Right Partner: Evaluating Insurance Lead Generation Companies

With a clear understanding of what defines a quality lead, you can now evaluate potential partners more effectively. Look beyond the sales pitch and analyze their business model and processes.

The Pay-Per-Lead Model vs. Retainers and Ad Spend

Many marketing agencies require you to pay a monthly retainer or commit to a large ad spend budget. This model puts all the risk on you. You pay them whether their campaigns generate results or not.

A far superior model is Pay-Per-Lead. In this performance-based partnership, you only pay for a verified lead that meets pre-defined quality standards. The lead generation company carries the risk of the ad spend. Their success is directly tied to your success, which perfectly aligns your incentives. If you don’t get quality leads, they don’t get paid.

Transparency and Data Ownership

Ask a potential vendor tough questions about their process.

- Are the leads exclusive?

- Will I receive a downloadable proof-of-consent certificate with every lead?

- Is all data handled securely and processed via encrypted workflows?

- Do you ever resell or share leads?

Trustworthy partners are fully transparent. They will proudly show you their compliance documentation and explain their data handling procedures. They understand that trust is built on verifiable systems and clear communication.

Niche Specialization: Do They Live and Breathe Final Expense?

A generic “lead vendor” that serves dozens of industries cannot compete with a specialist. A company that focuses exclusively on Life Insurance and Final Expense develops a profound depth of knowledge. They understand the nuances of the target audience, the most effective marketing channels, and the specific pain points of the agents they serve. This singular focus compounds their learning and results in a consistently higher quality product.

Beyond the Lead: Do They Offer Support and Education?

The best lead generation companies view themselves as your partner, not just a vendor. Their job isn’t done when the lead is delivered. They should provide value-added resources to help you succeed, such as:

- Proven scripts for the first call and follow-ups.

- Frameworks for effective follow-up cadences.

- Guidance on CRM integrations and automation.

- Weekly insights and feedback to help you improve your close rate.

This commitment to your success demonstrates a true partnership mentality.

How to Maximize ROI on Your Final Expense Leads

Buying the best final expense leads is only half the equation. Your process for handling those leads is what ultimately determines your ROI.

Speed to Lead: The First 5 Minutes are Critical

Studies have shown that the odds of connecting with and qualifying a lead decrease by over 10 times in the first hour. When a new lead hits your system, your goal should be to contact them within five minutes. This is when their interest is at its absolute peak. They just filled out the form, and the problem they want to solve is top of mind. Instant, automated lead delivery is crucial to enabling this speed.

The Follow-Up Cadence: A Multi-Touch Approach

Most sales are not made on the first call. It’s essential to have a persistent, multi-channel follow-up process. A good cadence might involve a mix of calls, texts, and emails over several days. The goal is to be professionally persistent without being annoying. Using a CRM to automate this process ensures no lead ever falls through the cracks.

Scripting for Success: It’s a Conversation, Not an Interrogation

While you need a script to guide your calls, it shouldn’t sound robotic. The goal is to have a natural conversation, build rapport, and uncover the prospect’s needs. Your script should focus on open-ended questions. Acknowledge that they filled out a form online requesting information about a final expense program to cover their burial or cremation costs. This immediately frames the call correctly and builds on the intent they’ve already shown.

Why Stallion Leads is the Future of Final Expense Lead Generation

Finding a predictable and scalable source of high-quality leads is the key to unlocking exponential growth for your insurance agency. It requires a partner that combines deep industry experience with a sophisticated, compliance-first technology stack.

Stallion Leads was built from the ground up to solve the core problems that final expense agents face. We operate on a performance-based Pay-Per-Lead model, meaning our success is directly tied to yours. We carry all the risk of media buying and campaign optimization; you only pay for the results.

Every lead we deliver is:

- 100% Exclusive: You will never compete with another agent for our leads.

- SMS-Verified: We eliminate fake data and ensure every phone number is real and active.

- TCPA-Compliant & TrustedForm-Certified: Each lead comes with irrefutable proof of consent, protecting your business.

- Generated In-House: We manage every step of the process, from ad creation to the final conversion funnel, ensuring quality and consistency.

We don’t just sell leads; we build pipelines. We see ourselves as your performance partner, providing the support and resources you need to convert at the highest level. If you are tired of wasting money on empty clicks and chasing dead-end prospects, it’s time to experience the difference that a true performance partnership can make. Explore our exclusive, SMS-verified insurance leads stallionleads.com and see how we can help you close more policies and scale your business faster.

The Final Word on Finding the Best Leads

Navigating the world of final expense leads in 2025 requires a shift in mindset. You must move away from hunting for the cheapest option and focus on finding the partner that delivers the most value and the highest ROI.

The best leads are born from a combination of high user intent, technological verification, ironclad compliance, and total exclusivity. By prioritizing these qualities and partnering with a specialist who operates on a performance-based model, you can eliminate wasted ad spend, protect your business from legal risk, and build a sustainable pipeline of clients who genuinely need your help. Stop chasing and start closing.