The difference between a closed deal and a dead lead often comes down to seconds. In the life insurance industry, hesitation is expensive. You can have the most persuasive presentation and the best carrier products, but none of that matters if you cannot get the prospect on the phone.

Table of Contents

We are looking at the tactical application of the 80/20 rule in your sales process. If 80% of your revenue comes from 20% of your activities, then the activity of speed to lead life insurance outreach is the most critical 20% you will perform all week.

At Stallion Leads, we handle the heavy lifting of generating exclusive, SMS-verified prospects. However, once that lead hits your CRM, the baton passes to you. This guide provides the exact cadence, timing, and insurance sales scripts necessary to maximize your contact rate and turn inquiries into policies.

The Mathematics of the Five-Minute Window

Industry data consistently shows that calling a prospect within five minutes of their inquiry increases the likelihood of contact by nearly 100 times compared to waiting just thirty minutes. Furthermore, the odds of qualifying that lead drop by 80% if you wait just ten minutes.

When a consumer fills out a form for Final Expense or Life Insurance, they are in a moment of high intent. They are thinking about their mortality, their family’s financial security, or their budget. That headspace is fragile. If you wait an hour, life gets in the way. They start making dinner, they go back to work, or worse, they answer a call from a competitor who dialed faster.

Speed to lead life insurance strategies are about honoring that moment of intent. You are not interrupting their day; you are responding to a request they just made.

Phase 1: The Technical Setup

You cannot achieve a sub-five-minute response time manually if you are staring at a static spreadsheet. Speed requires infrastructure. Before you make a single dial, ensure your environment is built for velocity.

CRM Integration

Stallion Leads delivers data in real-time via webhook or API. We support direct integrations with platforms like GoHighLevel, HubSpot, and others. If you are relying on checking your email inbox for lead notifications, you are already too slow. Your CRM should be set to trigger an automated workflow the second the data arrives.

The “Phone Ready” Mindset

If you are buying leads, you must be in a position to take them. This sounds obvious, but many agents turn on their ad spend or lead flow while they are in meetings or driving. If you cannot answer the phone or dial out immediately, pause your campaigns. It is better to receive zero leads than to receive ten leads you ignore for three hours.

Phase 2: The Stallion “Double Tap” Cadence

This entire sequence happens within the first 10 minutes of receiving the lead.

Minute 0-1: The First Dial

As soon as the lead lands, you call. Do not research them on Facebook. Do not check the map to see where they live. You have their name, age, and state. That is enough. Dial the number.

If they answer: Go straight to the script (provided below).

If they do not answer: Do not leave a voicemail yet. Hang up.

Minute 1-2: The Immediate Text

Modern consumers, especially those shopping for insurance, often screen unknown numbers. They see a call from a number they do not recognize and ignore it.

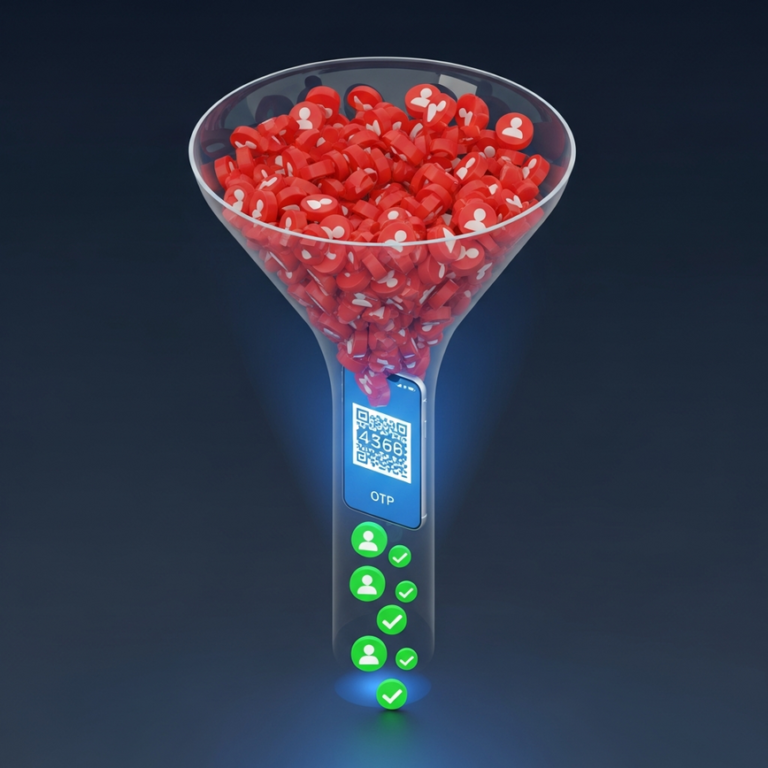

Immediately after hanging up, send a personalized text message. Since Stallion Leads uses SMS verification (One-Time Passcode) to capture the lead, you already know this is a valid mobile number.

SMS Template 1:

*”Hi [Name], this is [Agent Name]. I just received the request you verified regarding life insurance coverage. I’m giving you a quick call to confirm the details. Talk in a second.”

Minute 2-3: The Second Dial (The Double Tap)

Wait sixty seconds after sending the text, then call again.

This is the psychological key to the strategy. A single call from an unknown number looks like spam. Two calls back-to-call, especially following a text message explaining why you are calling, signals urgency and legitimacy. It tells the prospect, “This is a real person trying to reach me about the thing I just asked for.”

If they answer: Proceed to the script.

If they do not answer: Now you leave a voicemail.

Minute 5: The Email Follow-Up

If you still have not made contact, an automated email should go out. This ensures you are present in every channel they might check.

Subject Line: Regarding your request [Name]

Body:

*”Hi [Name], I tried to reach you quickly to verify the life insurance information you requested. I want to make sure I get you the accurate quotes before the system updates. Please give me a call back at [Your Number] or reply ‘YES’ to my text.”

Phase 3: Insurance Sales Scripts That Convert

Getting them on the phone is half the battle. Keeping them on the phone is the other half. When you are focused on closing insurance leads, your opening lines must build immediate trust.

Because Stallion Leads are exclusive and verified, you have a massive advantage. You are not a telemarketer calling a cold list. You are fulfilling a request.

The “Verification” Opener

This script leverages the fact that the user just went through a verification process on our site. It connects the dots for them immediately.

Agent: “Hello, is this [Prospect Name]?”

Prospect: “Yes.”

Agent: “Hi [Prospect Name], this is [Your Name]. I’m getting back to you regarding the life insurance information you just requested and verified with your phone code. I have that file on my desk right now. I just need to verify two quick things to make sure I’m not sending you generic junk mail. You put down here that you are [Age] years old, is that correct?”

Why this works:

- “Just requested”: Reminds them of the immediate action.

- “Verified with your phone code”: This is a specific detail that only the legitimate vendor would know. It proves you aren’t a spammer.

- “Not sending generic junk mail”: Establishing that you are there to provide value, not clutter.

The “Soft Landing” Script (For the Second Call)

If they pick up on the second dial (the Double Tap), acknowledge the persistence without apologizing for it.

Agent: “Hey [Prospect Name], sorry to double dial you there. It’s [Your Name]. I sent you a text a moment ago. I just wanted to make sure I caught you while you were still at your computer or phone so we didn’t end up playing phone tag all week. Regarding that life insurance request, are you looking more for burial coverage or income replacement?”

Why this works:

- It explains the behavior (avoiding phone tag).

- It immediately pivots to a binary question (Burial vs. Income), forcing them to think about their needs rather than how to get off the phone.

Handling the “I’m Busy” Objection

Even with perfect speed to lead life insurance execution, you will catch people at bad times.

Prospect: “I can’t talk right now, I’m at work.”

Agent: “I completely understand. I don’t want to take up your work time. Since I have you for ten seconds, let me just ask, were you looking to cover just burial expenses, or did you need to leave money behind for a spouse?”

Prospect: “Just burial.”

Agent: “Perfect. I’ll put a quote together for that specific need. What time do you get off work so I can share the numbers with you? 5:30 or 6:00?”

Why this works:

It respects their time but extracts a micro-commitment and a specific qualification detail before hanging up.

Phase 4: The Long-Tail Cadence (Days 2-7)

You will not close everyone in the first five minutes. The 80/20 rule applies here too: 80% of your easy sales come from that first burst, but the remaining revenue requires persistence.

Many agents give up after the first day. This is a mistake. Closing insurance leads often requires demonstrating reliability over time.

Day 2: Different Times, Different Mediums

If you called in the morning on Day 1, call in the afternoon on Day 2.

- Call 1: Afternoon (e.g., 2:00 PM)

- SMS: “Hi [Name], still working on this file for you. Do you have 5 minutes later today?”

Day 3: The Value Add

Stop asking for “time” and start giving value.

- SMS/Email: “I ran some numbers based on your age and state. There are a few state-regulated programs that look promising. I don’t want you to miss the window on these. Call me at [Number].”

Day 5: The “Is Everything Okay?” Approach

- Call: Leave a voicemail.

- Script: “Hey [Name], it’s [Your Name]. I’ve tried a few times to get this info to you. I’m starting to worry that maybe I have the wrong number or you’re dealing with an emergency. Just shoot me a text to let me know you’re okay, even if you aren’t interested anymore.”

Day 7: The Break-Up

This is a powerful psychological tool. People hate losing opportunities.

- SMS/Email: “Hi [Name]. Since I haven’t heard back, I assume you found coverage elsewhere or put this on the back burner. I’m going to close your file on my end so I stop bothering you. If you ever need help in the future, you have my number. Best of luck.”

Surprisingly, this message often generates a high response rate from people apologizing for being busy and asking you to keep the file open.

Common Speed Bumps and How to Fix Them

Implementing a high-velocity strategy exposes weaknesses in your process. Here is how to troubleshoot the most common issues.

“I get too many wrong numbers.”

If you are buying shared leads or aged data, this is the norm. With Stallion Leads, we mitigate this via SMS One-Time Passcode verification. If a lead lands in your CRM from us, that human physically held the phone and entered a code. If you are getting “wrong number” objections, it is usually a smokescreen. Pivot to: “Oh, I apologize. The system showed this number verified a request for life insurance just now. Since I have you on the line, do you currently have coverage in place?”

“I can’t call that fast because I’m on the phone.”

This is a good problem to have, but it requires management. If you are a solo agent, you must block your time. Dedicate specific hours to “inbound response” where you are not doing administrative work. Alternatively, use an AI appointment setter or a virtual assistant to handle the initial speed to lead life insurance outreach and book appointments on your calendar.

“They say they didn’t request anything.”

This is a reflex, not a fact. Consumers fill out forms and forget, or they fear a sales pitch.

Counter: “I understand completely. People fill out so many things online. I have the request here from [IP Location/City] stamped at [Time]. It looks like you were checking rates for [State]. I’m not here to sell you anything you don’t want, I just want to give you the information you asked for so you can cross it off your list.”

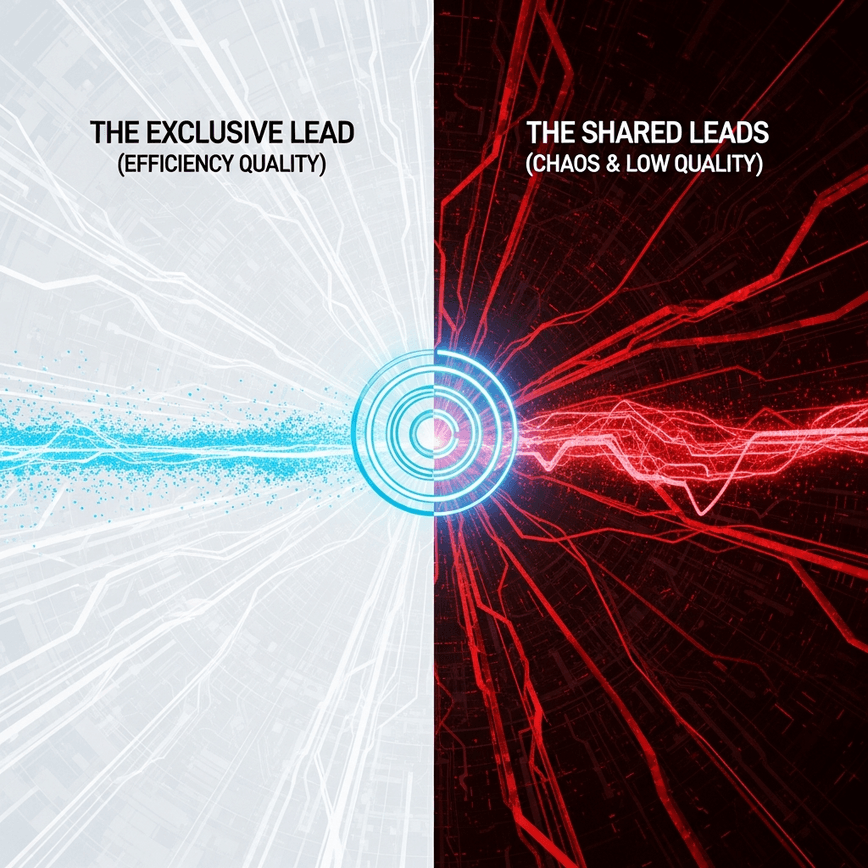

Why Lead Quality Dictates Speed Effectiveness

You can have the fastest trigger finger in the west, but if you are calling a phone book, you will not make sales. Speed only acts as a multiplier on lead quality.

If you multiply zero quality by high speed, you still get zero.

This is why closing insurance leads efficiently starts with the source. Stallion Leads focuses on exclusive, high-intent data. We do not recycle lists. When you apply the cadence described above to our data, you are contacting people who:

- Are actively looking (Real-time).

- Are reachable (SMS Verified).

- Have provided consent (TCPA Compliant).

This quality assurance allows you to be confident. You know you aren’t harassing a stranger; you are serving a prospect.

If you are tired of churning through data that doesn’t convert, it might be time to look at your lead source. You can Stop Chasing Dead Leads Get Leads That Actually Convert by partnering with a vendor that prioritizes exclusivity and verification. When you combine Stallion’s data integrity with the 5-minute hustle, you create a predictable revenue engine.

The 80/20 Takeaway

The Pareto Principle tells us to focus on the few things that produce the most results. In the context of buying leads:

- The 20% of Effort: Setting up automated alerts and committing to the 5-minute call window.

- The 80% of Results: A drastically higher contact rate and a pipeline full of qualified prospects.

Do not overcomplicate the sales process. You do not need a twenty-page script or a degree in psychology. You need a phone, a valid lead, and the discipline to dial immediately.

The agents who win with Stallion Leads are not necessarily the ones with the most experience. They are the ones who treat every lead notification like a ringing phone. They pick up. They verify. They close.

Review your current process today. If you are waiting an hour to call your leads, you are voluntarily giving 80% of your potential income to the agent who calls first. Tighten your timeline, load your insurance sales scripts, and watch your contact rates climb.