The insurance industry has a dangerous obsession with the grind. New agents are often told that success is purely a numbers game. They are taught that if they dial enough numbers, knock on enough doors, and buy enough aged data, the math will eventually work out in their favor. While hard work is non-negotiable, blind hustle is the fastest route to burnout.

Table of Contents

- Understanding the Pareto Principle in Insurance Sales

- How to Apply 80/20 Rule to Life Insurance Sales Closing

- Life Insurance Sales Strategy: The Quality Over Quantity Shift

- Identifying the “20%” in Your Current Pipeline

- Operationalizing the 80/20 Rule

- Compliance as a Quality Filter

- The Psychological Impact of Better Inputs

- Moving from “Busy” to “Productive”

- Conclusion: Stop Chasing, Start Closing

There is a smarter way to operate, and it is rooted in a concept that has governed economic efficiency for over a century: the Pareto Principle.

Commonly known as the 80/20 rule, this principle states that roughly 80% of consequences come from 20% of the causes. In the context of your agency, this likely means that 80% of your revenue comes from the top 20% of your leads. Conversely, it means you are spending 80% of your time chasing prospects who will never buy, simply because they were low-quality inputs from the start.

If you are tired of churning through hundreds of recycled names just to find one interested prospect, you need to fundamentally shift your approach. This guide explores how to apply 80/20 rule to life insurance sales closing by pivoting your focus from maximizing activity to maximizing lead quality.

Understanding the Pareto Principle in Insurance Sales

Vilfredo Pareto, an Italian economist, originally observed that 80% of Italy’s land was owned by 20% of the population. He later found this distribution applied to almost everything, from peapods in his garden to wealth distribution in nations.

In the life insurance sector, the distribution is often even more skewed. It is not uncommon for an agent to generate 90% of their commission from the top 10% of their lead sources. The remaining 90% of their time is spent fighting against bad data, disconnected numbers, and hostile prospects who never asked to be contacted.

The High Cost of Low-Quality Inputs

When you buy cheap, shared, or aged leads, you are essentially filling your funnel with the “80%.” These are the inputs that cause the majority of your headaches but contribute the least to your bank account.

Consider the operational costs of working low-quality leads:

- Time Waste: You spend hours dialing numbers that do not pick up or are incorrect.

- Morale Drain: Constant rejection from people who did not request information destroys agent confidence.

- Compliance Risk: Aged lists often contain data that has not been scrubbed against the DNC (Do Not Call) registry recently, or lacks proper consent documentation.

The goal of a modern life insurance sales strategy is not to work harder. It is to eliminate the 80% of waste so that every hour you work is spent on the 20% of activities that generate revenue. This starts with the raw material of your business: the lead.

How to Apply 80/20 Rule to Life Insurance Sales Closing

Applying this principle requires a ruthless audit of where your sales are coming from. Most agents track their closing rate, but few track their closing rate by lead source with enough granularity.

To truly apply the 80/20 rule, you must identify the characteristics of the leads that actually convert. Usually, these “top 20%” leads share specific traits:

- High Intent: The prospect actively requested information recently.

- Exclusivity: The lead was sold only to you, not five other agents simultaneously.

- Contactability: The phone number is valid and the person is expecting a call.

When you ask how to apply 80/20 rule to life insurance sales closing, the answer is to stop trying to close the uncloseable. You cannot script your way out of bad data. If a lead did not request information, or if they requested it three months ago, no amount of sales talent will convert them at a profitable rate.

The Filter is the Strategy

At Stallion Leads, we built our entire infrastructure around this concept. We recognized that the “80%” of waste in the lead industry comes from bad numbers and bots. That is why we implemented SMS-verified phone numbers. By requiring a one-time passcode (OTP) verification on the mobile input, we ensure that the phone number is real and in the hands of the prospect at the moment of submission.

This simple technical filter eliminates the vast majority of “junk” leads before they ever reach an agent. By purchasing leads that have passed this verification, you are automatically focusing your efforts on the top 20% of the market availability.

Life Insurance Sales Strategy: The Quality Over Quantity Shift

There is a pervasive myth that you need hundreds of leads a week to write significant business. This is only true if your leads are poor quality.

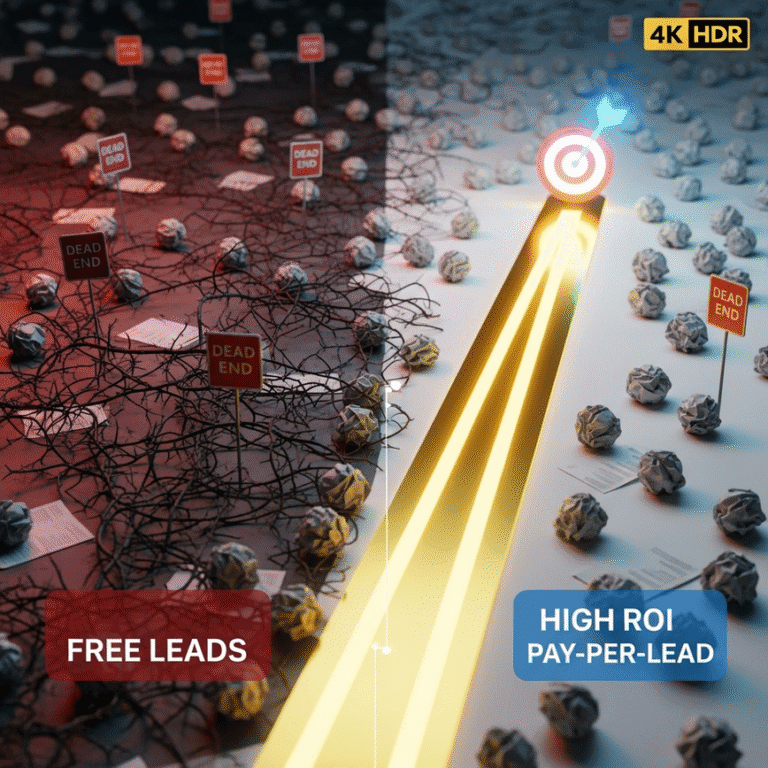

Let’s look at the math of two different strategies.

Agent A (The Volume Strategy):

- Buys 100 aged/shared leads at $2.00 each ($200 cost).

- Contact rate: 10% (10 people spoken to).

- Appointment rate: 20% (2 appointments set).

- Close rate: 50% (1 sale).

- Result: Agent A dialed 100 numbers, dealt with 90 rejections/no-answers, and made one sale.

Agent B (The 80/20 Strategy):

- Buys 10 exclusive, real-time leads at $45 each ($450 cost).

- Contact rate: 60% (6 people spoken to).

- Appointment rate: 50% (3 appointments set).

- Close rate: 66% (2 sales).

- Result: Agent B dialed 10 numbers, had meaningful conversations, and made two sales.

While Agent B spent more upfront, their ROI is significantly higher because they wasted zero time. They made two sales in a fraction of the time it took Agent A to make one. This is the essence of a Pareto Principle insurance sales approach. You pay for probability, not just possibility.

Why Exclusivity Matters

Shared leads are the enemy of the 80/20 rule. When a lead is shared, you are entering a race where speed is the only variable. Even if the lead is high intent, if four other agents are calling, your chances of closing drop precipitously.

Stallion Leads operates on a strict exclusivity model. We sell every lead once. This ensures that when you receive a prospect, you are the only solution they are considering at that moment. This exclusivity protects your margins and respects the prospect, preventing the bombardment of calls that turns high-intent buyers into hostile rejections.

Identifying the “20%” in Your Current Pipeline

If you are currently sitting on a mix of lead sources, you need to clean house. Look at your sales from the last six months.

- Which vendor provided the leads that stayed on the books?

- Which leads required the least amount of follow-up to get on the phone?

- Which leads resulted in the highest average premium?

You will likely find that a specific type of lead, likely real-time and exclusive, is responsible for the bulk of your income. The logical strategic move is to cut the budget for the underperforming sources and reallocate it entirely to the high-performing source.

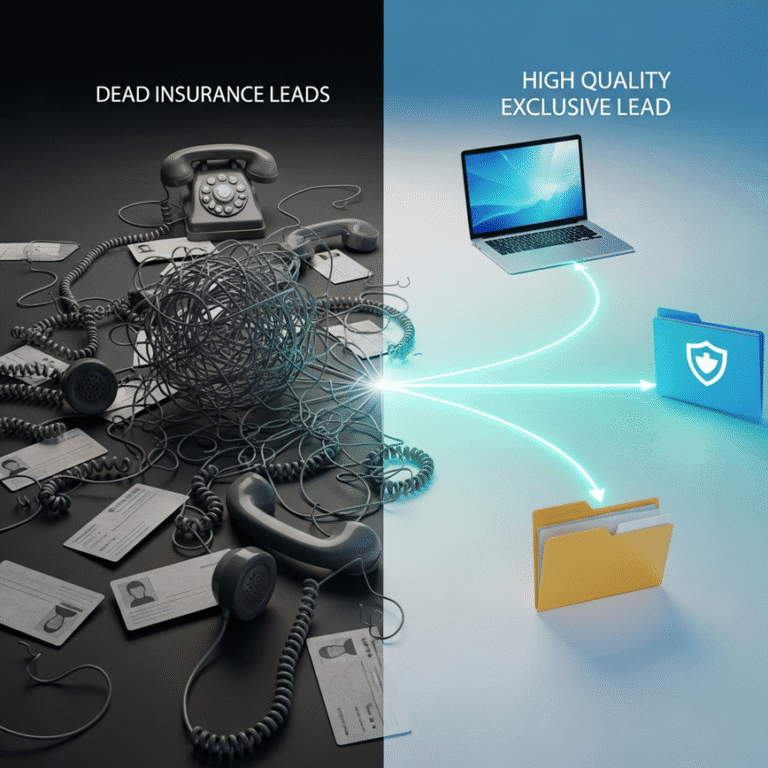

The Role of Data Verification

The “20%” leads are defined by data integrity. A lead is only as good as the contact information associated with it.

We employ carrier-level phone checks and duplicate suppression across our network. If a user has submitted a form recently, we do not sell that lead again as a “new” lead. This hygiene is invisible to you, but it is the reason why our agents report higher contact rates. We do the heavy lifting of filtering out the “80%” of noise so you do not have to.

Operationalizing the 80/20 Rule

Once you have secured a source of high-quality leads, you must apply the 80/20 rule to your workflow. Even with the best leads in the world, you can introduce waste if your process is flawed.

Speed to Lead: The Critical 20% of Effort

In lead conversion, 80% of your contact rate success comes from the first 5 minutes. This is a crucial application of the Pareto Principle. The effort you put in during the first 300 seconds is worth more than the effort you put in over the next 300 hours.

We recommend a specific cadence for our leads:

- Call within 5 minutes.

- Text within 1 minute of the call if there is no answer.

Because our leads are real-time and SMS verified, the prospect is usually looking at their phone when you receive the data. Calling immediately aligns your effort with their peak interest. If you wait an hour, you drift into the ineffective “80%” of the timeline where conversion rates plummet.

Automating the Rest

To focus on the top 20% of revenue-generating activities (closing), you should automate the bottom 80% of administrative tasks.

- CRM Integration: Do not manually type lead data into a spreadsheet. Use our webhooks to send leads directly into GoHighLevel, HubSpot, or your preferred CRM.

- Automated Nurture: If a lead does not pick up, your CRM should automatically send the follow-up text and email. You should not be manually thumbing out text messages unless you are in an active conversation.

By automating data entry and initial outreach, you preserve your mental energy for the actual sales conversation.

Compliance as a Quality Filter

In today’s regulatory environment, compliance is a massive factor in lead quality. A lead that was generated through non-compliant methods (like cold texting or deceptive ads) is a liability, not an asset. These leads are often angry and litigious.

A life insurance sales strategy that ignores compliance is built on sand. The “top 20%” of leads are those that are fully documented and consent-based.

At Stallion Leads, we provide TrustedForm-style consent certificates with every lead. This includes the timestamp, the IP address, and a snapshot of the page the user saw. This proves that the consumer asked to be contacted. Dealing with compliant leads removes the friction of “Why are you calling me?” and moves the conversation straight to “How can I help you?”

The Psychological Impact of Better Inputs

There is a mental component to the Pareto Principle that is often overlooked. When an agent spends their day talking to people who want to talk to them, their energy changes. They sound helpful, not desperate.

When you grind through bad leads, you develop “commission breath.” You become desperate to close anyone who stays on the line for more than ten seconds. Prospects can smell this desperation, and it kills sales.

By upgrading your lead source, you protect your mindset. You approach every call with the confidence that the person on the other end has a genuine need. This shift in attitude is often the “20%” emotional shift that yields 80% better conversations.

Moving from “Busy” to “Productive”

Being busy is often a mask for being ineffective. It feels good to say you made 300 dials today. It feels like work. But if those 300 dials resulted in zero applications, you were just busy, not productive.

The 80/20 rule demands that you be ruthless with your activity.

- Stop buying shared leads. They force you to compete on speed rather than skill.

- Stop buying aged data. You are fighting an uphill battle against memory loss and changing circumstances.

- Start investing in verified, exclusive intent.

It is better to have 5 conversations with qualified prospects than 50 conversations with people who are annoyed you called.

Scaling with Confidence

Once you have isolated the high-quality input, the exclusive, verified lead, you can scale. This is where the Pareto Principle insurance sales model becomes powerful.

If you know that for every 10 Stallion leads, you write 2 policies, you have a predictable equation. You can increase your volume stepwise. You are not hoping for a lucky day; you are executing a mathematical formula.

We support this scaling by offering flexible daily caps. You can start small, verify the quality for yourself, and then increase your volume as your closing rate stabilizes. We do not lock you into long-term contracts because we know the quality of the data is what keeps you as a client.

Conclusion: Stop Chasing, Start Closing

The application of the 80/20 rule to life insurance is straightforward: identify the source of your best sales and ruthlessly cut everything else.

The industry has convinced too many agents that the path to wealth is paved with rejection. It is not. The path to wealth is paved with conversation. By shifting your budget toward higher quality, verified, exclusive leads, you reduce the noise and increase the signal.

You can spend your career chasing the 80% of leads that go nowhere, or you can invest in the 20% that drive your business forward.

If you are ready to stop churning and start earning, you need a partner who understands the value of clean data. Stop Chasing Dead Leads Get Leads That Actually Convert and experience the difference that verification and exclusivity make in your daily workflow.

Focus on the 20%. Let us handle the rest.