The insurance industry has a massive, unspoken problem. It is not a lack of interest from prospects or a shortage of available data. The problem is the hidden liability buried inside cheap lead lists.

For years, agents have been taught to focus on Cost Per Lead (CPL). The math seems simple: If you buy more leads for less money, you should get more swings at the bat. However, this volume-based approach ignores a legal reality that has shut down agencies overnight. The Telephone Consumer Protection Act (TCPA) has evolved, and so have the predatory litigators who exploit it.

Sending a text message or making a dialer call to a consumer who did not explicitly give you permission is no longer just an annoyance. It is a potential lawsuit with statutory damages ranging from $500 to $1,500 per violation. If you buy a list of 1,000 names and even a small percentage are “litigator traps” or recycled numbers without proper consent trails, the financial risk outweighs any commission you might earn.

This guide explains the technical infrastructure required to protect your agency. We will break down how TCPA compliant insurance leads are generated, why SMS verified leads are the only safe path forward, and how high-intent life insurance leads are actually defined by their verification status.

The Legal Minefield: Why “Cheap” Leads Are Expensive

Before we dive into the technology, you need to understand the environment you are operating in. The days of buying a spreadsheet of 5,000 aged data points and loading them into a power dialer are effectively over.

Regulatory bodies and carriers are cracking down on unsolicited communications. But the bigger threat comes from professional plaintiffs. These are individuals who intentionally put their numbers on lead forms or recycled lists, waiting for an agent to call or text them without proper proof of consent. Once you make contact, they demand a settlement.

If your lead vendor cannot provide a digital certificate proving exactly when, where, and how that consumer asked to be contacted, you have no defense.

Many vendors cut corners to keep prices low. They might resell data that is months old (where consent has expired or the number has changed hands). They might use “co-reg” paths where a user signs up to win an iPad and is buried in fine print agreeing to be called by fifty different partners. This is not just bad for conversion; it is dangerous for your business.

Safety requires a shift in mindset. You are not just buying a name and a phone number. You are buying a documented, digital chain of custody.

Defining TCPA Compliant Insurance Leads

Compliance is not a gray area. For a lead to be safe to dial or text, specifically using automated technology, it must meet strict criteria. TCPA compliant insurance leads are defined by the clarity of the “hand-raise.”

When we generate a lead at Stallion Leads, compliance is baked into the user interface before the consumer even hits submit. Here is what that actually looks like technically:

1. Clear and Conspicuous Disclosure

The consent language cannot be hidden in a link or set in white text on a white background. It must be immediately visible to the consumer. It must explicitly state that by clicking the button, they agree to receive calls and texts from a specific entity (or a limited network) regarding insurance quotes.

2. The “Prior Express Written Consent” Standard

This is the legal gold standard. It means the consumer took an affirmative action to request contact. Pre-checked boxes generally do not hold up well in court. The user must physically check the box or click a button that is clearly labeled as a consent action.

3. One-to-One or Limited Scope

The FCC has moved to close the “lead generator loophole.” This means a consumer’s consent applies to the logical seller they expect to hear from, not thousands of unrelated marketing partners. When you purchase exclusive leads from us, that consent is not diluted across a massive network. It is generated for the purpose of selling a life insurance policy, and it is delivered exclusively to you.

If your current vendor cannot explain exactly how they capture this consent, or if they refuse to show you the landing pages they use, you are likely buying non-compliant data.

The Technical Shield: How TrustedForm Works

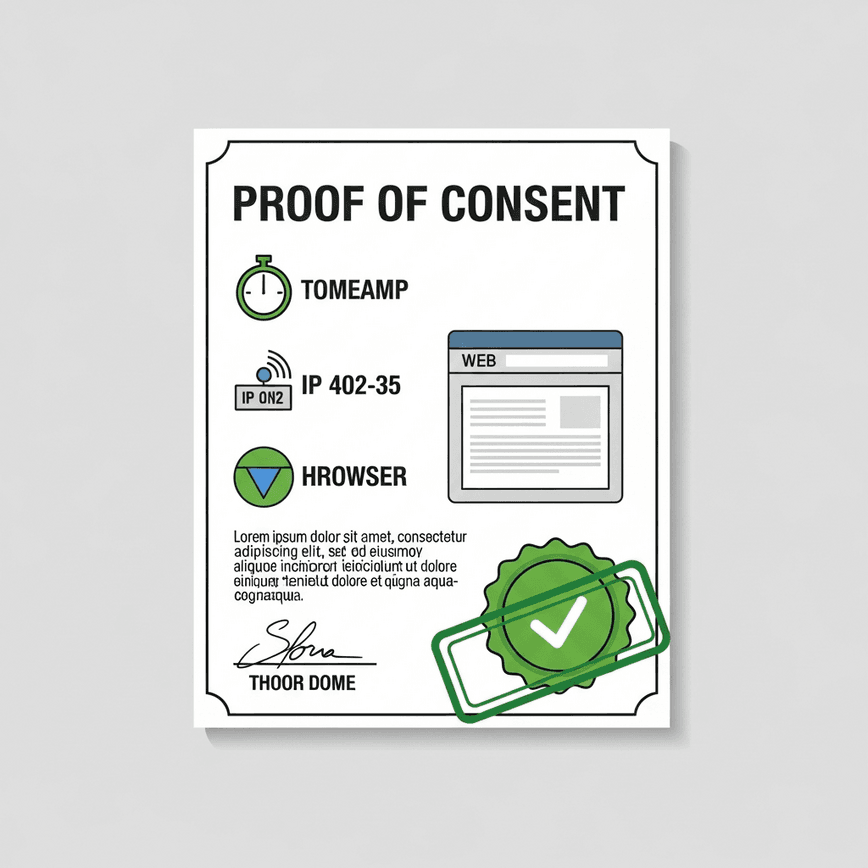

To prove that a lead is compliant, you need evidence. In the digital age, this evidence comes in the form of a TrustedForm certificate (or a similar solution like Jornaya).

Think of TrustedForm as a digital notary. It witnesses the transaction between the consumer and the website. When a prospect fills out one of our forms to request information on Final Expense coverage, a script runs in the background.

This script captures a “video replay” of the user’s interaction with the page. It records:

- The Timestamp: The exact second the request was made.

- The IP Address: Verifying the location of the user.

- The Browser User Agent: Confirming the device type.

- The Visual Context: A snapshot of what the page looked like at that moment, proving the disclosure text was visible and legible.

We provide this certificate with every single lead. If a consumer or a regulator ever questions why you called, you do not have to argue. You simply produce the certificate. It shows the consumer visiting the page, reading the disclosure, and clicking “Get Quote.”

This level of documentation transforms TCPA compliant insurance leads from a marketing buzzword into a tangible asset that protects your license and your bank account.

Beyond Compliance: The Power of SMS Verified Leads

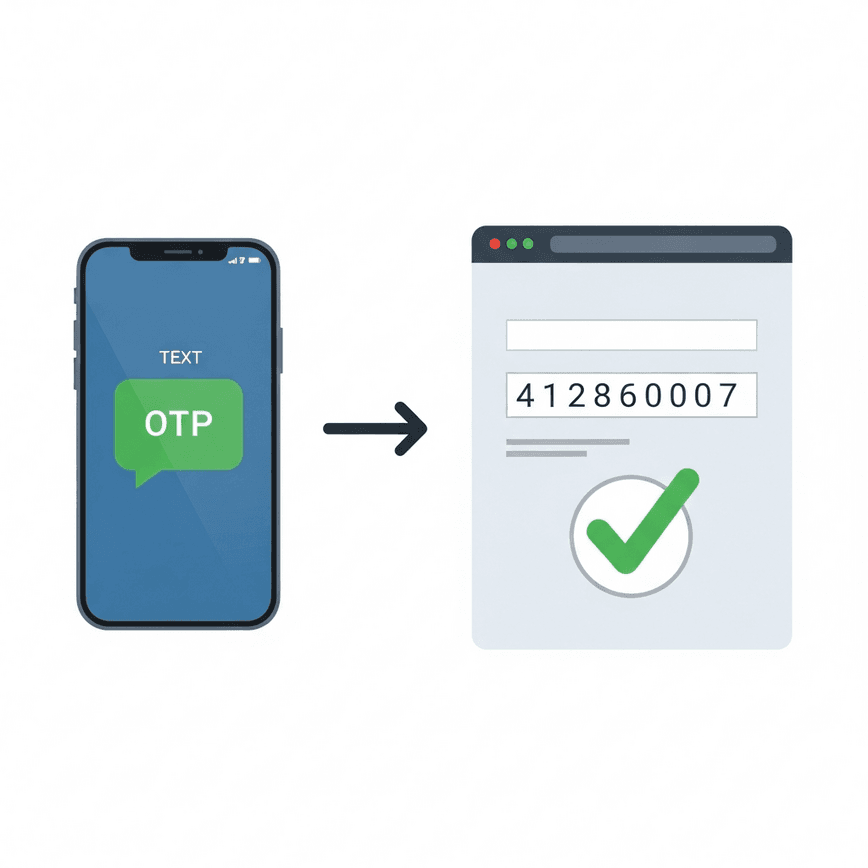

While TrustedForm protects you legally, it does not guarantee the person on the other end is real. This is where the second layer of our validation stack comes in: SMS One-Time Passcodes (OTP).

The internet is full of bots. There are scripts designed to fill out forms automatically to skew advertising algorithms or harass site owners. Furthermore, human error is real. A legitimate prospect might fat-finger their phone number, typing a 6 instead of a 7.

If you dial that wrong number, you are annoying a stranger. If you text that wrong number using automation, you might be violating the TCPA because that stranger never gave consent.

The OTP Solution

We solve this by requiring SMS verified leads. Here is the workflow we use at Stallion Leads:

- Input: The consumer enters their phone number on our landing page.

- Challenge: Before they can submit the form, our system sends a 4-digit code to that mobile number via text.

- Verification: The consumer must read the text and enter the code back into the website to unlock the “Submit” button.

This simple step, which happens in seconds, changes everything.

It physically proves possession of the device. A bot cannot read a text message on a physical phone. A person who typed a fake number cannot get the code. A person who mistyped their number will realize the error and correct it to get the code.

When you receive SMS verified leads, you know with 100% certainty that the number is active, it is a mobile device capable of receiving texts, and the human being requesting the quote has the phone in their hand right now.

Why High-Intent Life Insurance Leads Require Verification

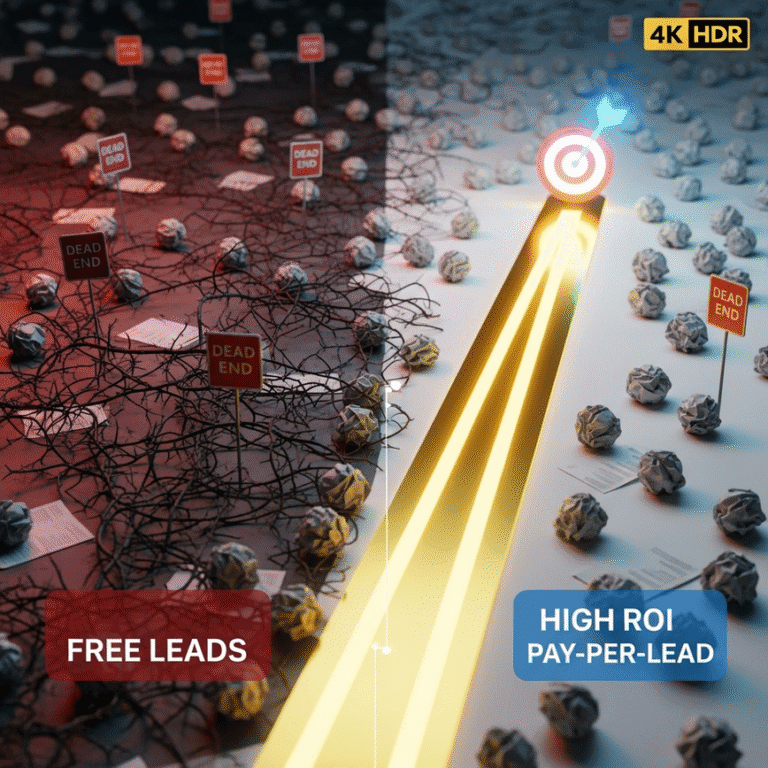

There is a direct correlation between the friction of the signup process and the intent of the buyer.

In the lead generation industry, “friction” is usually seen as a bad thing. Marketers want to make it as easy as possible for people to sign up so they can boast about high volumes. They use Facebook “Lead Forms” that auto-fill data without the user even typing.

The problem is that easy entry equals low intent. People often forget they filled out an auto-filled form ten minutes later. When you call them, they say, “I didn’t request this.”

By introducing the SMS verification step, we intentionally add friction. We ask the user to pause, look at their phone, and type in a code. A person who is just browsing or mildly curious will not do this. They will bounce off the page.

That is a good thing. You do not want to pay for window shoppers.

The prospects who complete the OTP process are demonstrating serious interest. They are jumping through hoops to talk to you. These are high-intent life insurance leads. They have proven they are willing to engage in a conversation.

When you combine this high intent with the security of TCPA compliant insurance leads, you get a prospect profile that is ready to close and safe to contact.

Stallion Leads’ 3-Step Validation Protocol

We do not rely on third-party brokers to do this work for us. We own the media, the pages, and the validation logic. This allows us to maintain a strict chain of custody.

Here is the protocol that runs quietly in the background for every lead you buy from us:

Step 1: The Compliance Capture

We drive premium traffic to our owned and operated sites. The user sees clear consent language. As they navigate the form, TrustedForm documents the session. If they do not agree to the terms, the data is never captured.

Step 2: The Identity Challenge

We run the phone number through carrier-level lookups to ensure it is not a known litigator line or a VoIP number associated with fraud. Then, we trigger the SMS OTP. If the code is not verified, the lead is discarded. We do not sell “partial” leads.

Step 3: The Real-Time Handoff

Once the lead is verified, it is routed instantly to your CRM or Google Sheet. We do not age the data. We do not sell it to five other agents. It is exclusive to you. You get the contact info, the TrustedForm certificate URL, and the timestamp.

This protocol is why agents who switch to us often see their contact rates double. They are no longer chasing ghosts; they are speaking to verified humans.

Checklist: Is Your Current Lead Vendor Putting You at Risk?

If you are currently buying leads from other sources, you need to audit them immediately. The liability falls on you as the caller, not just the vendor.

Ask your current provider these four questions:

- Do you provide a TrustedForm or Jornaya certificate with every single lead? If the answer is “no” or “only on request,” you are vulnerable.

- Are these leads SMS verified via One-Time Passcode? If they are not, you are likely paying for a percentage of bad numbers and bots.

- Are these leads sold exclusively to me? Shared leads dilute consent. If a consumer is called by ten agents, they will complain, and the risk of a TCPA violation increases with every angry interaction.

- Can you verify the age of the data? If they are selling you “aged” leads, the consent provided months ago may no longer be valid, especially if the number has been reassigned to a new user.

How to Scale Safely with Compliant Data

Safety does not mean slow growth. In fact, having a clean, compliant pipeline allows you to scale faster because you waste less time on bad data and disputes.

When you trust your data source, you can automate your initial outreach with confidence. You can set up SMS workflows to text your new leads immediately, knowing that you have the legal right to do so and that the number is valid.

The goal of your agency should be predictable revenue. Lawsuits, carrier complaints, and wasted ad spend are the enemies of predictability. By investing in high-intent life insurance leads that are backed by technical verification, you build a moat around your business.

You can focus on your sales script and your closing techniques, rather than worrying if the next person you dial is a plaintiff attorney.

If you are ready to stop chasing dead leads and secure your pipeline, it is time to look at your lead sources through the lens of compliance and quality.

Summary

The insurance lead market is shifting. The winners in the coming years will not be the agents who find the cheapest data. The winners will be the ones who secure the highest quality, most compliant data.

SMS verified leads offer the highest contact rates because they eliminate wrong numbers. TCPA compliant insurance leads offer peace of mind because they eliminate legal ambiguity. When you combine them, you get the Stallion Standard: exclusive, safe, and ready to convert.

Do not risk your agency’s future on a bad list. Demand verification. Demand consent. Demand proof.