The notification hits your phone. A new lead just landed in your CRM. It is a fresh, exclusive inquiry from a senior in your target territory looking for information on state-regulated burial programs. At this exact moment, the clock starts ticking. The difference between a closed policy and a “ghosted” prospect is often measured in seconds, not hours.

Table of Contents

- The Mathematics of Speed: Why Minutes Cost Money

- The Pre-Game Setup: Ready Before It Rings

- The 7-Minute Execution Sequence

- Mastering the Final Expense Sales Script

- Your Insurance Lead Follow Up Strategy for Non-Responders

- Overcoming Common Objections

- Why Data Quality is the Foundation of Speed

- Putting It All Together

- Summary Checklist for Agents

In the high-stakes world of insurance sales, buying high-quality data is only half the battle. The other half is execution. Even the most exclusive, SMS-verified lead can go cold if it is not worked correctly. This guide is not just about theory. It is a tactical, minute-by-minute breakdown of exactly what to do the moment a prospect raises their hand.

We are going to cover the psychology of the senior buyer, the exact final expense sales script to use when they pick up, and the precise insurance lead follow up strategy required to maximize your ROI. If you are tired of chasing dead ends and want to start closing final expense leads with consistency, this playbook is your new standard operating procedure.

The Mathematics of Speed: Why Minutes Cost Money

Before we dive into the scripts, we have to address the “why.” You have likely heard the term “speed-to-lead” thrown around in sales seminars, but in the final expense niche, it is not just a buzzword, it is a survival mechanism.

Data consistently shows that calling a prospect within the first five minutes of their inquiry increases the likelihood of contact by over 100 times compared to calling after thirty minutes. After five minutes, the drop-off is precipitous. Why? Because the prospect is still in the “problem-aware” mindset. They just filled out a form. They are thinking about their mortality, their budget, or a burden they do not want to leave for their children.

If you call ten minutes later, they might have moved on to making lunch, watching TV, or worse, answering a call from a competitor who bought a shared lead at the same time you bought yours.

However, when you partner with a provider like Stallion Leads, you are already starting with an advantage. Because our leads are exclusive and never sold as shared data, you are not racing five other agents. You are racing the prospect’s attention span. The goal is to catch them while the phone is still in their hand.

The Pre-Game Setup: Ready Before It Rings

You cannot execute a 7-minute playbook if you are fumbling for your login credentials or trying to find your headset. Closing final expense leads requires a “cockpit” mentality. Before you turn your lead flow on, ensure the following is in place:

- CRM Integration: Ensure your leads are posting directly to your CRM or a Google Sheet that sends you an instant notification. Relying on email refresh is too slow.

- Script Visibility: Have your final expense sales script printed or open on a second monitor. Even seasoned pros need a roadmap to avoid getting derailed.

- Phone Prep: If you use a dialer, have it active. If you dial manually, have your phone ready.

- Mental State: Seniors can sense hesitation. You need to sound authoritative, calm, and helpful immediately.

The 7-Minute Execution Sequence

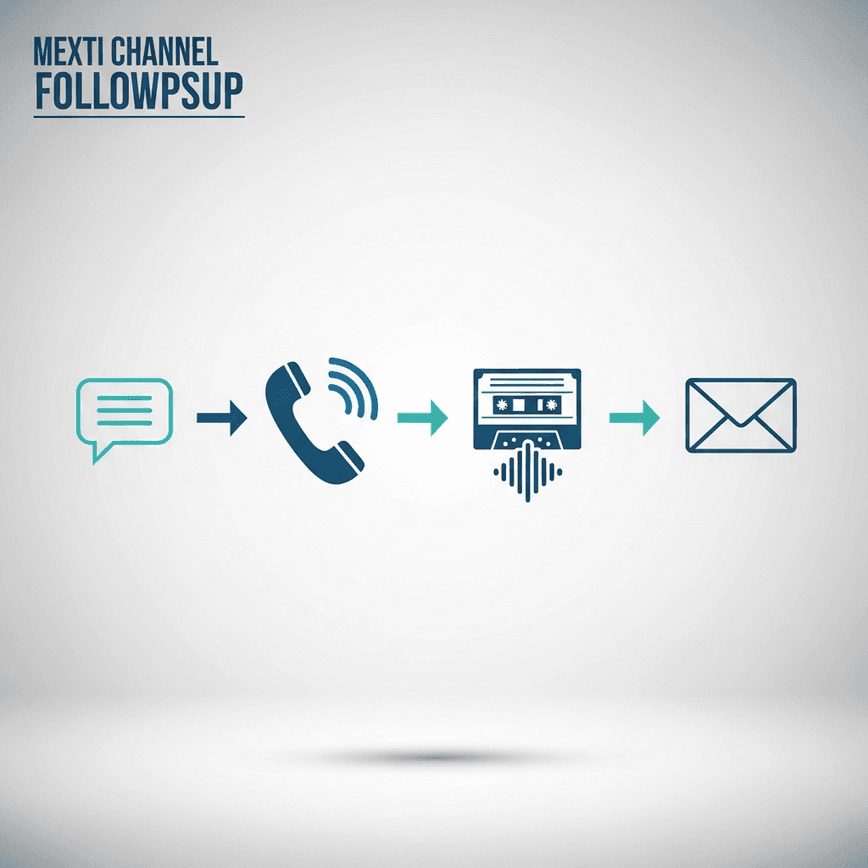

Here is the exact workflow to execute from the second the lead arrives. This sequence is designed to touch the prospect across multiple channels (phone and text) rapidly without seeming desperate.

Minute 0-1: The Immediate SMS (Automated or Manual)

As soon as the lead hits, your first action should be an SMS. Why text first? Because many people screen unknown numbers. A text establishes context for the call that is about to follow.

The Script:

“Hi [Name], this is [Agent Name]. I just received the request you sent regarding the new state-regulated final expense programs. I am giving you a quick call now to verify the information. Talk soon.”

This text does three things:

- It identifies you.

- It references the specific action they took (the request).

- It warns them a call is coming, which drastically increases the pick-up rate.

Because Stallion Leads uses SMS verification on the front end, you know this is a valid mobile number. You are not wasting credits texting a landline or a bot.

Minute 1-3: The Double Dial

Thirty seconds after the text is sent, make the call. If they do not answer the first time, hang up and dial again immediately.

This is known as the “Double Dial” technique. In an era of spam calls, most consumers ignore a single ring from an unknown number. However, if that same number calls back instantly, psychology shifts. The prospect thinks, “This must be important,” or “Maybe it’s an emergency.” It bypasses the mental spam filter.

Important Note: Do not leave a voicemail on the first dial. Only leave it if they miss the second dial.

Minute 3-5: The Voicemail Drop

If they miss the second call, you must leave a voicemail. The purpose of the voicemail is not to sell the policy. It is to sell the callback or the next answer.

The Script:

“Hello [Name], this is [Agent Name]. I’m the local field underwriter calling about the request you just filled out online regarding burial coverage. I have your file on my desk and just need to verify two quick details to see if you qualify. I’ll try you again later, or you can text me back at this number.”

Notice the language. “Field underwriter” sounds more authoritative than “sales agent.” “File on my desk” implies work has already been done. “Verify two quick details” sounds low friction. This is how you start closing final expense leads before you even speak to them.

Minute 5-7: The Email Chaser

While the voicemail is settling, send a follow-up email. This ensures you are visible in their inbox when they check it later.

Subject Line:Regarding your request: [Prospect Name]

Body:

“Hi [Name], I just tried calling you. I am reviewing the final expense inquiry you submitted. I have the information ready, but I need to confirm your age and beneficiary preference to ensure the quotes are accurate. When is a good time to chat for 5 minutes?”

By minute seven, you have touched the prospect via text, phone (twice), voicemail, and email. You have surrounded them professionally. If they were serious about the request, they now know you are serious about helping them.

Mastering the Final Expense Sales Script

You have executed the speed-to-lead protocol, and they picked up the phone. Now what? The first ten seconds determine the outcome of the call. Many agents fail here because they sound like telemarketers.

A strong final expense sales script must bridge the gap between an internet form and a human conversation.

The Opener: The “I’m Just Doing My Job” Approach

Avoid asking, “How are you today?” It screams “salesperson.” Instead, get straight to business with a tone of professional obligation.

Agent:“Hello, is this [Name]?”

Prospect:“Yes.”

Agent:“Hi [Name], this is [Agent Name]. I’m getting back to you about the request you just sent in regarding the final expense burial programs for residents in [State]. You listed your favorite hobby as [Hobby/Color/Qualifier] and your age as [Age], correct?”

Why this works:

By referencing specific data points provided in the lead (which Stallion Leads captures clearly), you prove you are not a cold caller. You are referencing a specific action they took.

The Bridge: Establishing Authority

Agent:“Great. My job is simple. I’m the field underwriter assigned to your county. I just need to ask a few medical questions to see which state-regulated programs you qualify for. It usually takes about five minutes. Do you have a few moments now, or should I call back in ten minutes?”

This sets expectations. It is not a sales call; it is an eligibility check.

The Discovery: Finding the Pain

You cannot close a deal without finding the “why.”

Agent:“Now, [Name], most folks I speak with are looking into this because they don’t want to leave a financial burden on their kids, or they just want to make sure their current policy is enough. What was it that made you look into this today?”

This question is the pivot point. If they answer this honestly, you are on your way to closing final expense leads.

Your Insurance Lead Follow Up Strategy for Non-Responders

Realistically, even with a 7-minute response time, you will not reach everyone immediately. People work, sleep, and drive. This is where your insurance lead follow up strategy determines your long-term profitability.

Amateur agents call once, get no answer, and throw the lead away. Professional agents know that 80% of sales happen between the 5th and 12th contact.

The 14-Day Cadence

Here is a proven schedule for working exclusive leads:

- Day 1: The 7-Minute Playbook (3 calls, 1 text, 1 email).

- Day 2: Call in the morning. Call in the afternoon. Send a text with a different angle (e.g., “Did you see the email I sent?”).

- Day 3: Call once. Send a “video text” (a short selfie video introducing yourself).

- Day 4: Rest.

- Day 5: Call once. Email with a subject line: “Closing your file?”

- Day 7: The “Hail Mary” Call.

- Day 14: The Break-up Text.

The Break-Up Text

This is a powerful psychological tool.

Script:

“Hi [Name], I’ve tried to reach you a few times regarding your request for burial insurance but haven’t had any luck. I assume you’ve already found coverage or changed your mind, so I’m going to close your file to prioritize other families. Take care.”

Surprisingly, this text often gets the highest response rate. People hate losing an opportunity. They will often reply, “No, don’t close it! I’ve just been busy.”

Overcoming Common Objections

When closing final expense leads, you will face resistance. The quality of the lead helps, but your ability to handle objections seals the deal.

Objection: “I didn’t request anything.”

This is common with seniors who forget what they clicked on, or with low-quality leads where the data was farmed. With Stallion Leads, you have a secret weapon: The TrustedForm Certificate.

The Rebuttal:

“I understand, [Name]. There is a lot of spam out there. However, I have a request here that was submitted from your IP address at [Time] today. You specifically mentioned your date of birth as [DOB]. Does that ring a bell? I’m not trying to sell you anything you don’t want; I just need to mark your file correctly. Were you just looking for prices?”

By validating the data we provide (timestamp, IP, and consent), you gently remind them of their action without being aggressive.

Objection: “I’m busy right now.”

The Rebuttal:

“I completely understand. I’m running between appointments myself. I don’t need to go through the whole thing right now. I just need to verify your age and smoking status so I can put the information in the mail for you. You are [Age], correct?”

This is a “loophole” technique. You agree they are busy, promise to be brief, and immediately ask a simple data question. Once they answer that one question, they are usually back in the conversation.

Objection: “I already have insurance.”

The Rebuttal:

“That is excellent, [Name]. Most of my clients do. The reason they request this information is usually to check if they can get more coverage for the same price, or because their current policy has a waiting period. Who are you currently insured with?”

This turns a rejection into a policy review.

Why Data Quality is the Foundation of Speed

You can have the best final expense sales script in the world and the most aggressive insurance lead follow up strategy, but if the phone number is wrong, you are shouting into the void.

This is where the source of your leads dictates your success. Many vendors sell “real-time” leads that are actually recycled data or filled with fake numbers. When you try to execute a speed-to-lead strategy on bad data, you burn out. You spend your energy leaving voicemails for disconnected numbers or arguing with people who never opted in.

Stallion Leads changes this dynamic through rigorous verification:

- SMS Verification: We require a One-Time Passcode (OTP) for the prospect to submit the form. This guarantees the mobile number is real and in their possession at that moment.

- Exclusive Delivery: We do not sell the same lead to five agents. When you get it, you own the opportunity.

- Compliance Documentation: We capture the TrustedForm certificate, giving you the legal and psychological leverage to prove they requested the call.

When you trust your data, you can commit to the process. You can dial with confidence knowing there is a real human on the other end who asked for help.

Putting It All Together

The difference between a struggling agent and a top producer is rarely talent. It is the system. The top producers have a system for closing final expense leads that relies on speed, persistence, and a relentless focus on data quality.

If you implement this 7-minute playbook, you will see your contact rates soar. The double dial works. The immediate text works. The structured follow-up works. However, they only work if you have the discipline to execute them every single time a lead comes in.

Stop leaving your sales to chance. Stop buying shared leads and wondering why no one answers. Upgrade your fuel source. When you combine high-intent, verified prospects with a professional speed-to-lead cadence, you stop chasing ghosts and start building a book of business.

If you are ready to stop wasting time on bad data and start applying this playbook to leads that actually convert, we are ready to help you scale. Get high-quality leads that actually convert and see the difference exclusive data makes in your daily dial count.

Summary Checklist for Agents

To wrap up, print this checklist and tape it to your desk. This is your daily roadmap for closing final expense leads:

- Tech Check: CRM is open, headset is charged.

- First 5 Minutes: Text, Double Dial, Voicemail, Email.

- The Script: Reference the specific data points (favorite color, age, address).

- The Objection: Use the “I’m just the underwriter” frame to lower resistance.

- The Follow-Up: Commit to the 14-day cadence for every non-responder.

- The Mindset: Assume every lead wants to buy; they just need you to help them navigate the confusion.

Your insurance lead follow up strategy is your safety net. It catches the deals that speed misses. But speed is your spear. It pierces the market and secures the easiest wins. Use both, and watch your production numbers climb.