For ambitious insurance agents, growth is a simple equation: the more qualified prospects you speak with, the more policies you write. But the path to a full pipeline is littered with expensive pitfalls, from dead-end data lists that waste your time to complex digital ad campaigns that burn cash with no tangible return. In this competitive landscape, the single most important metric you can track is your life insurance leads cost, but a simple price tag rarely tells the whole story of what you’re actually paying to acquire a new client.

Table of Contents

- Why Understanding Lead Cost is Critical for Insurance Agents

- The Traditional Models for Buying Leads (And Their Hidden Costs)

- The Modern Solution: Pay-Per-Lead Services

- Breaking Down the Real Life Insurance Leads Cost: What Are You Paying For?

- How to Find the Best Life Insurance Leads for Agents

- Why a Higher Lead Cost Can Mean a Lower Cost Per Policy

- Conclusion: Investing in Quality Leads is Investing in Growth

Understanding the true cost requires looking beyond the price per name and focusing on the price per policy. This is the only metric that truly reflects the health and profitability of your client acquisition strategy. This guide breaks down the different lead generation models, explains what factors determine the price you pay, and shows how a performance-based approach can deliver a predictable, scalable pipeline of interested prospects. We will explore why a higher initial cost for a quality lead often results in a much lower final cost to acquire a new client, saving you time, money, and frustration.

Why Understanding Lead Cost is Critical for Insurance Agents

In the insurance business, every dollar spent on marketing must be an investment, not an expense. It should generate a predictable and positive return. The only way to ensure you are making a smart investment is by diligently tracking your numbers. Your Cost Per Lead (CPL) is the starting point, but the ultimate goal is to lower your Cost Per Acquisition (CPA), which is the total amount you spend to close one policy. This figure includes not only the lead cost but also the value of your time and your team’s effort.

Failing to grasp the relationship between lead quality and final CPA is the fastest way to drain your marketing budget and burn out your team. Cheap leads might seem appealing on a spreadsheet, but if they do not answer the phone, are not actually qualified for a policy, or are already talking to ten other agents, your true cost skyrockets. You waste valuable time, energy, and morale chasing ghosts instead of having productive conversations with genuinely interested consumers. A clear understanding of your lead cost empowers you to make data-driven decisions, optimize your spending, and build a foundation for sustainable, long-term growth.

The Traditional Models for Buying Leads (And Their Hidden Costs)

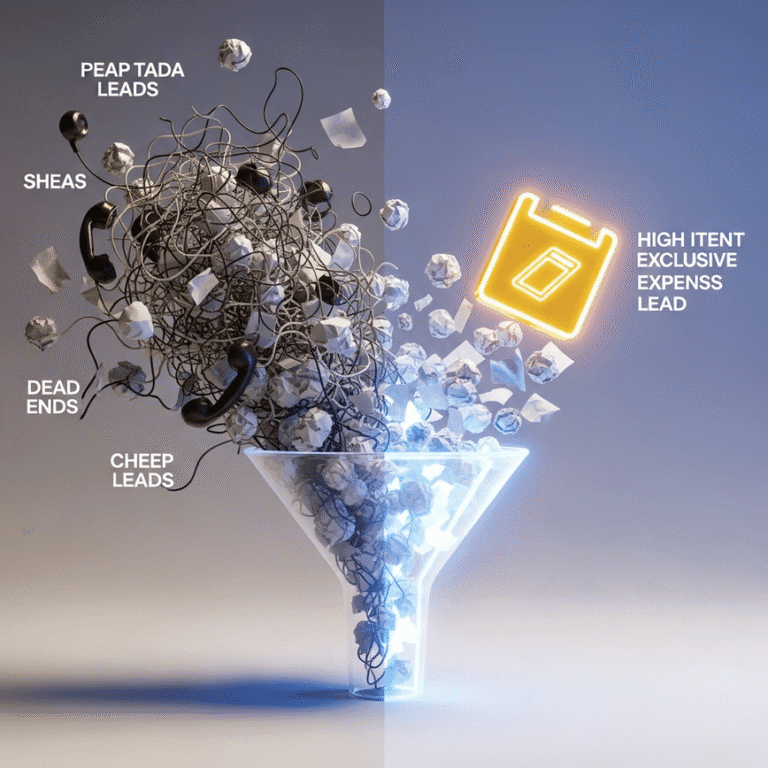

Not all leads are created equal, and neither are the methods used to generate them. The market is flooded with different types of leads, each with its own pricing model and inherent risks that can inflate your true cost per policy.

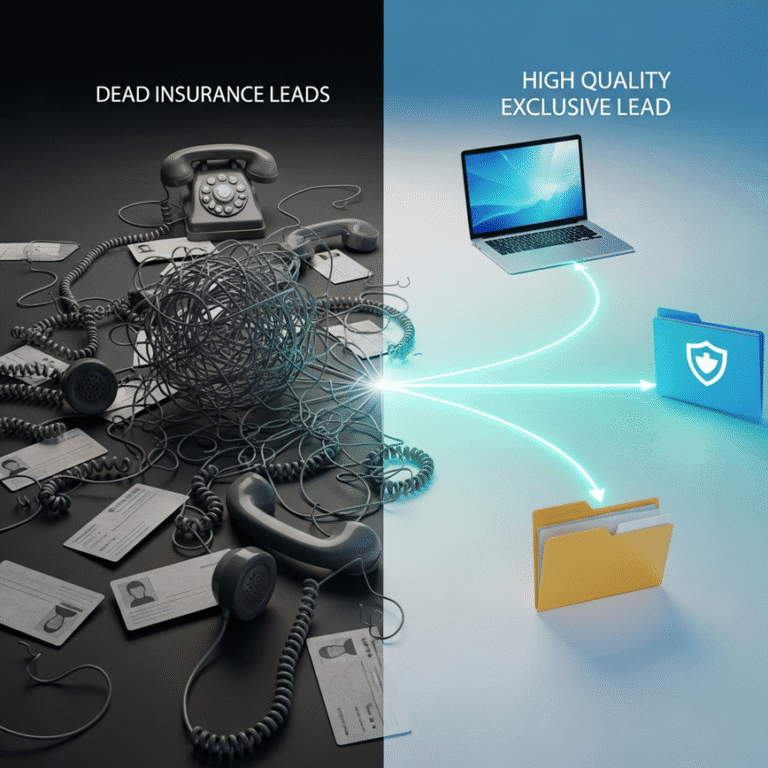

Model 1: Aged Leads

Aged leads are exactly what they sound like: old data. This is information from prospects who expressed some form of interest weeks, months, or even years ago. They are incredibly cheap, often sold in bulk for just a few dollars each, making them seem like a low-risk way to fill a CRM.

- The Problem: The low price is a direct reflection of their low value and the minimal effort required to acquire them. Contact rates are abysmal because the prospect’s original intent is long gone. In the time that has passed, they have likely already been contacted by dozens of other agents, have already purchased a policy, or their life circumstances have changed completely. You spend most of your day navigating dead numbers, disconnected lines, and frustrated rejections from people who barely remember filling out a form. The hidden cost here is your time and morale, which are far more valuable than the few dollars saved.

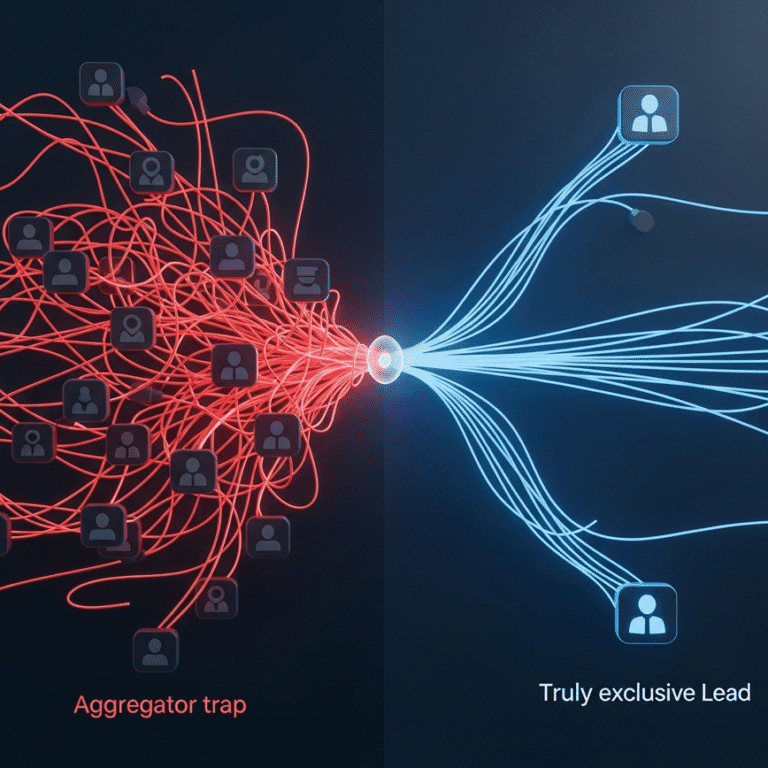

Model 2: Shared Leads

Shared leads are sold to multiple agents, often simultaneously. A prospect fills out one form on a generic quote website and, within seconds, their phone rings with calls from three, five, or even more agents all competing for the same sale. While less expensive than exclusive leads, they create a different kind of problem.

- The Problem: You are immediately forced into a high-pressure race to be the first to call, where speed trumps service. The conversation inevitably becomes about price, not value, as the prospect pits you against the other agents who just called or are waiting on the line. This commoditizes your expertise and professional service, severely damages your closing ratio, and creates a frustrating experience for both you and the potential client.

Model 3: Running Your Own Ads (DIY)

Frustrated with low-quality lists, many agents turn to running their own Facebook or Google ads to generate leads. This approach offers complete control over the creative, messaging, and targeting, which is an attractive proposition for any entrepreneur.

- The Problem: DIY lead generation is a full-time job that requires a specialized skillset far beyond what most agents have the time to develop. You have to master media buying on platforms with ever-changing algorithms, write compelling ad copy, design and A/B test high-converting landing pages, and navigate complex compliance rules like TCPA to avoid hefty fines. Without deep experience, it is incredibly easy to spend thousands of dollars on “testing” and data collection with no guarantee of producing a single qualified, convertible lead. The hidden cost is the opportunity cost—every hour you spend trying to be a digital marketer is an hour you’re not spending selling insurance.

The Modern Solution: Pay-Per-Lead Services

A smarter, more efficient model has emerged to solve these problems: pay per lead services. In this performance-based partnership, you do not pay for clicks, impressions, or hope. You only pay when a qualified prospect, who has been verified and has expressed clear intent, is delivered to you in real time.

This model fundamentally aligns the incentives of the lead generator with your own. Their success is directly and inextricably tied to your success. If the leads they provide don’t convert, you won’t continue to buy them, so they are motivated to deliver the highest quality possible. A reputable pay-per-lead partner handles all the complexities of digital marketing, including:

- Ad management and media buying: Constantly optimizing campaigns across multiple platforms to find in-market consumers at the lowest possible cost.

- Funnel optimization and conversion rate testing: Building and refining the customer journey, from the initial ad to the final thank you page, to ensure a seamless experience that filters for high intent.

li>Technical verification and compliance: Implementing systems to validate contact information and ensure every lead is generated in full compliance with regulations like TCPA.

This allows you to offload the risk and complexity of marketing and focus on what you do best: talking to interested buyers, building relationships, and closing policies. It effectively shifts the financial risk from you, the agent, to the lead generation experts who have the systems, scale, and expertise to produce consistent, high-quality results.

Breaking Down the Real Life Insurance Leads Cost: What Are You Paying For?

When you partner with a high-quality lead generation agency, you are not just buying a name and phone number. The life insurance leads cost is a reflection of the quality, compliance, and intent baked into every single lead. It represents an investment in a highly filtered and qualified business opportunity.

Lead Quality and Exclusivity

The single biggest factor in a lead’s value—and its price—is exclusivity. Exclusive life insurance leads are generated for and sent to you and only you. This simple fact completely changes the dynamic of your first conversation. It eliminates the frantic race to be the first to call and gives you the time and space to build rapport, understand the client’s needs, and act as a true advisor. Because we never resell or share leads, our partners know that every prospect they receive is theirs alone to convert. This dramatically increases contact and appointment rates, which directly impacts your ROI and reduces wasted effort.

Generation Method and Compliance

How and where a lead is generated matters immensely. A prospect actively searching for “life insurance quotes for new parents” on Google has far higher intent than someone who casually clicked a generic social media ad while scrolling. Furthermore, strict compliance is non-negotiable in today’s regulatory environment. Every lead must be TCPA-compliant, with a clear and unambiguous record of consent to be contacted. We provide a TrustedForm certificate with every lead, offering a downloadable, verifiable record of the exact moment of consent that protects your business from costly legal challenges.

Verification and Intent

Fake information and low-intent tire-kickers waste your most valuable asset: time. That is why real-time verification is crucial to a lead’s value. We use SMS verification on every lead to ensure the phone number is valid and belongs to the person filling out the form at that very moment. Our conversion-optimized funnels are also engineered with specific, multi-step questions about health, coverage needs, and income. These questions are designed to filter out low-intent prospects and deliver motivated buyers who are genuinely interested in securing a policy and have already invested time in the process.

How to Find the Best Life Insurance Leads for Agents

Finding a reliable lead partner in a crowded market can feel overwhelming. To identify the best life insurance leads for agents, you need to look for a true partner, not just a vendor. You want a company that operates as an extension of your own team, fully invested in your success.

Ask these critical questions when evaluating a provider:

- Are they transparent? A trustworthy partner will clearly explain their lead generation and verification process. They won’t hide behind vague “proprietary methods.”

- Are they specialists? Do they focus exclusively on insurance, or are they a generic marketing agency that also serves plumbers and roofers? Deep industry familiarity means they understand the nuances of your customer and what it takes to find them.

- Is it a partnership? Do they offer support beyond the lead itself, like proven scripts, follow-up frameworks, or a feedback system to help improve lead quality over time?

- Is the model performance-based? Are you paying for a verified, exclusive, and qualified lead, or are you paying for clicks, impressions, and effort with no guarantee of results?

Ultimately, your goal is to find a partner who helps you get leads that actually convert into policies. The right partner is as invested in your pipeline as you are and provides the high-quality prospects and support you need to scale your agency effectively and predictably.

Why a Higher Lead Cost Can Mean a Lower Cost Per Policy

It may seem counterintuitive, but in the world of lead generation, paying more for a premium lead almost always leads to a lower cost to acquire a new client. The upfront cost is only one part of the equation; the real metric for success is your final Cost Per Acquisition (CPA).

Consider this simple, realistic math:

- Scenario A (Cheap Leads): You buy 100 aged leads at $5 each for a total cost of $500. After hours of dialing, you manage to contact 20 of them. Of those, only 2 are willing to set an appointment, and you ultimately close 1 policy. Your Cost Per Acquisition is $500, not to mention the immense amount of time and frustration spent on 99 dead ends.

- Scenario B (Exclusive Leads): You buy 10 exclusive, verified leads at $50 each for a total cost of $500. Because they are fresh and expecting your call, you contact 9 of them. Six of these high-intent prospects agree to an appointment, and you close 2 policies. Your Cost Per Acquisition is $250 per policy.

In this example, you spent the exact same amount of money but closed double the business with a fraction of the effort and frustration. The upfront life insurance leads cost was ten times higher, but the final ROI was exponentially better. This is the power of investing in quality over quantity.

Conclusion: Investing in Quality Leads is Investing in Growth

Stop thinking about leads as a commodity and start seeing them as strategic investments in your business’s future. The quality of your pipeline is the number one predictor of your agency’s growth. By shifting your focus from the upfront cost of a name on a list to the final, all-in cost of a closed policy, you can make smarter, more profitable decisions that eliminate waste and maximize your time.

Embracing a pay-per-lead model with a trusted, specialist partner removes the guesswork, complexity, and financial risk from your marketing efforts. You get a predictable flow of exclusive, verified, and high-intent prospects delivered directly to you, allowing you to focus on what you’re best at: serving clients and building the thriving insurance business you deserve.