Every agency owner and independent agent eventually faces the same mathematical temptation. You sit down with your calculator, look at your monthly marketing budget, and you do the division. If you have $2,000 to spend, the logic seems simple. You could buy 40 high-intent, exclusive leads at $50 each. Or, you could buy 200 $10 final expense leads.

Table of Contents

- The Economics of “Cheap”: What You Actually Get for $10

- Breaking Down the Math: A Side-by-Side ROI Case Study

- Why Exclusive Final Expense Leads Command a Premium

- The Psychological Toll of Low-Quality Data

- How to Transition from Volume to Value

- A Sustainable Growth Model for Pennsylvania Agencies

- Why Stallion Leads Fits the High-ROI Model

- Conclusion: Stop Buying Leads, Start Buying Customers

- Frequently Asked Questions

On the surface, the volume play looks like the winner. More leads means more swings at the plate, right? It implies more opportunities to close, more conversations, and a fuller pipeline. This is the logic that keeps the market for cheap final expense leads thriving. It is also the primary reason why so many talented agents wash out of the industry within their first twelve months.

The allure of low-cost data is a mirage that hides the true cost of acquisition. When you peel back the layers of what you are actually buying for ten dollars, the math shifts aggressively against you. The cost of a lead is never just the purchase price. It is the purchase price plus the cost of the time spent working it, the opportunity cost of missing real prospects while chasing ghosts, and the morale cost of dialing three hundred numbers only to get cursed out or ignored.

This analysis is designed to walk you through the real economics of the final expense market. We will break down exactly what happens behind the scenes of a cheap lead vendor, compare the ROI of volume versus quality, and explain why shifting your focus to exclusive final expense leads is the only way to build a predictable, scalable agency.

The Economics of “Cheap”: What You Actually Get for $10

To understand why $10 final expense leads usually result in a net loss, you have to understand the supply chain of the lead generation industry. Real-time, high-intent traffic is expensive to generate. Media buying on platforms like Facebook, YouTube, and Google requires significant ad spend, creative testing, and technical infrastructure.

If a vendor is selling you a lead for $10, one of three things is usually happening.

1. The Resold Data Trap

The most common scenario is that the lead is not yours. It is a shared lead. To make a profit on a lead sold for $10, the vendor must sell that same data packet to three, four, or even ten different agents.

When you buy a shared lead, you are not paying for a prospect. You are paying for a ticket to a race. As soon as that consumer hits “submit” on a web form, their phone rings. It rings again ten seconds later. And again a minute later. By the time you dial, that prospect has already been bombarded by five other agents. They are not just annoyed; they are hostile. They stop picking up the phone.

The contact rate on shared leads often hovers below 10%. This means for every ten leads you buy ($100 spend), you speak to one person. That person has likely already spoken to someone else.

2. The Aged Inventory Dump

Another way vendors offer cheap final expense leads is by selling aged data. These are leads that were generated three weeks, three months, or even three years ago. They have been worked by other agencies, discarded, repackaged, and sold to you as “discounted inventory.”

The intent has evaporated. The consumer has either already bought a policy, decided they cannot afford one, or completely forgotten they ever filled out a form. You are essentially cold calling with a name attached. While some skilled agents can mine gold from aged data, it requires a massive volume of dials and a distinct skillset that most growing agencies do not have the time to train.

3. The Incentivized “Bot” Farm

The darkest corner of the cheap lead market involves incentivized traffic. These are users who fill out a form not because they want life insurance, but because they are trying to unlock a game level, enter a sweepstakes for an iPad, or get a free gift card.

The data is real in the sense that a human typed it in, but the intent is zero. They do not want insurance. They want the prize. When you call them, they are confused. They never asked for a quote. These leads are often mixed in with legitimate traffic to lower the average cost for the vendor, but they poison your funnel.

Breaking Down the Math: A Side-by-Side ROI Case Study

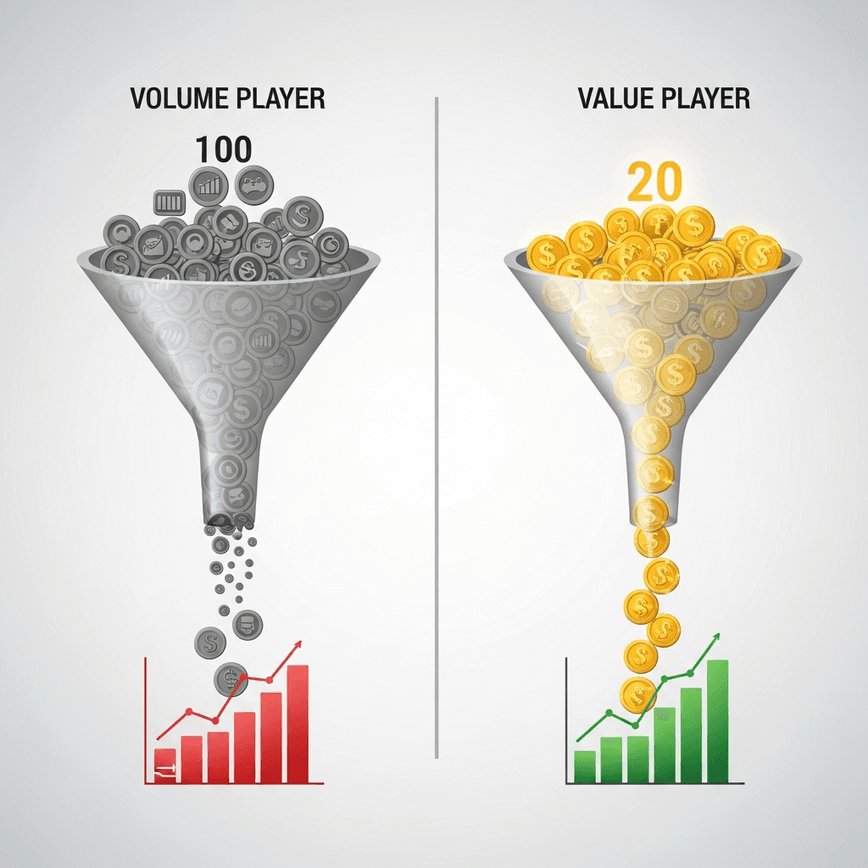

Let’s move away from theory and look at the hard numbers. We will compare two hypothetical agents in Pennsylvania. Agent A decides to go the volume route with $10 final expense leads. Agent B decides to invest in high-quality, exclusive final expense leads from a provider like Stallion Leads.

Both agents have a budget of $1,000.

Scenario A: The Volume Player (Agent A)

- Budget: $1,000

- Lead Cost: $10

- Total Leads: 100

- Lead Type: Shared / Aged / Low Intent

Agent A feels great on Monday morning. They have 100 names to call. However, because these are cheap leads, the contact rate is low (8%) and the intent is low.

- Contacts Made: 8 people (out of 100 dials).

- Appointment/Pitch Rate: 25% of contacts (2 people).

- Close Rate: 50% of pitches (1 sale).

- Average Commission: $600 (assumed annual premium).

The Result: Agent A spent $1,000 to make $600. They lost $400 in cash and spent roughly 8 to 10 hours dialing through 92 dead numbers and getting hung up on. Their effective hourly rate is negative.

Scenario B: The Value Player (Agent B)

- Budget: $1,000

- Lead Cost: $50 (hypothetical exclusive price)

- Total Leads: 20

- Lead Type: Exclusive, Real-Time, SMS-Verified

Agent B has fewer leads, but they are confident. These leads are sold only once. The phone numbers have been verified via SMS One-Time Passcode (OTP) to ensure they are real. The intent is fresh.

- Contacts Made: 45% (9 people).

- Appointment/Pitch Rate: 40% of contacts (3 people).

- Close Rate: 60% of pitches (roughly 2 sales).

- Average Commission: $600.

The Result: Agent B spent $1,000 to make $1,200. They made a $200 profit immediately. More importantly, they only had to manage 20 records. They spent less time dialing and more time pitching. Their morale is high, and they have cash flow to reinvest.

This is the hidden math that vendors of cheap final expense leads do not want you to see. The Cost Per Lead (CPL) is irrelevant. The only metric that matters is Cost Per Acquisition (CPA). In this scenario, Agent A had a CPA of $1,000. Agent B had a CPA of $500. The “expensive” leads were actually 50% cheaper in terms of generating revenue.

Why Exclusive Final Expense Leads Command a Premium

You might wonder why the price difference is so stark. Why does one lead cost $10 and another $45 or $55? The difference lies in the engineering of the lead generation process.

High-quality providers like Stallion Leads operate on a completely different model than the bulk aggregators.

Real-Time Intent vs. Recycled Data

Exclusive leads are delivered in real-time. This means the second the prospect hits submit, the data is pushed to your CRM via webhook or API. Speed to lead is the single biggest factor in conversion. If you call within 5 minutes, your contact rates skyrocket.

Aggregators often batch data. They collect leads all day and distribute them the next morning, or they hold them until they have enough buyers. By the time you get the file, the “micro-moment” of interest has passed. The prospect has moved on.

The Role of Verification

One of the biggest frustrations with $10 final expense leads is the number of disconnected lines and wrong numbers. This happens because users mistype their numbers (accidentally or intentionally) to bypass forms.

Premium providers use technology to solve this. At Stallion Leads, for example, we utilize SMS verification. A user must enter a One-Time Passcode sent to their mobile device to submit the form. This guarantees that the phone number is valid and that the person filling out the form has the phone in their hand right now. This step alone drastically reduces your wasted dials, but it increases the cost of media buying, which is reflected in the lead price.

Compliance as an Asset

In the current regulatory environment, specifically with FCC rulings and TCPA guidelines, buying cheap data is a legal risk. Many cheap lead vendors scrape data or use “co-reg” paths where a user agrees to hear from “marketing partners.” This vague consent does not hold up well against TCPA scrutiny.

True exclusive final expense leads come with a digital paper trail. This includes TrustedForm certificates that capture the consumer’s IP address, a timestamp, and a video replay of them navigating the page and checking the consent box. You are paying for the security of knowing that your agency is compliant.

The Psychological Toll of Low-Quality Data

We have discussed the money, but we must also discuss the mindset. Agency turnover in the insurance space is notoriously high. The number one reason agents quit is not a lack of sales skills; it is burnout from a lack of conversations.

When an agent sits down to dial $10 final expense leads, they are signing up for rejection. They are bracing themselves to be yelled at by people who have already been called ten times that day. They are preparing to hear “disconnect” tones over and over.

This grinds an agent down. It creates call reluctance. Even the most motivated salesperson will hesitate to pick up the phone after the fiftieth bad number in a row.

Conversely, working exclusive final expense leads changes the energy of the workday. When the phone rings, there is a high probability a real person answers. That person actually remembers filling out the form. Even if they don’t buy immediately, the conversation happens. The agent gets to practice their script. They get to overcome objections. They feel like they are working, not just gambling.

For an agency owner, providing your team with exclusive data is not just a financial decision; it is a retention strategy. Good agents will not stay if you feed them bad data. They will leave for an agency that invests in their success.

How to Transition from Volume to Value

If you are currently relying on cheap final expense leads, transitioning to a high-quality model requires a shift in operations. You cannot treat exclusive leads the same way you treat cheap ones.

1. Adjust Your Volume Expectations

You will receive fewer leads. This is a mental hurdle. You might go from getting 50 leads a day to 10. Do not panic. Look at your contact rate. You will likely speak to more people with those 10 exclusive leads than you did with the 50 cheap ones.

2. Tighten Your Follow-Up Cadence

With $10 final expense leads, agents often “burn and churn.” They call once, no answer, and throw the lead away. You cannot do that with exclusive data. You are paying for the intent, and you must harvest it.

We recommend a “triple touch” approach for the first day:

- Call immediately upon receipt.

- If no answer, leave a voicemail and send a text message immediately.

- Call again 4 hours later.

- Call again the next morning.

Because the data is exclusive to you, you have the right to nurture it. The prospect is not being hammered by other agents, so they are less likely to block your number.

3. Track CPA, Not CPL

Stop celebrating a low cost per lead. Start tracking your Cost Per Acquisition.

- How much did you spend this week?

- How many policies did you write?

- Divide spend by policies.

If your CPA is under your target (usually 50-70% of first-year commission), your lead source is viable, regardless of the upfront CPL.

A Sustainable Growth Model for Pennsylvania Agencies

For agents operating in competitive markets like Pennsylvania, standing out is vital. The state has a high population of seniors, making it a prime territory for Final Expense, but it also means high competition.

Local authority is built on trust. When you use exclusive final expense leads, you are often the first and only person speaking to that senior. You have the chance to build a relationship rather than fighting for attention.

Furthermore, by using a vendor that allows for state-specific targeting, you can refine your approach. You can reference local geography, weather, or state-specific insurance programs in your opening script. This level of personalization is impossible when you are churning through generic, nationwide aggregated lists.

Why Stallion Leads Fits the High-ROI Model

At Stallion Leads, we made a conscious decision early on. We refused to participate in the “race to the bottom” of lead pricing. We knew that selling cheap final expense leads would damage our clients’ businesses in the long run.

Instead, we focused on building a system that delivers predictable ROI.

- 100% Exclusivity: We never resell a lead. Once you buy it, it is yours.

- SMS Verification: We filter out the bots and the typos before you ever pay.

- Consent Capture: Every lead comes with a TrustedForm certificate so you can dial with confidence.

- Transparency: We don’t hide behind “proprietary algorithms.” We tell you exactly how the lead was generated and provide all the metadata.

We serve agents who are tired of the churn. We serve business owners who understand that time is their most expensive asset. If you are ready to stop chasing bad data and start closing more deals with less friction, it is time to upgrade your pipeline.

Get exclusive, real-time, and SMS-verified leads and stop wasting your budget on data that doesn’t convert.

Conclusion: Stop Buying Leads, Start Buying Customers

The math is undeniable. The “savings” you get from buying $10 final expense leads are an illusion. You pay for them with your time, your sanity, and your lost opportunities.

In the high-stakes world of insurance sales, the most expensive lead is the one that doesn’t close. The cheapest lead is the one that results in a commission check. By shifting your mindset from volume to quality, and by partnering with a vendor that prioritizes data integrity over bulk sales, you build an agency that is not just busy, but profitable.

Don’t let the sticker price fool you. Invest in data that respects your time. Invest in exclusive leads.

Frequently Asked Questions

Can I really make a profit if I’m paying $40+ per lead?

Yes, absolutely. Profitability is determined by your closing ratio. If you close 1 in 5 exclusive leads, your CPA is significantly lower than closing 1 in 100 cheap leads, once you factor in the value of your time and the consistency of your pipeline.

Why are cheap final expense leads so prevalent if they are bad?

They are prevalent because they have a low barrier to entry. New agents with small budgets often feel they have no other choice. Additionally, large call centers with hundreds of agents can sometimes make the math work by using predictive dialers to blast thousands of numbers an hour, a strategy that is illegal or impractical for small agencies.

How do I know if a lead is truly exclusive?

You should ask your vendor for proof. Ask if they resell data. Ask if the lead is delivered in real-time. With Stallion Leads, our exclusivity is a core guarantee. We do not operate a lead exchange; we generate traffic and deliver it directly to the end buyer.

What is the best way to work an exclusive lead?

Speed and persistence. Call within minutes of receipt. If they don’t answer, use a compliant SMS text to introduce yourself. Because the lead is exclusive, you can follow up over several days without worrying that another agent has already sold them.

Do exclusive leads guarantee a sale?

No lead source can guarantee a sale; that depends on your sales skill. However, exclusive leads guarantee a higher probability of a quality conversation. We guarantee the delivery of a contactable prospect who has requested information; you handle the closing.