The Pareto Principle, commonly known as the 80/20 rule, is a concept most agency owners know in theory but rarely apply to their lead sources. In the context of life insurance sales, the rule suggests that 80 percent of your revenue will come from 20 percent of your prospects.

Table of Contents

- The Mathematics of Misery: Why Cheap Leads Cost More

- Defining the Top 20%: What Makes Exclusive Life Insurance Leads Different?

- How to Identify Leads That Convert to Sales

- Calculating the Real ROI of Premium Data

- Optimizing Your Funnel for the Top 20%

- Why Stallion Leads Fits the Pareto Principle

- Conclusion

If you analyze your book of business right now, you will likely see this pattern. A small fraction of the people you speak with are responsible for the vast majority of your commissions. The problem is not the math. The problem is how you spend your time finding that top 20 percent.

Most agents spend their days sifting through the bottom 80 percent. They churn through shared leads, aged data, and recycled lists hoping to stumble upon a single interested buyer. This is not sales. This is manual labor. It burns out agents, inflates acquisition costs, and creates a ceiling on how much you can scale.

To build a predictable pipeline, you must invert this dynamic. You need to stop paying for the haystack and start paying for the needle. You need leads that convert.

This article explores why exclusivity is the single most important variable in lead generation and how shifting your budget toward verified, exclusive data can transform your agency’s profitability.

The Mathematics of Misery: Why Cheap Leads Cost More

There is a pervasive myth in the insurance industry that volume cures all ills. The logic goes that if you buy enough cheap leads, the sheer number of dials will eventually result in a sale. While this might be mathematically possible, it is operationally disastrous.

Let us look at the real cost of “cheap” shared leads.

When you purchase a shared lead for a few dollars, you are not buying a prospect. You are buying a ticket to a race. That same consumer information has been sold to three, four, or sometimes ten other agents. By the time you receive the data, the prospect’s phone is already ringing.

If you are not the very first person to call, you are likely the fifth. By that point, the prospect is not just uninterested; they are annoyed. They stop answering unknown numbers. They install spam blockers. They regret filling out the form in the first place.

The cost of this lead is not just the purchase price. The real cost is the time your agents spend dialing, leaving voicemails, and getting hung up on. If an agent spends four hours calling 100 cheap leads to get zero appointments, you have lost four hours of payroll and four hours of opportunity cost.

Furthermore, there is a psychological toll. High-performing salespeople thrive on momentum. When they face constant rejection from prospects who never intended to speak with them or have already been pitched by five other brokers, their morale plummets. This leads to churn. Replacing a trained agent is far more expensive than paying for better data upfront.

Leads that convert to sales are rarely found in the bargain bin. Cheap data is cheap for a reason. It lacks intent, verification, and exclusivity.

Defining the Top 20%: What Makes Exclusive Life Insurance Leads Different?

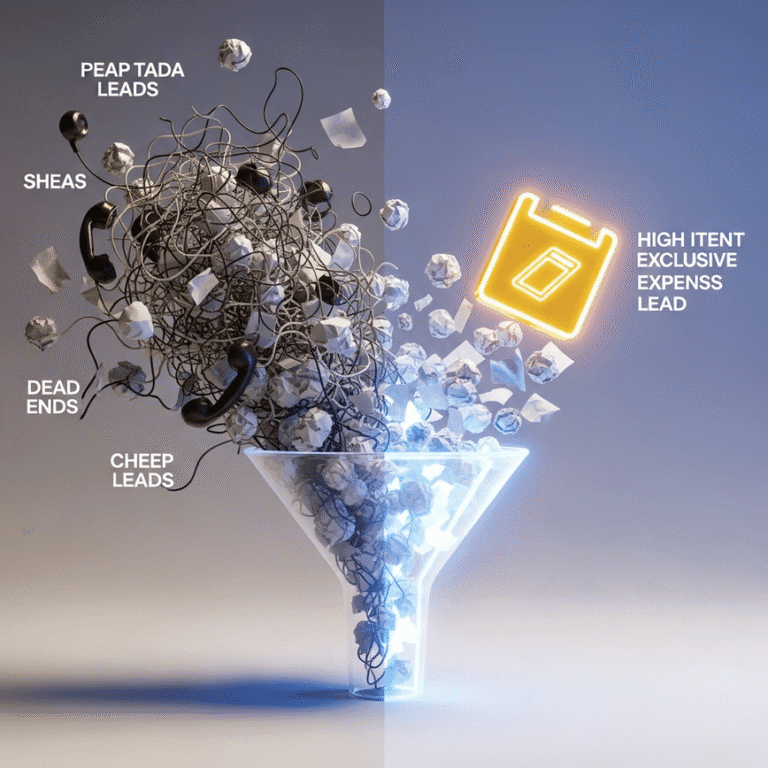

If the bottom 80 percent of leads are shared, aged, or low-intent, what does the top 20 percent look like?

High-quality, exclusive life insurance leads are defined by three specific criteria: Exclusivity, Verification, and Intent.

1. True Exclusivity

Exclusivity is not a buzzword. It is a strict operational standard. A truly exclusive lead is sold to one agent and one agent only. Once that data is delivered to your CRM, it is removed from the marketplace.

At Stallion Leads, we adhere to a strict “sold once” policy. We do not recycle data. We do not act as a list broker who resells the same contact info next week. When you buy a lead from us, you own that opportunity. This means when you call the prospect, you are not competing with a dozen other voices. You are the only professional they are expecting to hear from.

2. Technical Verification

The internet is full of bots and mistyped numbers. A lead is worthless if the phone number is invalid or belongs to the wrong person. The top 20 percent of leads undergo rigorous technical scrutiny before they ever reach an agent.

We utilize SMS One-Time Passcodes (OTP) on our mobile inputs. This means a user cannot submit a form unless they verify their phone number in real-time. This simple step eliminates fake numbers and significantly reduces the “I didn’t request this” objection. If they verified the number, they are real, and they are at the other end of the line.

3. Documented Intent

Did the prospect actually ask for help with life insurance, or were they tricked by a “win a customized iPad” survey? Leads that convert come from high-intent funnels where the consumer explicitly requests a quote or consultation.

We prioritize transparency through TrustedForm certificates. Every lead we generate comes with a digital receipt showing exactly when and where the prospect opted in. You can see the consent language they agreed to. This protects your agency from TCPA violations and ensures the person on the other end is genuinely looking for coverage.

How to Identify Leads That Convert to Sales

Identifying quality data requires looking beyond the price tag. You need to audit the source. Whether you are buying from Stallion Leads or evaluating other vendors, there are specific signals that indicate whether a lead source belongs in your top 20 percent.

Compliance as a Quality Signal

Compliance is often viewed as a legal hurdle, but it is actually a massive quality filter. A vendor that plays fast and loose with TCPA regulations is likely cutting corners on data quality too.

Look for clear consent language. The prospect should know they are going to be contacted. If the disclosure is hidden in white text on a white background, the lead will not convert because the prospect will feel ambushed when you call.

At Stallion, we place compliance first. Our consent language is clear, and we capture IP addresses, timestamps, and user agents for every submission. This creates a paper trail of intent. When an agent calls a prospect who knowingly opted in, the conversation starts on a foundation of trust rather than suspicion.

Real-Time Delivery Architecture

Speed is the second half of the conversion equation. Even the best exclusive life insurance leads degrade in quality if they sit in a database for an hour before being delivered.

The “Golden Window” for contacting a lead is within five minutes of submission. After five minutes, the odds of contacting the lead drop by 10x. After 30 minutes, the lead is effectively cold.

Your lead provider must have the infrastructure to deliver data instantly. We use direct API and webhook integrations to push leads into your CRM (like GoHighLevel, HubSpot, or Salesforce) the second the prospect hits submit. If you don’t use a CRM, we can deliver to a secure Google Sheet or send instant email and SMS alerts. The goal is to get the phone ringing while the prospect is still thinking about life insurance.

Calculating the Real ROI of Premium Data

Agency owners often hesitate at the price per lead of exclusive data compared to shared lists. However, the metric that matters is not Cost Per Lead (CPL). It is Cost Per Acquisition (CPA).

Let’s look at a hypothetical scenario to illustrate why leads that convert to sales are actually cheaper in the long run.

Scenario A: The Shared List Strategy

- You buy 100 shared leads at $5 each. Total spend: $500.

- Your contact rate is 5% because the consumers are bombarded with calls. You speak to 5 people.

- Your conversion rate on contacts is low because they are annoyed. You close 0 sales.

- Total Revenue: $0.

- Net Loss: $500 plus agent time.

Scenario B: The Exclusive Strategy

- You buy 10 exclusive, verified leads at $50 each. Total spend: $500.

- Your contact rate is 35% because the leads are real-time and expecting a call. You speak to 3 or 4 people.

- Your conversion rate is higher because the intent is verified. You close 1 sale with an Annual Premium (AP) of $1,000.

- Total Revenue: $1,000 (approx. commission varies).

- Net Profit: Positive.

In Scenario B, you spent the same amount of money but generated revenue. More importantly, your agent only had to manage 10 records instead of 100. They spent their time having meaningful conversations rather than listening to dial tones.

When you focus on the top 20 percent of data, you maximize the efficiency of your human capital. You stop paying your agents to be telemarketers and start paying them to be closers.

Optimizing Your Funnel for the Top 20%

Buying exclusive life insurance leads is only the first step. To fully leverage the 80/20 rule, your internal processes must be optimized to handle premium data with the respect it deserves.

You cannot treat a $50 exclusive lead the same way you treat a $2 aged lead.

Speed to Lead Protocols

We mentioned the five-minute window earlier, but it bears repeating. Speed is the ultimate variable.

Stallion Leads provides a “Speed to Lead” playbook to all our partners. The cadence is simple but ruthless:

- Call within seconds: As soon as the lead hits the CRM, dial.

- Double Dial: If they don’t answer, hang up and call right back. This breaks through “Do Not Disturb” modes and signals urgency.

- Immediate Text: If there is no answer after the second attempt, send a personalized SMS immediately. Since our leads are SMS-verified, you know the text will be delivered.

The Follow-Up Cadence

Many agents give up after one attempt. This is a waste of premium data. A prospect might be driving, working, or putting kids to bed when they submit the form.

We recommend a structured follow-up cadence over the first 48 hours. This includes a mix of calls, texts, and emails. Because the lead is exclusive to you, you have the luxury of nurturing the prospect without worrying that another agent will snipe the sale in five minutes. You own the lead. You can work it until you get a disposition.

If you are tired of burning payroll on leads that never pick up, it is time to change your approach. Stop Chasing Dead Leads Get Leads That Actually Convert by switching to a provider that prioritizes quality over volume.

Why Stallion Leads Fits the Pareto Principle

Our entire business model is built to serve the 20 percent of agents who do 80 percent of the business. We do not cater to the mass market of churn-and-burn call centers. We serve professional agents and agencies who understand the value of their time.

We Filter the Noise

We handle the heavy lifting of traffic generation, ad copy testing, and fraud filtering. We run the bot mitigation and the carrier-level phone checks. By the time a lead reaches your dashboard, it has passed a gauntlet of quality controls. We filter out the noise so you can focus on the signal.

Transparent Pricing and Scalability

We believe in earning your business with every batch. That is why we do not require long-term contracts or massive retainers. You can start with a small pilot block to test the quality. Once you see the contact rates and the ROI, you can scale up.

You choose your target states. You choose your daily caps. You are in control of the flow.

Partnership, Not Transaction

We don’t just send you a CSV file and wish you luck. We provide the resources you need to close. From our onboarding process that takes less than 10 minutes to our weekly snapshots of volume and trends, we act as a partner in your growth. We know that if you don’t make sales, you won’t buy more leads. Our incentives are perfectly aligned with yours.

Conclusion

The 80/20 rule is inescapable. You can either fight it by working harder on low-quality inputs, or you can leverage it by upgrading your data sources.

Leads that convert are not a matter of luck. They are the result of a deliberate strategy that prioritizes exclusivity, verification, and speed.

If you are ready to stop chasing the bottom 80 percent and start closing the top 20 percent, you need a lead partner that understands the difference. You need data that is exclusive, compliant, and verified.

Your time is your most valuable asset. Stop spending it on wrong numbers and angry prospects. Invest in exclusive life insurance leads that actually want to hear from you. The math is simple, and the choice is yours.