Are you tired of spending your day dialing numbers that lead to disconnected lines, wrong numbers, or people who have already been called by ten other agents? This frustrating cycle is the reality for too many insurance professionals. If your current lead provider is sending you recycled lists, you aren’t just wasting money; you are wasting your most valuable asset: time. Every hour spent chasing a phantom lead is an hour you could have spent consulting a client, closing a policy, or growing your business. It’s time to stop chasing ghosts and start closing policies. To do that, you need to buy exclusive life insurance leads that connect you with real, interested prospects the moment they ask for help.

Table of Contents

- Stop Wasting Your Budget on Dead Ends. It’s Time for Leads That Close.

- What Makes Exclusive Life Insurance Leads Different?

- The Stallion Leads Difference: How We Deliver Life Insurance Leads That Close

- Ready to Buy Exclusive Life Insurance Leads? Here’s How It Works.

- Build Your Pipeline with Predictable, High-Quality Leads

At Stallion Leads, we deliver a steady pipeline of verified, high-intent prospects directly to your CRM. These aren’t stale names from a spreadsheet that have been sitting around for weeks. They are real-time, exclusive opportunities to connect with motivated buyers who are actively seeking coverage for their families and their future, giving you the best possible chance to win their business.

Stop Wasting Your Budget on Dead Ends. It’s Time for Leads That Close.

The traditional lead generation model is broken for agents. For years, lead brokers have prioritized volume over value, often selling the same outdated data to multiple agents. This creates a frantic race to the bottom where the fastest dialer might get a brief conversation, but everyone else is left with a dead end and a wasted investment. This is why so many agents feel like they have to stop chasing dead insurance leads just to stay afloat and avoid burnout.

These shared or aged leads suffer from critical, business-killing problems:

- Low Contact Rates: By the time you receive the lead, the prospect has already been contacted multiple times. They become “lead-fatigued,” annoyed by the constant calls, and start ignoring any number they don’t recognize. Your call never even gets a chance.

- Zero Exclusivity: You are competing against a handful of other agents for the same person’s attention. This immediately commoditizes your expertise, forcing you to compete on price rather than the value you provide as a trusted advisor, severely diminishing your chance of building genuine rapport.

- Questionable Consent: Old leads often have a murky and untraceable history. You have no way of knowing how the data was collected, putting you at serious risk for TCPA compliance violations, which can come with steep financial penalties.

This outdated approach forces you to pay for abstract activities like clicks, impressions, or raw data, with no guarantee of quality or intent. You are paying for a *chance* to find a lead, not the lead itself. You deserve a partner whose success is tied directly to yours—a partner who only wins when you do.

What Makes Exclusive Life Insurance Leads Different?

The term “exclusive” is more than just a marketing buzzword; it’s a fundamental qualifier that defines the lead’s value and your potential for success. An exclusive lead is generated for and sold to only one agent. Crucially, it is delivered in real time, often mere seconds after the prospect submits their information online. This immediacy is your greatest advantage.

Here’s why that matters for your business:

- Higher Connection Rates: When you call, you are the first and only agent reaching out. The prospect is expecting your call because they just requested information. This transforms the interaction from a disruptive cold call into a welcome, scheduled consultation, dramatically increasing the odds of a meaningful conversation.

- Reduced Competition: With exclusivity, the pressure to be the fastest dialer vanishes. You can take a breath and focus on what you do best: building a relationship, listening to the prospect’s needs, and crafting the perfect solution instead of just trying to be the first one to spit out a quote. You become an advisor, not just another salesperson.

- Increased ROI: While the upfront cost for an exclusive lead may be higher than for a shared one, the conversion rate is significantly better. This results in a much lower cost per acquisition because you are spending less time and money sifting through unqualified contacts to find the one that closes. This leads to more profitable policies and predictable growth.

When you invest in exclusive leads, you are buying a genuine, pre-qualified business opportunity, not just a name and phone number from a list.

The Stallion Leads Difference: How We Deliver Life Insurance Leads That Close

We built our system from the ground up to solve the core problems agents face every day. We don’t just sell leads; we build predictable, scalable client acquisition pipelines based on quality, compliance, and performance. Our entire model is meticulously designed to deliver life insurance leads that close, fueling your business with consistent opportunities.

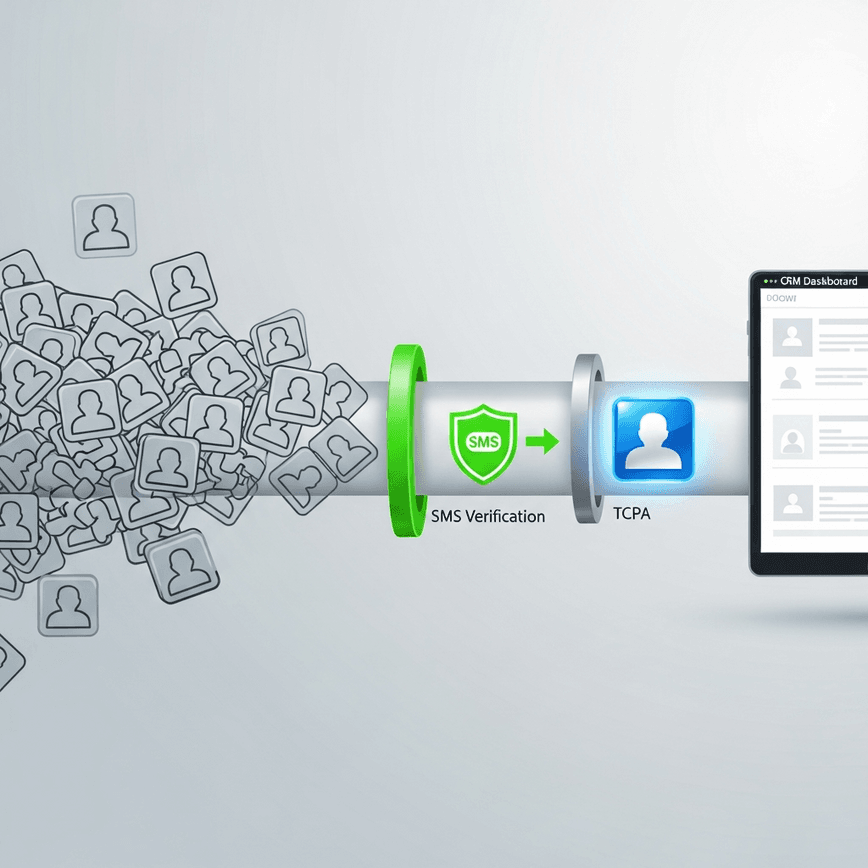

Real-Time, SMS-Verified Prospects

Every lead is a real person who has actively requested a quote online. Before a lead ever reaches you, it passes through our automated verification system. We use a real-time SMS verification process to confirm the phone number is valid and actively monitored by the prospect. This simple step eliminates fake data, typos, and disconnected numbers, ensuring you can connect on the very first try.

100% Exclusive and TCPA-Compliant

Every lead you receive from Stallion Leads is 100% exclusive to you and you alone. We stake our reputation on this promise—we never resell or share your leads with other agents. To guarantee your peace of mind, each lead is also TrustedForm-certified, providing you with a downloadable certificate of consent. This digital receipt gives you ironclad proof of when and how the prospect gave their consent, protecting your business from costly compliance issues.

Engineered for High Intent

Our leads are generated through conversion-optimized marketing funnels that we constantly test and refine. We go beyond just collecting a name and number. We ask the right qualifying questions to gauge their intent and understand their needs, so you spend your valuable time talking to people who are serious about purchasing a policy, not just window shopping or casually browsing.

A Performance Partnership, Not a Transaction

Unlike other agencies that charge hefty retainers or for vague ad spend, we operate on a simple and transparent Pay-Per-Lead model. You only pay for the verified, exclusive leads you receive. There are no long-term contracts, no hidden fees, and absolutely no wasted ad spend on empty clicks or impressions. Our growth is directly tied to your success. We only succeed when you are consistently closing policies.

Ready to Buy Exclusive Life Insurance Leads? Here’s How It Works.

Getting started is simple and transparent. We handle all the complexities of digital advertising, media buying, ad compliance, and data verification so you can focus on what you do best: building relationships and selling policies.

- Define Your Criteria: Let us know your exact needs. Are you targeting final expense leads in Florida or term life leads for young families in Texas? We’ll customize the campaign to fit your ideal client profile and licensed states.

- Set Your Volume: Tell us how many leads you want per day or per week. You are in complete control of your budget and lead flow. You can start with a small test batch to prove the quality and scale up as you start closing deals and seeing a return on your investment.

- Receive Leads Instantly: As soon as a prospect is verified, their information is delivered directly to your CRM or email in real time. This delivery includes all their contact details and the proof of consent, allowing you to engage while their interest is at its absolute peak.

Build Your Pipeline with Predictable, High-Quality Leads

Long-term success in the insurance industry comes from consistency. The anxiety of not knowing where your next client will come from can be paralyzing. A predictable flow of high-quality opportunities is the engine that drives sustainable growth, allowing you to move from uncertainty to confidence. It gives you the power to scale your business, hire more agents, and forecast your revenue with accuracy. It’s time to move beyond the guesswork and feast-or-famine cycles of traditional prospecting and invest in a system that delivers real, measurable results. Stop chasing dead leads and start building meaningful connections with prospects who are actively looking for a policy today.