The search for free final expense leads is an understandable one. For new agents managing a tight budget or veterans tired of overpaying for duds, the idea of a zero-cost prospect list is incredibly tempting. It feels like a risk-free way to fill your pipeline and start dialing. But in the world of insurance sales, the old adage holds true: if you’re not paying for the product, you are the product.

Table of Contents

The reality is that “free” and “cheap” are the most expensive words in the lead generation industry. They come with a hidden price tag paid in wasted time, shattered morale, compliance risks, and ultimately, lost commissions. The true cost isn’t measured in dollars spent upfront, but in the opportunities and revenue you sacrifice by chasing prospects with no intent, no verification, and no exclusivity.

This article pulls back the curtain on the myth of free leads. We will break down the five hidden costs that cripple an agent’s growth and explore why savvy professionals are shifting their focus from cost-per-lead to cost-per-acquisition. More importantly, we will show how a performance-based, pay-per-lead model eliminates these risks, aligns incentives, and provides the answer to the real question every agent should be asking: which lead companies have the best ROI?

The Dangerous Allure of “Free” Leads

Before we dissect the costs, it’s important to understand where these leads come from. When you see an offer for free final expense leads or rock-bottom cheap final expense leads, you are almost certainly looking at one of the following sources.

1. Aged Leads

These are the ghosts of marketing campaigns past. An aged lead is a prospect who submitted their information weeks, months, or even years ago. While they may have had genuine interest at one point, that intent has long since faded. By the time their data reaches you, they have likely already purchased a policy, changed their mind, or been contacted by dozens of other agents. You are calling a cold contact who may not even remember filling out the form.

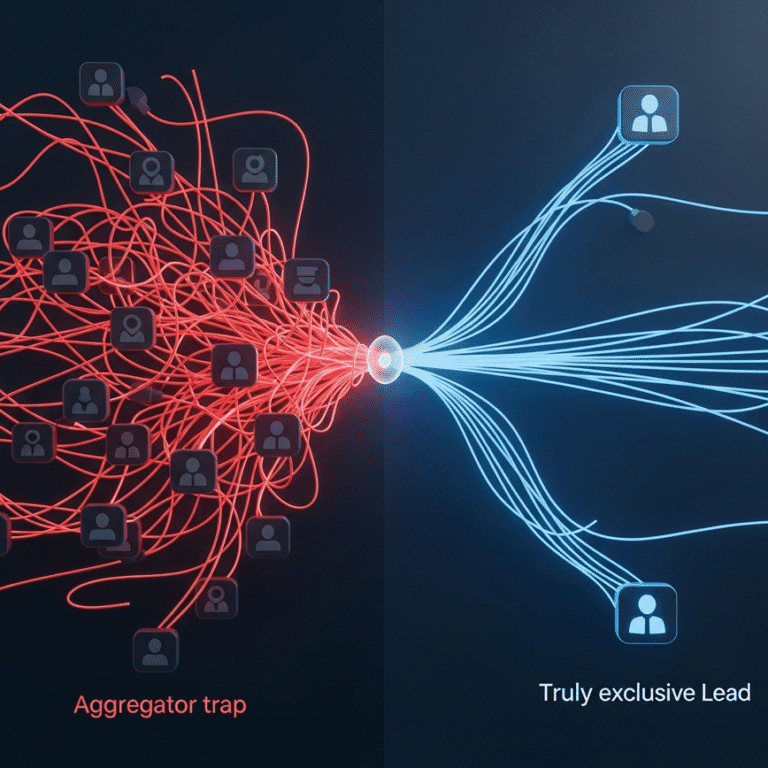

2. Shared Leads

Shared leads are sold to multiple agents at the same time. The lead vendor’s business model is based on volume, not quality. They sell the same prospect’s information to five, ten, or even twenty agents, creating a frantic race to the bottom. The prospect is immediately overwhelmed with calls and messages, becoming frustrated and unresponsive. For the agent, it means intense competition, price-driven conversations, and a vanishingly small chance of closing the deal.

3. “Sweat Equity” Leads (DIY Prospecting)

This category includes building your own prospect lists through social media groups, cold calling data brokers, or other manual methods. While technically “free” in terms of direct cost, this approach consumes your most valuable asset: time. Every hour spent prospecting on Facebook, scrubbing lists, or dialing disconnected numbers is an hour you are not spending in qualified appointments with people who have actively requested information. The opportunity cost is immense.

4. Co-Registration Leads

These are leads generated when a user signs up for one offer (like a contest or a free coupon) and unknowingly checks a box consenting to receive information about other products, including insurance. Their intent is not to learn about final expense coverage; it was to get the freebie. As a result, these leads have notoriously low conversion rates and often result in confused or annoyed conversations.

Each of these sources promises a full pipeline for little to no money. But what they actually deliver is a list of names and numbers detached from the single most important ingredient for a sale: genuine, real-time intent.

The Five Hidden Costs That Make “Free” Leads Expensive

Focusing solely on the upfront price of a lead ignores the real metrics that determine an agent’s success. The true cost of a lead is the total investment of resources required to convert it into a paying client. Here is where cheap final expense leads reveal their astronomical price.

1. The Time Cost: Your Most Valuable Asset

An agent’s income is directly tied to the time spent speaking with qualified, interested prospects. Free and cheap leads destroy this equation. Instead of spending your day in meaningful conversations, your calendar is filled with unproductive activities:

- Dialing wrong numbers and disconnected lines.

- Leaving voicemails that are never returned.

- Speaking with people who have no idea why you are calling.

- Trying to re-ignite interest that died months ago.

- Navigating gatekeepers for prospects who are not expecting your call.

If you spend 20 hours a week chasing 100 “free” leads to secure just one appointment, your time has been squandered. A high-quality, verified lead might cost more upfront, but it can lead to an appointment in minutes, not days. The opportunity cost of a week spent on bad data could be thousands of dollars in lost commissions.

2. The Morale Cost: The Burnout Spiral

Sales is a game of mindset. Confidence, energy, and resilience are critical. Nothing drains an agent’s morale faster than a relentless stream of rejection from low-quality leads. Day after day of hearing “I already bought a policy,” “I’m not interested,” or “Stop calling me” creates a cycle of frustration and burnout.

This psychological toll is a real business cost. It leads to call reluctance, decreased motivation, and a negative outlook that prospects can sense. Many promising agents leave the industry not because they can’t sell, but because they are exhausted from fighting a losing battle with poor-quality data.

3. The Reputation Cost: Being Labeled a Spammer

When you call a shared lead, you are not the first agent to do so, and you will not be the last. The prospect sees you as just another number in a long list of callers interrupting their day. This damages your personal brand and professional reputation. Instead of being a trusted advisor, you are perceived as a nuisance.

This is especially true with leads that lack clear consent. Calling individuals who did not explicitly ask for information about final expense insurance can make you seem unprofessional and untrustworthy, making it harder to build the rapport necessary to close a sale.

4. The Compliance Cost: Navigating TCPA Minefields

The Telephone Consumer Protection Act (TCPA) is a federal law designed to protect consumers from unwanted solicitations. Violations can result in fines of up to $1,500 per incident. “Free” and cheap lead sources are a compliance nightmare because they rarely provide verifiable proof of consent.

- Where is the consent record? Can the vendor provide a timestamp, IP address, and the exact language the consumer agreed to?

- Is there a TrustedForm certificate? This technology independently documents consent, providing a bulletproof record of compliance.

Without this documentation, every dial you make is a legal risk. A single complaint can trigger a costly lawsuit that could jeopardize your entire business. A compliant, high-quality lead provider sees TCPA adherence not as a burden, but as a fundamental pillar of their business. They protect their clients by providing ironclad proof of consent with every lead.

5. The ROI Cost: The Ultimate Metric

This is where everything comes together. Return on Investment (ROI) is the only metric that matters. Let’s compare two scenarios:

- Scenario A (Free Leads): You get 200 free leads. You spend 40 hours dialing them. You set 5 appointments, and 1 of them closes for a $700 commission. Your upfront cost was $0, but your return on 40 hours of work is just $17.50 per hour, before any other business expenses. The ROI is abysmal.

- Scenario B (Pay-Per-Lead): You purchase 20 high-intent, exclusive, and verified final expense leads for sale at $45 each, for a total investment of $900. Because they are high-quality, you spend only 10 hours to contact them all. You set 8 appointments and close 3 policies for a total commission of $2,100. After subtracting your $900 lead cost, your profit is $1,200 for 10 hours of work, or $120 per hour.

Scenario A was “free,” but Scenario B was infinitely more profitable. The conversation must shift from “How much does a lead cost?” to “How much does a closed policy cost?”

The Mindset Shift: Cost Per Lead vs. Cost Per Acquisition

The most successful insurance agents do not think in terms of Cost Per Lead (CPL). They focus exclusively on Cost Per Acquisition (CPA), which is the total cost to acquire one new client.

- CPL = Total Lead Spend / Total Number of Leads

- CPA = Total Lead Spend / Total Number of Closed Policies

A low CPL is a vanity metric if it results in a high CPA. You could have a CPL of $1, but if it takes 1,000 of those leads to get one sale, your CPA is $1,000. Conversely, you could have a CPL of $50, but if you close 1 out of every 10 leads, your CPA is only $500.

Choosing a lead generation strategy based on the lowest CPL is like building a house with the cheapest possible materials. It looks good on the initial invoice, but the long-term costs of repairs, instability, and foundational problems will be catastrophic. Building a sustainable sales career requires investing in high-quality materials: leads with clear intent, verified data, and proven compliance.

The Superior Alternative: A Performance-Based Pay-Per-Lead Model

Understanding the flaws of the “free” model naturally leads to a better solution: the performance-based, or pay-per-lead, model. This is the framework used by elite lead generation partners like Stallion Leads, and it is designed to directly address the hidden costs we have discussed.

In a pay-per-lead model, you do not pay for clicks, impressions, or ad spend. You only pay when a specific result is delivered: a qualified prospect who has been verified and meets a strict set of quality criteria. This model fundamentally changes the relationship between the agent and the lead provider, transforming it from a simple transaction into a true partnership.

1. Aligned Incentives: We Win When You Win

The core beauty of the performance model is incentive alignment. A vendor selling cheap, shared leads gets paid whether you close a deal or not. Their goal is to sell as much data as possible.

A pay-per-lead partner only succeeds when you succeed. Our growth is directly tied to your ROI. We are financially motivated to provide you with the highest quality leads possible, because if our leads do not convert into appointments and sales for you, you will not continue to buy them. This shared goal ensures that quality is always the top priority.

2. Built-In Quality Control and Compliance

Performance-based lead vendors live and die by the quality of their data. This necessitates investing in a robust infrastructure for verification and compliance. At Stallion Leads, every lead is generated through our own conversion-optimized funnels and undergoes a rigorous validation process before it ever reaches you:

- SMS Verification: Prospects must verify their phone number in real time via an OTP code, eliminating fake data and wrong numbers at the source.

- TCPA Compliance with TrustedForm: Every lead is backed by a TrustedForm certificate, providing an unimpeachable digital record of consent that protects you from legal risk.

- 100% Exclusive Delivery: Leads are delivered in real time to only one agent. You never have to compete with a dozen other callers for the same prospect.

This built-in quality control means you spend less time filtering and more time selling.

3. Predictable Scaling and Transparent ROI

With a pay-per-lead model, your marketing becomes predictable and scalable. You can easily calculate your Cost Per Acquisition. If you know that for every 10 leads you buy, you close 2 policies, you have a reliable formula for growth. Need to write more business next month? Simply increase your lead order.

This model removes the guesswork and financial risk of traditional advertising. You are not gambling a monthly budget on a marketing campaign that might not work. You are purchasing a predictable outcome, allowing you to scale your business with confidence and without the need for long-term contracts.

How to Identify a High-ROI Lead Partner

As you move away from the search for cheap final expense leads, your new focus should be on finding a partner that delivers the best ROI. When evaluating a potential lead company, ask these critical questions:

- How are your leads generated? Look for partners who manage their own advertising and funnels. This demonstrates hands-on experience and control over quality, unlike vendors who are just reselling data from unknown sources.

- Are your leads exclusive? If the answer is anything but a definitive “yes,” you are buying a shared lead. True partners protect your investment by ensuring you are the only agent contacting that prospect.

- Can you provide proof of consent for every lead? Ask specifically about TCPA compliance and whether they provide a TrustedForm certificate or an equivalent record. Vague answers are a major red flag.

- What is your data verification process? Do they verify contact information in real time? Methods like SMS verification are a strong indicator of a commitment to data accuracy.

- What happens after I receive the lead? A true partner offers more than just data. Do they provide scripts, follow-up frameworks, or CRM integration support to help you maximize your close rate? This shows they are invested in your success beyond the initial transaction.

Conclusion: Stop Paying the Price for “Free”

The search for free final expense leads is a trap. It promises a shortcut to success but delivers a long, frustrating road paved with wasted time, compliance risks, and missed opportunities. The true cost is far greater than the zero-dollar price tag suggests.

The most profitable agents in the industry understand that investing in high-quality, exclusive, and verified leads is not an expense; it is the most efficient and reliable way to generate revenue. By shifting your focus from the cost of a lead to the cost of a closed policy, you change the entire dynamic of your business.

The right question isn’t “Where can I find the cheapest leads?” It’s “Which lead companies have the best ROI?” The answer lies in finding a performance-based partner whose success is directly linked to your own. A partner who eliminates risk, guarantees quality, and provides a predictable path to growth. When you are ready to stop chasing dead ends and start building a scalable, profitable business, it is time to invest in a system that delivers results.