Every independent insurance agent eventually faces the same dilemma. You are staring at your monthly budget, trying to decide how to allocate your marketing dollars. On one side, you have vendors offering leads for $2 or $3 a pop. On the other side, you see providers offering exclusive life insurance leads at a significantly higher price point.

Table of Contents

- The Economics of the “Race to the Bottom”

- The Hidden Costs of Cheap Leads

- Defining Exclusive Life Insurance Leads

- The ROI Showdown: Running the Numbers

- Why “Cost Per Lead” is a Vanity Metric

- The Role of Technology in Lead Quality

- How to Transition from Shared to Exclusive

- Compliance: The Ultimate Value Add

- Conclusion: You Get What You Pay For

The math seems simple on the surface. If you have $1,000 to spend, you could get 300 shared leads or perhaps only 30 to 40 exclusive ones. If you are purely looking at volume, the cheaper option looks like the winner. More names means more dials, which should mean more sales, right?

This is the trap that kills more insurance careers than burnout.

The reality of the cost of final expense leads is not found in the price tag per lead. It is found in the Cost Per Acquisition (CPA). When you peel back the layers of wasted time, low contact rates, and the emotional toll of dialing angry prospects who have already been called ten times that morning, the “cheap” leads often turn out to be the most expensive investment you can make.

In this guide, we are going to break down the true economics of shared vs exclusive leads. We will look at the hidden costs of shared data, the operational advantages of exclusive verification, and how shifting your focus from “cost per lead” to “return on investment” can transform your agency from a telemarketing churn-and-burn operation into a profitable business.

The Economics of the “Race to the Bottom”

To understand why shared leads are so cheap, you have to understand the business model behind them. Lead aggregators, the companies selling these files, operate on a volume model. They purchase data from various sources, often incentivized surveys or generic “win a customized iPad” sweepstakes, and then they resell that data to as many agents as legally possible.

In a shared lead environment, a consumer fills out a form. Within milliseconds, that information is sold to three, five, or sometimes even ten different agents.

The Speed-to-Lead Paradox

We know that speed to lead is critical. However, in a shared environment, it creates a chaotic experience for the prospect. If five agents receive the lead at the exact same second, that consumer’s phone rings immediately. Then it rings again. And again.

By the time you dial, even if you are fast, you might be the third or fourth person to call. The prospect is not just annoyed; they are defensive. They did not realize their request for a quote would result in a bombardment of calls. This drastically lowers your contact rate. You are not just competing with other agents; you are competing against the consumer’s patience.

The Data Degradation

Because shared leads are sold multiple times, the data degrades instantly. A lead is only “fresh” for the first agent who connects. For everyone else, it is effectively an aged lead the moment it is bought. When you analyze the cost of final expense leads in this bracket, you are paying for data that has already been harvested by a competitor.

The Hidden Costs of Cheap Leads

Agents often fixate on the upfront invoice amount, but the cost of final expense leads includes operational expenses that are harder to track but deeply impactful. When you buy cheap, shared data, you are agreeing to pay these hidden taxes on your business.

1. The Cost of Time

Your time is your most valuable inventory. If you are dialing 300 shared leads to get one sale, calculate how many hours you spent dialing, leaving voicemails, and getting hung up on.

If you value your time at even a modest $50 per hour, spending 10 hours to close one deal adds $500 to your acquisition cost. High-volume, low-quality leads turn agents into telemarkers rather than closers. You spend 90% of your time trying to find someone to talk to and only 10% of your time actually selling insurance.

2. The Morale Drain

Churn creates burnout. Dialing hundreds of numbers only to hear “stop calling me” or “I already bought” destroys agent morale. This is a major reason why new agents wash out of the industry within the first year. They are not failing because they cannot sell; they are failing because they cannot endure the rejection volume required to make shared leads work.

3. Compliance Risks

This is the most dangerous hidden cost. Cheap shared leads often have murky origins. Did the consumer actually consent to be called? Did they see a clear TCPA disclosure?

In the aggregator model, consent is often buried in fine print. If you call a prospect who is on the Do Not Call (DNC) list and the lead vendor did not capture proper consent, you are personally liable. TCPA lawsuits can cost thousands of dollars per violation. Exclusive life insurance leads that come with TrustedForm certificates and documented consent receipts mitigate this risk, acting as an insurance policy for your business.

Defining Exclusive Life Insurance Leads

So, what exactly are exclusive life insurance leads? In the context of a high-quality provider like Stallion Leads, “exclusive” means the data is generated in real-time and sold to exactly one agent. It is never resold. It is never recycled.

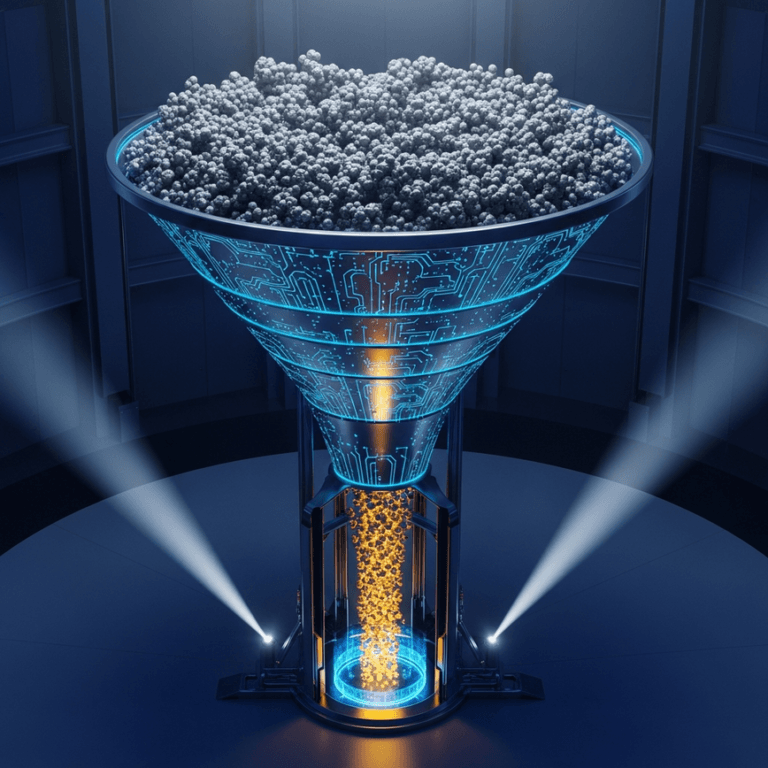

But exclusivity alone is not enough. A lead can be exclusive but still be low intent (e.g., someone who clicked a wrong button). The true value comes when exclusivity is paired with high-tech verification.

The Verification Difference

At Stallion Leads, we implement a layer of technology that most shared lead vendors simply cannot afford to use. We use SMS-verified phone numbers. When a prospect fills out a form, they receive a One-Time Passcode (OTP) to their mobile device. They must enter this code to submit the inquiry.

This single step eliminates bots, removes wrong numbers, and ensures the person on the other end is actually holding the phone. It filters out the “tire kickers” and leaves you with prospects who are genuinely interested. When you compare shared vs exclusive leads, this verification step is often the difference between a 5% contact rate and a 50% contact rate.

Consent and Compliance

True exclusive life insurance leads come with a paper trail. We provide TrustedForm-style consent certificates with every lead. This includes a timestamp, the IP address, and a snapshot of the page the user was on when they submitted their info. You know exactly what they saw and what they agreed to. This transparency allows you to call with confidence, knowing you are compliant with federal regulations.

The ROI Showdown: Running the Numbers

Let’s move away from theory and look at the hard math. We will compare two scenarios. In Scenario A, an agent buys cheap shared leads. In Scenario B, the agent invests in verified, exclusive life insurance leads.

Scenario A: The “Cheap” Route

- Budget: $500

- Lead Cost: $2.50 (Shared)

- Volume: 200 Leads

- Contact Rate: 8% (Due to competition and bad numbers)

- Contacts Made: 16 people

- Close Rate on Contacts: 10%

- Total Sales: 1.6 (Round to 2 policies)

- Average Commission: $600

- Total Revenue: $1,200

- Gross Profit: $700

- Time Investment: To dial 200 leads enough times to get those 16 contacts, you likely spent 15 to 20 hours of pure dialing.

- Real Hourly Wage: ~$35/hour.

Scenario B: The Exclusive Route

- Budget: $500

- Lead Cost: $25 (Exclusive, SMS Verified)

- Volume: 20 Leads

- Contact Rate: 45% (Verified numbers, no competition)

- Contacts Made: 9 people

- Close Rate on Contacts: 25% (Higher intent, less defensive)

- Total Sales: 2.25 (Round to 2 policies)

- Average Commission: $600

- Total Revenue: $1,200

- Gross Profit: $700

- Time Investment: To dial 20 leads and speak to 9 people, you likely spent 2 to 3 hours.

- Real Hourly Wage: ~$230/hour.

The Verdict

In both scenarios, the upfront cost and the total revenue were similar. However, the cost of final expense leads in terms of effort was drastically different. In Scenario B, the agent made the same money in one afternoon that the agent in Scenario A took three days to earn.

Furthermore, the agent in Scenario B has 18 remaining high-quality leads that can still be nurtured. The agent in Scenario A has 184 dead leads that will likely never convert.

When you scale this up, the difference becomes massive. If you want to write $10,000 in premium a month, you physically cannot make enough dials to do it with bad data. You need efficiency. You need exclusive life insurance leads.

Why “Cost Per Lead” is a Vanity Metric

Marketing agencies love to brag about getting leads for $1. It sounds impressive in a Facebook ad. But as a business owner, you should not care about Cost Per Lead (CPL). You should care about Cost Per Acquisition (CPA).

- If you spend $500 to get one customer using shared leads, your CPA is $500.

- If you spend $500 to get three customers using exclusive leads, your CPA is $166.

The cost of final expense leads is irrelevant if they do not convert. High-intent, exclusive leads will always have a higher sticker price because they cost more to generate. We bid on premium traffic on mainstream channels. We pay for the SMS verification texts. We pay for the server infrastructure to route that lead to your CRM in seconds via webhook or API.

You are paying for the infrastructure that guarantees the quality. When you buy a $2 lead, you are paying for a row on a spreadsheet that five other people also own.

The Role of Technology in Lead Quality

Understanding the technology behind lead generation helps explain the price difference in shared vs exclusive leads.

At Stallion Leads, we do not just run ads and hope for the best. We utilize a sophisticated tech stack involving n8n, Google Sheets, and Twilio to analyze, score, and route leads instantly.

Real-Time Delivery

Shared leads are often delivered in batches or via email CSV files hours after the consumer applied. By then, the intent has cooled. Exclusive life insurance leads from Stallion are delivered in real-time.

When a prospect hits “submit,” our system processes the data, verifies the phone number, captures the consent certificate, and pushes the lead directly into your CRM (like GoHighLevel or HubSpot) or a secure Google Sheet. This happens in seconds.

This means you can call the prospect while they are still looking at their phone. The psychological impact of calling within one minute of a request increases conversion rates by up to 391%. You cannot achieve that speed with shared, batched data.

Continuous QA Loops

We treat lead generation as a living system. We have a continuous Quality Assurance loop where we monitor buyer feedback. If an agent reports that a specific creative angle is generating leads that are confused about the product, we adjust the funnel.

We do not disclose our media plans or testing frameworks because that is our intellectual property, but you get the outcome: a list of prospects who know what they applied for. This level of management and optimization is absent in the cheap lead market.

How to Transition from Shared to Exclusive

If you are currently relying on shared leads, the idea of paying 10x more per lead can be scary. You might worry about blowing your budget on a small handful of prospects.

Here is the safest way to transition:

- Do Not Quit Cold Turkey: If shared leads are currently paying your bills, keep them running at a lower volume.

- Start with a Pilot Block: You do not need to sign a long-term contract. At Stallion Leads, we have no retainers and no lock-in contracts. You can fund a small block of leads to test the waters.

- Adjust Your Workflow: When working exclusive life insurance leads, you cannot just power dial. You need to prepare. Review the lead data. Check the age and location.

- Commit to the Cadence: Since you have fewer leads, you must work them harder. We provide a “Speed to Lead” playbook that outlines exactly when to call and text.

- Measure CPA, Not CPL: At the end of the pilot, look at how much commission you generated relative to the spend. Ignore the lead count. Look at the profit.

Compliance: The Ultimate Value Add

We touched on this earlier, but it bears repeating in the context of value. The regulatory environment for telemarketing is getting stricter every year. The FCC is cracking down on “consent farming.”

When you evaluate the cost of final expense leads, you must factor in the value of safety. Stallion Leads ensures that every single lead is TCPA and CASL aligned. We store the consent receipts. We do not sell your data to other vendors.

If a consumer complains, you have the documentation to prove they requested the call. That peace of mind is worth more than the few dollars you save on shared data.

Conclusion: You Get What You Pay For

The old adage holds true in the lead generation industry. You can have cheap leads, or you can have good leads, but you generally cannot have both.

The cost of final expense leads should be viewed as an investment in your sales pipeline. If you fill that pipeline with sludge, your engine will seize up. If you fill it with premium fuel, your agency will run efficiently and profitably.

By choosing exclusive life insurance leads, you are choosing to value your time, protect your business from liability, and build a predictable revenue stream. You are moving away from the chaos of the shared market and into a professional partnership where the goal is quality, not just quantity.

Stop burning out on data that was dead before you even dialed. Stop chasing dead leads and start working with verified prospects that are waiting to hear from you.

Stallion Leads is ready to be your partner in this transition. With transparent pricing, SMS verification, and a commitment to exclusivity, we provide the tools you need to stop churning and start closing. Request your state-by-state rate card today and see the difference that quality makes.