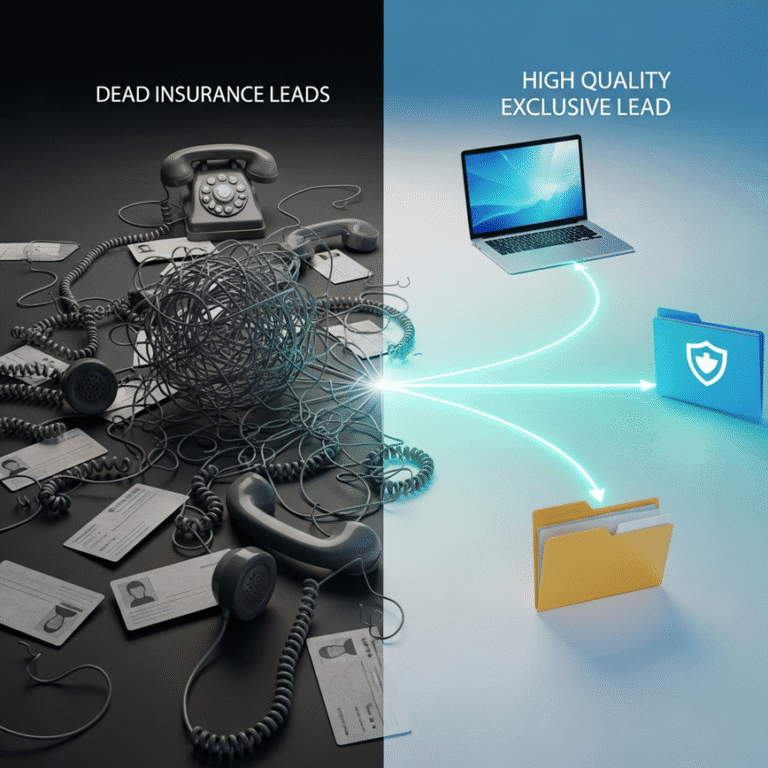

Every licensed insurance agent knows the feeling. You just purchased a batch of fresh leads. You sit down, dial the first number, and prepare your script. The prospect answers, but before you can even introduce yourself, they interrupt. “I already told the last three guys I’m not interested! Stop calling me!”

Table of Contents

- The Aggregator Trap: Why Shared Leads Burn Agents

- Defining True Exclusivity in Lead Generation

- The Critical Role of Verification

- Comparing the Economics: Price vs. ROI

- Analyzing Exclusive Life Insurance Leads Reviews

- The Compliance Advantage in a Litigious World

- How We Generate Leads vs. The “Black Box”

- Integrating Stallion Leads into Your Workflow

- Why Stallion is the Premier EverQuote Life Insurance Leads Alternative

- Making the Switch: A Risk-Free Transition

- Conclusion

The line goes dead. You paid for that lead. You called it immediately. Yet, you were already the fourth or fifth person to reach out.

This is the reality of the aggregator model. It is a volume game where the same consumer data is sold to multiple agents simultaneously, creating a frantic “race to the bottom” where the fastest autodialer wins and everyone else loses money. If you are searching for the best place to buy life insurance leads, you have likely encountered this frustration repeatedly.

The industry is shifting. Smart agents are realizing that low cost per lead often equals a high cost per acquisition. They are moving away from shared, recycled data and looking for a viable everquote life insurance leads alternative that prioritizes quality over quantity.

In this comprehensive guide, we will pull back the curtain on how lead aggregators operate versus the direct-to-consumer exclusive model used by Stallion Leads. We will explore what “exclusivity” actually means, why verification matters more than volume, and how to read exclusive life insurance leads reviews to find a partner that actually helps you grow your book of business.

The Aggregator Trap: Why Shared Leads Burn Agents

To understand why Stallion Leads operates differently, you first need to understand the mechanics of the massive lead aggregators. These are the household names in the industry. They have massive marketing budgets and dominate search results.

Their business model is built on arbitrage. They generate a lead for a certain cost, say $10. To make a profit, they cannot just sell it to you for $15. Instead, they sell that single lead to five different agents for $8 each. They make $40 on a $10 asset, while five agents fight over a single prospect who is rapidly becoming annoyed.

The Speed-to-Lead Fallacy

Aggregators will tell you that success with their data comes down to “speed to lead.” They claim that if you call within seconds, you will win. While speed is important in any sales environment, the aggregator model weaponizes it against you.

When a consumer fills out a form on a generic insurance comparison site, their information is instantly pinged to a network of buyers. Within milliseconds, five to ten CRMs are triggered. The consumer’s phone starts ringing immediately, often from multiple numbers at once.

By the time you connect, the prospect is defensive. They feel harassed. The trust is broken before you even say hello. This environment makes it nearly impossible to build the rapport necessary to sell Final Expense or Life Insurance products.

The Data Degradation Cycle

Another issue with large aggregators is the recycling of data. If a lead is not sold instantly to the maximum number of buyers, it is often stored and sold later as an “aged lead.” While aged leads have their place, they are frequently mixed into “fresh” batches or sold without clear disclosure of their origin.

This results in agents calling numbers that have been disconnected, belong to people who have already bought a policy, or worse, are active on Do Not Call (DNC) lists but were not properly scrubbed.

Defining True Exclusivity in Lead Generation

Stallion Leads was built to solve the specific pain points created by the aggregator model. We are not a lead broker; we are a lead generator. The distinction is critical for agents looking for an everquote life insurance leads alternative.

When we say a lead is exclusive, we mean it is sold to one agent, one time. Period.

The One-to-One Chain of Custody

In our model, the journey of a lead is linear and transparent.

- Traffic: We drive premium traffic through mainstream channels using compliant placements.

- Capture: The prospect lands on a funnel designed specifically for life insurance intent.

- Verification: The prospect verifies their phone number via SMS One-Time Passcode (OTP).

- Delivery: The lead is routed in real-time to a single buyer’s CRM or Google Sheet.

- Closure: The lead data is locked. It is never sold again by us.

When you call a Stallion lead, you are likely the first and only agent reaching out to them regarding that specific inquiry. The prospect is not defensive because their phone isn’t blowing up. They are expecting a call because they just verified their number to request one.

Why We Don’t Share

We often get asked why we don’t sell shared leads to lower the price point. The answer lies in our commitment to agent success. We know that the best place to buy life insurance leads is a vendor that protects your time.

If you spend three hours calling shared leads to get one presentation, you have lost half your day. If you call exclusive, verified leads, you might get that same presentation in thirty minutes. Your time is the most expensive asset you have. Our model protects it.

The Critical Role of Verification

One of the most common complaints found in exclusive life insurance leads reviews is the prevalence of fake contact information. “Mickey Mouse” at “555-555-5555” is a lead that agents pay for all too often with low-quality vendors.

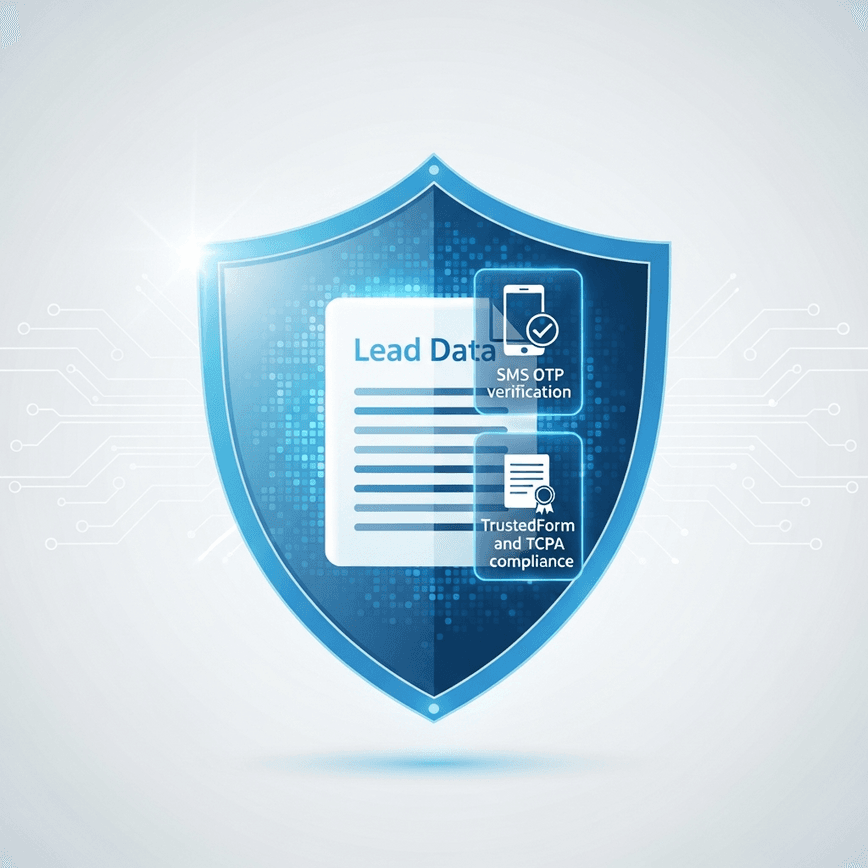

Stallion Leads implements a strict technology layer to filter out bots, typos, and fake intent.

SMS One-Time Passcode (OTP)

Before a lead can enter our system, the user must verify their mobile number. We send a text message with a code to the phone number provided. The user must enter that code to submit the form.

This single step eliminates:

- Fat-finger errors: Users mistyping their own number.

- Fake numbers: Users entering a random string of digits to see the next page.

- Bots: Automated scripts that fill out forms to spam networks.

By the time a lead hits your CRM, you know that a human being controls that phone number and was active on the device seconds ago. This dramatically increases contact rates.

TrustedForm and Consent Receipts

In the current regulatory environment, specifically with the FCC’s tightening of TCPA (Telephone Consumer Protection Act) rules, proving consent is mandatory. Aggregators often rely on “partner network” language buried in fine print, which exposes agents to lawsuits if they call a prospect who didn’t explicitly agree to be called by them.

Stallion Leads captures a TrustedForm certificate for every single lead. This digital receipt records the user’s IP address, the timestamp, the browser they used, and a video snapshot of the screen as they filled out the form.

It proves, beyond a shadow of a doubt, that the consumer asked to be contacted. This level of compliance is rare among bargain-bin lead sellers but is standard for us. It is a key reason why compliance-minded agencies view us as the best place to buy life insurance leads.

Comparing the Economics: Price vs. ROI

When searching for an everquote life insurance leads alternative, price is always a factor. Aggregators will always win on the sticker price. A shared lead might cost $8, while an exclusive, verified lead costs significantly more.

However, the sticker price is a vanity metric. The metric that matters is Cost Per Acquisition (CPA).

The Aggregator Math:

- Cost per lead: $8

- Leads needed to make contact: 20 (due to low contact rates and competition)

- Total cost to speak to a human: $160

- Contacts needed to close: 10

- Total Marketing Cost for 1 Sale: $1,600

The Stallion Leads Math:

- Cost per lead: (Higher exclusive rate)

- Leads needed to make contact: 3 (due to SMS verification and exclusivity)

- Contacts needed to close: 5 (prospects are less defensive)

- Total Marketing Cost for 1 Sale: Significantly lower than the aggregator model when factoring in labor hours.

When you factor in the hours you save by not dialing dead numbers, the ROI tilts heavily in favor of high-quality, exclusive data. You are paying for the result, not just the data row.

Analyzing Exclusive Life Insurance Leads Reviews

If you scour the internet for exclusive life insurance leads reviews, you will see a pattern. The negative reviews almost always center on three things:

- “They sold the lead to everyone.”

- “The numbers were all disconnected.”

- “I couldn’t cancel my subscription.”

Stallion Leads addresses these specific pain points directly in our operational model.

Addressing “Sold to Everyone”:

We have strict internal controls. Our system physically blocks a lead from being routed to a second destination once it has been assigned. We do not have a “remnant inventory” sales team trying to squeeze extra pennies out of old data.

Addressing “Disconnected Numbers”:

Our carrier-level phone checks and SMS OTP verification mean disconnected numbers are virtually impossible in our real-time feed. If a lead does slip through with bad data—because no system is 100% perfect—we have a fair-play replacement policy. We don’t argue; we replace clearly invalid data.

Addressing “Couldn’t Cancel”:

We hate long-term contracts. We believe we should earn your business with every batch. That is why we operate on a “fund and fly” model. You fund your account, we deliver the leads. If you want to pause, you pause. If you want to scale, you scale. There are no retainers and no handcuffs.

The Compliance Advantage in a Litigious World

We briefly touched on TrustedForm, but it deserves its own section. The legal landscape for insurance marketing is dangerous. Serial litigators actively look for agents who call without proper consent.

When you buy from a massive aggregator, the chain of consent can be murky. Did the user agree to be called by “Marketing Partners”? Does that include you? Can you prove it in court?

Stallion Leads simplifies this. The consent language on our sites is clear, prominent, and specific. We store the proof. If you ever receive a complaint, we can provide the TrustedForm certificate that shows exactly when and where the consumer invited you into their life.

For agency owners, this peace of mind is invaluable. You are building a business, not a gambling operation. Partnering with a compliance-first vendor is the only sustainable way to scale.

How We Generate Leads vs. The “Black Box”

Many vendors operate as a “black box.” They won’t tell you where the leads come from. Are they incentivized? (e.g., “Win a free iPad if you fill out this insurance form”). Are they from overseas call centers?

Stallion Leads is transparent about our sourcing. We use premium traffic on mainstream advertising channels. We target users searching for life insurance and final expense coverage.

Our funnels are designed to qualify, not just capture. We ask questions about age, coverage amount, and intent. We use progressive qualification steps that balance volume with intent. A prospect who completes our flow has jumped through several hoops, indicating a genuine interest in speaking with an agent.

We do not use “incentivized” traffic. A prospect who fills out our form wants insurance, not a free gift card. This distinction is vital when looking for the best place to buy life insurance leads that actually convert into policies.

Integrating Stallion Leads into Your Workflow

Switching from an aggregator to an exclusive provider requires a slight adjustment in strategy.

With aggregator leads, the strategy is “dial as fast as possible and overcome the anger.” With Stallion Leads, the strategy is “dial promptly and have a professional consultation.”

Because the lead volume is lower but the quality is higher, you can afford to spend more time preparing for the call. You can research the area, look at the age and data fields provided, and tailor your opening.

Our Delivery Options:

- Direct to CRM: We can push leads instantly via webhook to GoHighLevel, HubSpot, Salesforce, or any major CRM.

- Google Sheets: For simpler setups, we can populate a secure spreadsheet in real-time.

- Email/SMS Alerts: Get notified the second a lead arrives so you can call while they are still thinking about insurance.

We also provide a “Speed to Lead” playbook. Even with exclusive leads, calling quickly increases conversion. We recommend calling within 5 minutes and sending a text within 1 minute. Since the number is mobile-verified, your text delivery rate will be exceptionally high.

Why Stallion is the Premier EverQuote Life Insurance Leads Alternative

If you are currently buying from EverQuote or similar giants, you are likely accustomed to a dashboard with thousands of leads and a low conversion rate. You might be managing a large team just to sift through the noise.

Stallion Leads offers a leaner, more profitable approach.

- Quality Over Volume: You don’t need 1,000 leads to write 10 policies if your leads are verified and exclusive. You might only need 50.

- Predictable Pricing: No bidding wars. You know your cost per lead upfront.

- Support: We are not a faceless corporation. We have a support team available Monday to Friday. We review lead quality with you. We want you to renew, so we are invested in your ROI.

This partnership mentality is what sets us apart. We provide voicemail scripts, SMS templates, and follow-up cadences to help you squeeze every drop of value from the leads we deliver.

Making the Switch: A Risk-Free Transition

We understand that trying a new lead vendor is a risk. You have likely been burned before. That is why we make onboarding simple and low-risk.

You don’t need to sign a 12-month contract. You can start with a small pilot block. Test the waters. See the connection rates for yourself. Verify the “exclusive” claim by hearing the relief in prospects’ voices when they realize you are the only one calling.

The 7-Minute Onboarding:

- Tell us your target states and age filters.

- Choose how you want the leads delivered (CRM, Email, Sheet).

- Fund your initial block.

- Go live.

It is that simple. We handle the heavy lifting of ad buying, copywriting, funnel optimization, and compliance. You handle the closing.

Conclusion

The insurance industry is competitive enough without having to fight other agents for the same lead. The aggregator model served a purpose in the early days of digital marketing, but it has evolved into a saturation machine that hurts agents and annoys consumers.

If you are looking for the best place to buy life insurance leads, look for a partner that values the integrity of the data. Look for verified phone numbers, documented consent, and true 1-to-1 exclusivity.

Stallion Leads offers a clean break from the “churn and burn” tactics of the past. We provide the high-intent, compliant, exclusive leads you need to build a predictable, scalable agency.

Don’t settle for being the fifth caller. Stop chasing dead leads and get leads that actually convert. Experience the difference of a lead generation partner that puts your ROI first.