The Pareto Principle, commonly known as the 80/20 rule, dictates that 80% of your results come from 20% of your efforts. In the context of selling life insurance, this ratio is often painfully skewed in the wrong direction. Agents frequently spend 80% of their time chasing prospects who will never buy, leaving only a fraction of their energy for the 20% of leads who are genuinely interested.

Table of Contents

- The Hidden Cost of Unverified Data

- The Mechanics of the Lead Verification Process

- Why TCPA Compliant Leads Are Superior

- Applying the 80/20 Rule to Your Pipeline

- The Role of Speed-to-Lead in Verified Data

- How Bots Infiltrate the Lead Ecosystem

- The Compliance “Paper Trail”

- Optimizing Your CRM for Verified Data

- The Future of Lead Generation

- Conclusion: Quality is the Ultimate Efficiency

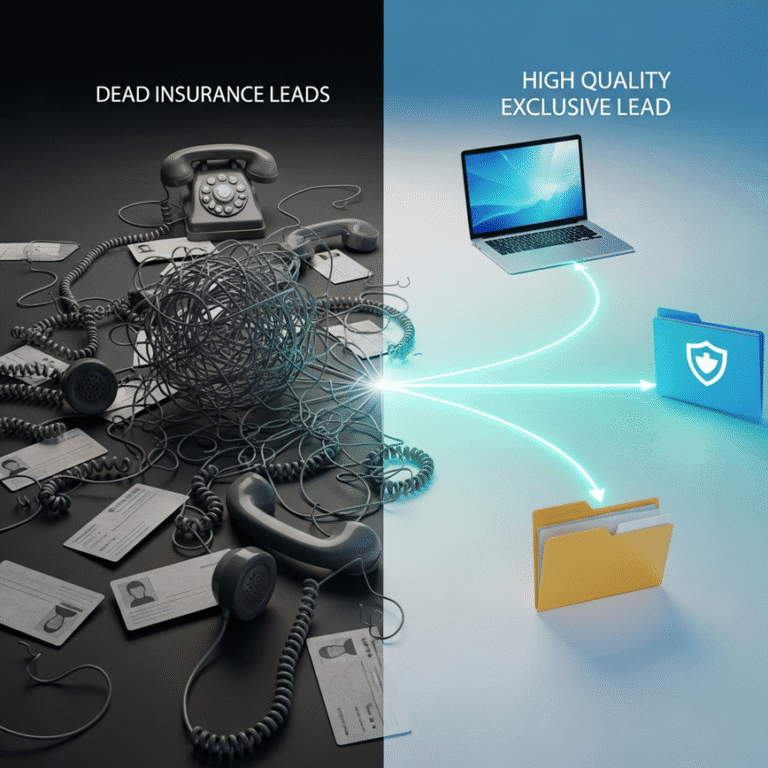

The root cause of this inefficiency is almost always data quality. When an agent buys a batch of leads, they are often purchasing a mixed bag of serious inquiries, tire kickers, wrong numbers, and automated bot submissions. The time spent filtering through this “bottom 80%” of waste manually is time stolen from closing deals.

This is where technology must intervene. The modern solution to this age-old sales problem is the implementation of a rigorous technical filter before a lead ever reaches your CRM. By utilizing SMS One-Time Passcodes (OTP), carrier-level validation, and strict compliance protocols, we can mechanically eliminate the waste.

This article explores the mechanics of the lead verification process, why verified insurance leads are the only viable option for scalable agencies, and how TCPA compliant leads protect your business while simultaneously increasing your conversion rates.

The Hidden Cost of Unverified Data

Most agents calculate the cost of a lead simply by looking at the price tag. If a lead costs $10, and they buy 100, the total cost is $1,000. However, this math ignores the single most expensive resource in an agency: producer time.

If a lead has not gone through a robust lead verification process, the agent becomes the filter. You are paying your staff, or using your own valuable time, to act as a data scrubber. Every time you dial a number that is disconnected, belongs to the wrong person, or was submitted by a bot, you incur a “time tax” that destroys your ROI.

Consider the workflow of calling unverified data. You dial. You wait. You hear a disconnect message. You mark it in the CRM. You move to the next. This cycle repeats. If 40% of your list consists of bad numbers or bots, you are effectively working a part-time job as a data cleaner.

Verified insurance leads remove this burden. When you purchase data that has been subjected to technical filtration, the “bottom 80%” of non-contactable leads are removed before you pay for them. This shifts the 80/20 dynamic. Instead of spending 80% of your time finding someone to talk to, you spend 80% of your time talking to people who requested information.

The Mechanics of the Lead Verification Process

- The phone number is valid.

- The person submitting the form possesses that phone.

- The person explicitly consents to be contacted.

Layer 1: HLR Dips and Carrier Validation

The first line of defense is technical validation against the carrier network. Before a lead is sold, the system should perform a Home Location Register (HLR) dip. This is a real-time query to the mobile network database.

This query tells the lead generator if the number is currently active, what carrier it belongs to, and if it is a mobile or landline. This step immediately filters out “555” numbers, disconnected lines, and obvious fakes. However, knowing a number is active is not enough. You need to know that the person filling out the form owns that number.

Layer 2: SMS One-Time Passcode (OTP)

This is the gold standard of verification. When a prospect fills out a form requesting life insurance information, they are asked to enter their mobile number. The system then sends a 4-digit code to that device via SMS. The user must read the text and enter the code back into the website to submit the form.

This step is a massive friction point, and that is a good thing. It serves two critical functions.

- First, it proves possession. A bot filling out forms at random cannot read a text message sent to a real physical device. This single step eliminates nearly 100% of bot traffic.

- Second, it proves intent. A user who is only mildly interested might browse a site. A user who is willing to wait for a text, open it, and type in a code is demonstrating a significantly higher level of intent. They want the information bad enough to jump through a hoop to get it.

Layer 3: Duplicate Suppression

A robust process also checks the database to ensure this person hasn’t already been sold to another agent in the last 30, 60, or 90 days. selling the same lead to five agents simultaneously is a common practice in the industry, but it destroys conversion rates. True verified insurance leads are exclusive, meaning the suppression logic ensures you are the only one calling.

Why TCPA Compliant Leads Are Superior

Compliance is often viewed as a legal hurdle, a box to be checked to avoid lawsuits. While the legal protection is vital, TCPA compliant leads also perform better from a sales perspective.

The Telephone Consumer Protection Act (TCPA) requires that consumers give “prior express written consent” before receiving marketing calls or texts, especially if automated dialing technology is used. To be compliant, a lead capture form must have clear disclosure language right above the submit button.

The TrustedForm Standard

At Stallion Leads, we utilize technology like TrustedForm to document this consent. This technology captures a video replay of the user’s interaction with the website. It records them reading the disclosure, filling out the form, and clicking submit. It captures their IP address, the timestamp, and the specific browser they used.

Why does this matter for sales? Because a lead that generates a TrustedForm certificate is a lead that saw the disclosure. They know you are going to call. They know you are going to text.

When you call TCPA compliant leads, you are not cold calling. You are fulfilling a request. The psychological state of the prospect is different. They are not surprised to hear from you; they are expecting it. This reduces the “who is this?” objection and allows you to move straight into your script.

Non-compliant leads often come from “co-registration” paths where a user signs up for a sweepstakes or an unrelated offer, and their data is sold as an insurance lead. These people did not ask for insurance. They are angry when you call. Compliance acts as a filter for intent. If they didn’t agree to the terms, they don’t get into your CRM.

Applying the 80/20 Rule to Your Pipeline

Once you understand the technical filtering that goes into verified insurance leads, you can restructure your agency’s operations around the 80/20 rule.

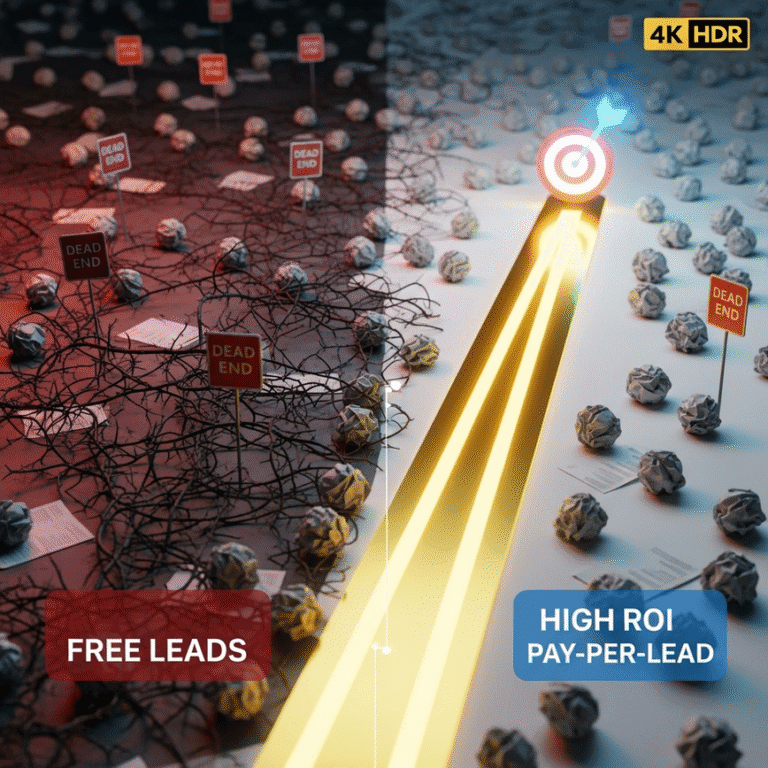

The 80/20 rule in sales suggests that 80% of your revenue will come from the top 20% of your prospects. In a traditional model using low-quality shared leads, you have to churn through the bottom 80% (the waste) to find the gold.

By purchasing leads that have already been filtered via SMS verification and TCPA protocols, you are effectively outsourcing that churning process to technology. You are buying a list that consists entirely of the “top 20%” of the general population.

The Math of Verification

Let’s look at a hypothetical scenario comparing cheap, unverified data vs. verified leads.

Scenario A: Unverified Leads

- Volume: 100 leads

- Cost: $3 per lead ($300 total)

- Bad Numbers/Bots: 40%

- Contact Rate on Remaining: 10%

- Contacts: 6 people

- Sales: 1 policy

Scenario B: Verified Insurance Leads

- Volume: 20 leads

- Cost: $15 per lead ($300 total)

- Bad Numbers/Bots: 0% (Filtered by SMS OTP)

- Contact Rate: 35% (Higher intent)

- Contacts: 7 people

- Sales: 2 policies

In this scenario, the spend is the same. However, in Scenario A, the agent had to dial 100 numbers and deal with 40 disconnects to make one sale. In Scenario B, the agent only dialed 20 numbers to make two sales. The efficiency gain is massive. The agent in Scenario B has 80% more free time to focus on follow-up, referrals, or personal development.

The Role of Speed-to-Lead in Verified Data

Even the best lead verification process cannot overcome a slow agent. In fact, high-intent leads expire faster than low-intent ones. A prospect who verifies their number via SMS is sitting by their phone right now. They are in a “buying window.”

If you wait two hours to call, that window closes. They get distracted, they go to work, or they find another solution.

This is why real-time delivery is the partner to verification. At Stallion Leads, we deliver leads instantly via webhook or API. This allows you to Stop Chasing Dead Leads and Get Leads That Actually Convert. The combination of SMS verification (to ensure the number is real) and instant delivery (to ensure you catch them while they are interested) is the formula for high conversion.

Most agents see the best results when they call within 5 minutes and text within 1 minute of receiving the lead. Because the lead has just verified their number, you know they have the phone in their hand. Your pick-up rates on the first dial will skyrocket compared to aged or unverified data.

How Bots Infiltrate the Lead Ecosystem

To appreciate the value of the lead verification process, it helps to understand the enemy: bots.

The internet is crawling with automated scripts designed to fill out forms. Some are malicious, looking for vulnerabilities. Others are “lead bots” designed by unscrupulous affiliates to inflate their numbers.

A bot can fill out a standard name/email/phone form in milliseconds. If a lead vendor does not have a “challenge” in place, that bot submission looks like a real lead. It gets sold to you. You call it. The number is either fake, or it belongs to an innocent person who never visited the site.

Standard CAPTCHAs (those “click the traffic light” puzzles) are decent, but AI is getting better at solving them. However, a bot cannot physically possess a SIM card to receive an SMS text message. By mandating SMS verification, we create a physical barrier that software cannot cross.

If you are buying leads that do not claim to be SMS verified, you are undoubtedly paying for a percentage of bot traffic. It is unavoidable in the current digital landscape without technical intervention.

The Compliance “Paper Trail”

When you purchase TCPA compliant leads, you are buying insurance for your agency. The regulatory environment for telemarketing is tightening. Lawsuits regarding unwanted calls are common.

A proper verification process produces a digital paper trail.

- The Consent Certificate: A document showing the visual proof of the user on the site.

- The IP Address: Proving the digital location of the user.

- The Timestamp: Matching the exact second the lead was generated.

- The Verification Log: Proof that the OTP was sent and successfully entered.

This data package protects you. If a consumer claims they never asked to be called, you have irrefutable proof that they visited the site, read the disclosure, received a text code, and entered that code to request contact. This turns a potential legal headache into a non-issue.

Stallion Leads provides this level of transparency for every single lead. We do not hide the source. We believe that verified insurance leads should come with the receipts to prove their validity.

Optimizing Your CRM for Verified Data

Once you have secured a flow of verified insurance leads, you must adjust your CRM settings to maximize the 80/20 rule.

Since you know the numbers are valid, you should employ a more aggressive initial contact cadence. With unverified data, you might hesitate to double-dial or text immediately for fear of disturbing a wrong number. With verified data, you have license to pursue.

Suggested Workflow for Verified Leads:

- Minute 0: Lead arrives in CRM via Webhook.

- Minute 1: Automated SMS sent: “Hi [Name], I just received your request for life insurance info. I’m reviewing your options now.”

- Minute 2: Outbound Call. If no answer, leave a voicemail.

- Minute 5: Email with a calendar link.

- Hour 4: Second Call.

Because the lead verification process has already filtered the “bottom 80%” of non-buyers, every lead in your system deserves this level of attention. You are no longer looking for a needle in a haystack; you are polishing a collection of needles.

The Future of Lead Generation

The industry is moving toward stricter standards. Carriers and FCC regulations are making it harder to call consumers without strict consent. The days of buying massive lists of unverified data and using a 10-line dialer to blast them are coming to an end.

The future belongs to high-intent, low-volume, high-conversion strategies. Agents who adapt to this by prioritizing TCPA compliant leads and robust verification will thrive. Those who continue to chase volume over quality will find their margins squeezed by wasted time and legal risks.

Stallion Leads was built for this future. We do not act as a list broker. We generate our own traffic, manage our own funnels, and verify every single inquiry with SMS OTP. We do this because we know that for a life insurance agent, the only asset more valuable than their money is their time.

Conclusion: Quality is the Ultimate Efficiency

Applying the 80/20 rule to your sales process starts with your inputs. You cannot expect high-quality outputs (sales) if your inputs (leads) are 80% garbage.

By utilizing a lead verification process that includes SMS OTP and TrustedForm certification, you effectively slice off the bottom 80% of the market – the bots, the fakes, and the non-consenting. This leaves you with a pure stream of prospects who have proven they are real, reachable, and interested.

Investing in verified insurance leads is not just about buying data; it is about buying back your time. It allows you to focus your skill and energy on closing deals rather than scrubbing lists. In a competitive market, the agent who speaks to the most qualified people wins. Technical filtration is the tool that makes that possible.

Stop settling for the haystack. Start demanding the needle.