For any ambitious life insurance agent, a predictable and steady flow of new prospects is the absolute lifeblood of the business. Without it, even the most skilled agent will struggle. The central question isn’t if you need leads, but how you get them in a way that is both sustainable and profitable. How do life insurance agents get leads that actually turn into policies? The answer typically falls into two distinct camps: generating them yourself through in-house efforts, a path often referred to as DIY, or partnering with a professional life insurance lead generation service that specializes in finding qualified prospects.

Table of Contents

The DIY route promises ultimate control over every detail, while a professional service offers the immense advantages of speed, established expertise, and reduced risk. Choosing the right path can be the difference between struggling to fill your calendar and consistently closing new business. This guide breaks down the realities, both seen and unseen, of both approaches to help you decide which life insurance lead generation strategy will best fuel your agency’s growth.

The DIY Approach: How to Generate Life Insurance Leads on Your Own

Going in-house, often called creating DIY life insurance leads, means you are not just the agent; you are also the chief marketing officer, media buyer, copywriter, and compliance manager. You are responsible for every single step of the complex process, from conceptualizing and creating an ad to capturing a prospect’s information and ensuring its quality. This typically involves running paid advertising campaigns on competitive platforms like Facebook or Google, which requires building high-converting landing pages, writing compelling ad copy that grabs attention, designing eye-catching visuals, and meticulously managing a daily or weekly budget.

The Potential Upsides of In-House Lead Generation

On the surface, the DIY method has a certain appeal, especially for agents who want to be hands-on with every aspect of their business. The primary benefits include:

- Complete Control: You have the final say on everything. You dictate the exact messaging, the branding elements, and the specific demographic you want to target for every campaign. Every word, image, and call-to-action is yours to command, allowing you to tailor the approach to your unique sales style.

- Direct Market Insights: By managing campaigns yourself, you get a raw, firsthand look at what messaging resonates with your audience. You can see which ad headlines get the most clicks or which pain points generate the most interest, which can provide valuable data to refine your sales process and conversations.

- Potential for Lower Costs: This is the most alluring, yet most elusive, benefit. If you possess a rare combination of deep marketing expertise, analytical skill, and a bit of luck, you might achieve a lower cost per lead than you would by purchasing them. However, this outcome is far from guaranteed and often ignores the cost of your own time.

The Hidden Costs and Challenges of DIY

While control is appealing, the path of a DIY marketer is filled with significant hurdles that are often underestimated by even the most ambitious agents. The reality is that generating high-quality, compliant leads is a full-time profession, not a side task to be managed between client calls.

- First, there is a massive and unforgiving learning curve. Mastering digital advertising platforms like Google Ads and Facebook Ads, understanding the principles of conversion rate optimization, and learning to write compelling, persuasive copy takes years of dedicated practice and continuous education. You are not just competing with other agents; you are competing with seasoned media buyers who manage massive budgets and have teams of analysts behind them.

- Second, the financial risk is entirely on you, with no safety net. With DIY life insurance lead generation, you pay for clicks and impressions, not for results. Every dollar of ad spend that doesn’t convert—whether due to a poorly worded ad, an ineffective landing page, or targeting the wrong audience—comes directly out of your pocket with no guarantee of a single valid lead. This is a stark contrast to a performance model where you only pay for a verified outcome.

- Finally, and most critically, is the compliance minefield. Navigating TCPA regulations, ensuring proper one-to-one consent, and securely handling data is a complex and ever-changing legal challenge. A single misstep, such as failing to document consent correctly, can lead to crippling fines and legal trouble that can threaten your entire business. Without a robust system for capturing irrefutable proof of consent, like a TrustedForm certificate for every submission, you are operating with significant and unnecessary liability.

Partnering with a Professional Lead Generation Service

The alternative is to delegate your lead generation to a specialized agency whose entire business model revolves around this one critical task. A professional service handles the entire marketing process from end to end: building the high-performance sales funnels, running and optimizing the ad campaigns, verifying the data for accuracy, and delivering exclusive, real-time leads directly to you or your CRM. You are effectively hiring a team of experts whose sole focus is to fill your pipeline so you can focus on yours.

The Strategic Advantages of a Professional Partner

Working with a specialist transforms lead generation from a time-consuming liability into a powerful strategic asset. The advantages are clear, tangible, and immediate:

- Immediate Access to Expertise: You get to bypass the steep, expensive learning curve entirely. A dedicated agency that specializes exclusively in the life insurance niche has already spent years and significant capital testing and optimizing campaigns. This gives you instant access to proven ad copy, targeting strategies, and conversion funnels from day one.

- Predictable and Scalable Lead Flow: Instead of the unpredictable feast-or-famine cycle of DIY marketing, you get a consistent and reliable volume of prospects delivered to your inbox. This allows you to accurately forecast your sales activity, manage your time effectively, and scale your business predictably. You can start with a small test batch and confidently increase your volume as you close more deals.

- Guaranteed Quality and Compliance: Reputable partners deliver leads that are SMS-verified to prevent fake phone numbers and are fully TCPA-compliant, removing a massive burden from your shoulders. Every lead should come with a full consent record, like a Jornaya or TrustedForm certificate, giving you the documentation you need to contact prospects with complete confidence and peace of mind.

- Focus on What You Do Best: Outsourcing this critical but time-consuming task frees you and your team to focus on nurturing prospects, conducting needs analyses, and closing policies. Your valuable time is spent on revenue-generating activities, not troubleshooting ad campaigns, analyzing click-through rates, or worrying about legal compliance.

What to Look for in a Lead Generation Partner

Not all lead services are created equal, and choosing the wrong one can be just as costly as a failed DIY campaign. To ensure you find a true partner dedicated to your success, look for these key qualities:

- Industry Specialization: A generic marketing agency won’t understand the unique nuances, regulations, and customer psychology of the life insurance market. Partner with a company that lives and breathes your industry and knows how to speak to your ideal client.

- Lead Exclusivity: This is non-negotiable. Ensure the leads you buy are 100% exclusive to you. Shared leads, which are sold to multiple agents, create a frustrating race to the bottom, annoy prospects, and destroy your conversion rates before you even pick up the phone.

- Data Transparency: Your partner should be an open book, providing the full details of every lead, including timestamps, source information, and verifiable proof of consent. This transparency is essential for your own records and for building a foundation of trust.

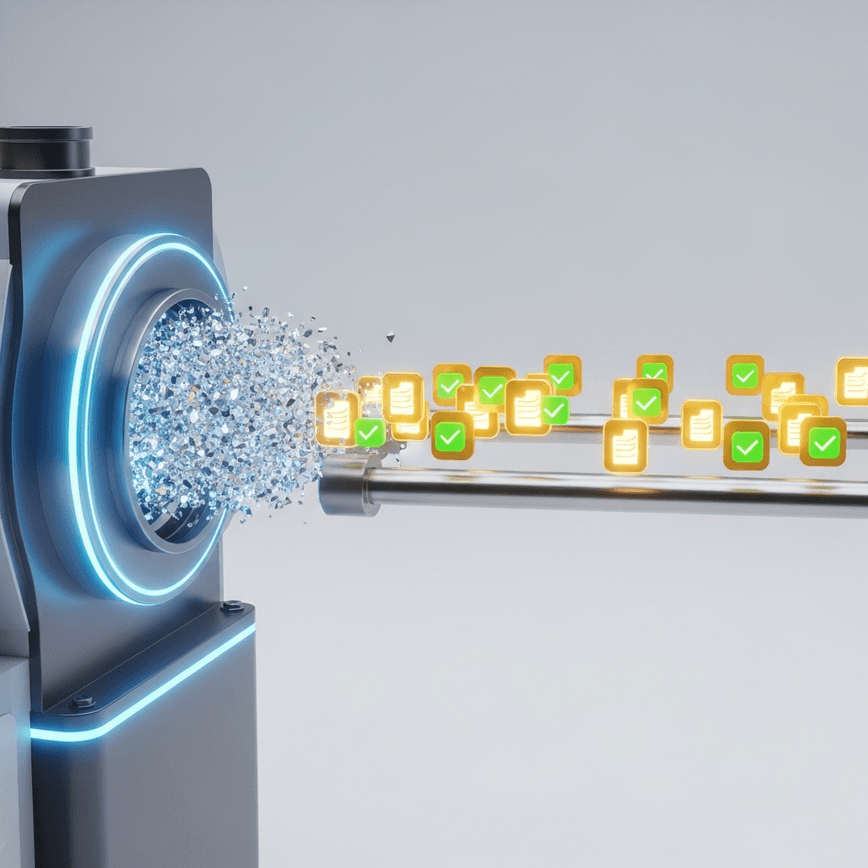

- A Performance-Based Model: The best partners align their success directly with yours. A pay-per-lead model means they only win when you get a qualified, verified lead that meets the agreed-upon criteria. This powerful model ensures you pay for tangible results, not just effort or exposure.

Making the Right Choice for Your Agency

The decision between DIY and a professional service ultimately comes down to a simple trade-off: control versus results. It’s a question of where your time and capital will generate the highest return.

The DIY path is best suited for agents who not only have a deep background in digital marketing but also view it as a core competency they wish to develop further. It requires a significant budget for testing and inevitable losses, and, most importantly, the dedicated time to manage and optimize campaigns daily.

For the vast majority of agents whose primary goal is to scale their business efficiently, minimize financial risk, and focus on selling insurance, partnering with a specialist is the most logical and effective choice. It provides a clear and direct path to predictable growth without the operational headaches, steep learning curve, and financial gambles of in-house marketing. If your goal is to avoid wasted ad spend and stop chasing dead-end leads, get leads that actually convert, then an expert partner is your greatest asset.

Why a Performance-Based Partner is the Ultimate Solution

The most advanced and agent-friendly form of life insurance lead generation moves beyond a simple transaction to form a true performance partnership. In this model, the incentives of the agent and the lead provider are perfectly and powerfully aligned. You are not just buying a list of names and numbers; you are investing in a meticulously engineered pipeline built on a foundation of quality, intent, and compliance.

Because you only pay for a verified lead that meets strict quality standards, the provider is financially motivated to deliver prospects with genuine high intent. They have every reason to weed out bad data, use ethical and effective marketing, and find people who are actively seeking information. This completely eliminates the risk of paying for empty clicks, bot traffic, or unqualified inquiries. This approach combines the targeted nature of a well-run DIY campaign with the security, scale, and expertise of a professional service, creating a powerful and sustainable engine for growth.

Ultimately, effective life insurance lead generation is measured by closed policies and protected families, not just by clicks or form submissions. While going it alone is an option for a select few, partnering with a performance-based specialist de-risks the entire process, guarantees compliance, and allows you to do what you do best: help families secure their financial future.