The promise of $10 final expense leads sounds like a magic bullet for any insurance agent. It suggests a world where your pipeline is always full, your risk is minimal, and your daily activity is packed with potential clients. For just the cost of a couple of coffees, you get a name, a number, and a chance to write a policy. It’s an incredibly tempting offer, especially when you’re trying to scale your business or get a new agency off the ground.

Table of Contents

- The Anatomy of a ‘$10 Final Expense Lead’

- Calculating the Hidden Costs: The Real Price You Pay

- The Myth of ‘Final Expense Leads Free’

- The Solution: Focus on Cost-Per-Acquisition, Not Cost-Per-Lead

- How to Make the Switch from Cheap to Valuable

- Conclusion: Stop Buying Data, Start Investing in Conversations

But this promise is a trap. The initial low price masks a mountain of hidden costs that drain your most valuable resources: your time, your energy, and your capital. The reality is that cheap final expense leads often result in a cost-per-acquisition (CPA) that is astronomically higher than investing in premium, exclusive leads from the start.

This article pulls back the curtain on the low-cost lead industry. We will dissect the anatomy of a typical $10 final expense lead, calculate the true financial and operational costs, and provide a clear framework for shifting your focus from a low cost-per-lead (CPL) to a profitable cost-per-acquisition (CPA). Building a sustainable career in final expense insurance isn’t about finding the cheapest data; it’s about investing in the most efficient path to a closed deal.

The Anatomy of a ‘$10 Final Expense Lead’

To understand why these leads are so detrimental, you first need to know where they come from and what they actually are. Vendors offering rock-bottom prices are not lead generation magicians; they are operating on a business model built on volume and reselling, not quality and exclusivity. When you buy cheap final expense leads, you are almost certainly buying one of the following.

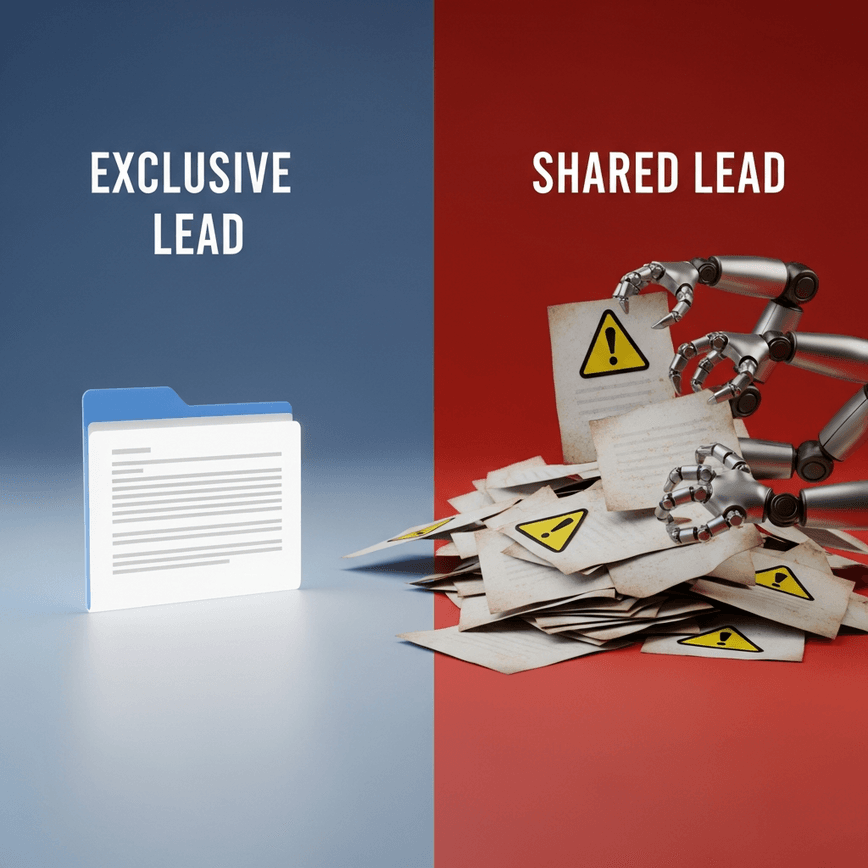

1. Shared and Oversold Leads

The most common type of cheap lead is the shared lead. The vendor’s entire profit model relies on selling the same prospect’s information to as many agents as possible. That single lead you purchased for $10 was also sold to five, ten, or even twenty other agents at the same time.

This immediately creates a toxic environment for both the agent and the prospect. The moment the lead enters the system, the prospect’s phone starts ringing off the hook. You are no longer a helpful advisor; you are just another number in a long call log. The conversation shifts from “How can I help you?” to “Who are you and why are you calling me?” The prospect becomes irritated, defensive, and completely burned out before you even have a chance to build rapport. You are forced into a high-pressure race to be the first person to make contact—a race you will almost always lose.

2. Aged Final Expense Leads

Another staple of the low-cost market is aged final expense leads. These are not fresh inquiries. They are prospects who expressed interest at some point in the past, perhaps a week, a month, or even six months ago. The vendor purchased this old data for pennies on the dollar and is now reselling it to you.

The problem with aged final expense leads is simple: intent has a short shelf life. The urgency that drove the prospect to seek information has vanished. In the time since their initial inquiry, they have likely:

- Already purchased a policy from another agent.

- Decided against getting coverage for now.

- Forgotten they ever filled out a form.

- Been contacted by dozens of other agents who bought the same aged list.

You are calling people who are no longer in the market. Your contact rate will be abysmal, and the few people you do reach will have little to no interest in speaking with you. You are spending your valuable time attempting to resurrect dead opportunities.

3. Recycled and Incentivized Data

The lowest tier of cheap final expense leads often comes from questionable sources. This data isn’t generated from a form where a person specifically requested a quote for final expense insurance. Instead, it’s scraped from unrelated online activities. The prospect might have entered a contest for a “free iPad” or filled out a survey that sold their data in the fine print.

These individuals have zero intent. They were not looking for insurance and are often confused or angry when you call. This practice is not only ineffective but also dangerous. Leads generated without explicit, documented consent can put you in direct violation of the Telephone Consumer Protection Act (TCPA), opening you and your agency up to severe legal and financial penalties. A quality lead provider will always furnish proof of consent, such as a TrustedForm-style certificate, to protect you. If your vendor can’t provide this, you are taking a massive risk.

Calculating the Hidden Costs: The Real Price You Pay

The sticker price of a $10 final expense lead is just the tip of the iceberg. The true cost is measured in wasted hours, depleted motivation, and a disastrously inefficient sales process. Let’s break down the real expenses you incur when you build your business on a foundation of cheap data.

The Cost of Wasted Time

Time is your most finite and valuable asset as a sales professional. Every hour you spend dialing disconnected numbers, leaving voicemails for uninterested prospects, and navigating hostile conversations is an hour you cannot spend on revenue-generating activities.

Imagine you spend four hours dialing a list of 100 cheap final expense leads. You might encounter:

- 30–40 wrong or disconnected numbers.

- 30–40 prospects who don’t answer.

- 10–20 people who are angry you called.

- A handful of lukewarm conversations that go nowhere.

At the end of the day, you have nothing to show for your effort but frustration. A premium lead provider mitigates this by using real-time SMS verification and carrier-level checks to ensure the phone number is valid and belongs to the prospect, drastically increasing the efficiency of your dialing sessions.

The Cost of a Devastated Contact Rate

The first metric that suffers is your contact rate. With shared and aged final expense leads, you are lucky if you speak to 10–15% of the people on your list. The rest are bad numbers or people who are actively ignoring calls from unknown numbers after being harassed.

Let’s do the math. If you buy 100 leads at $10 each for a total of $1,000, and you only manage to speak with 15 of them, your effective cost-per-contact is not $10. It’s over $66 ($1,000 / 15 contacts). You are paying $66 just for the chance to have a conversation, and that conversation is often with an annoyed and unqualified individual.

The Cost of Abysmal Conversion Rates

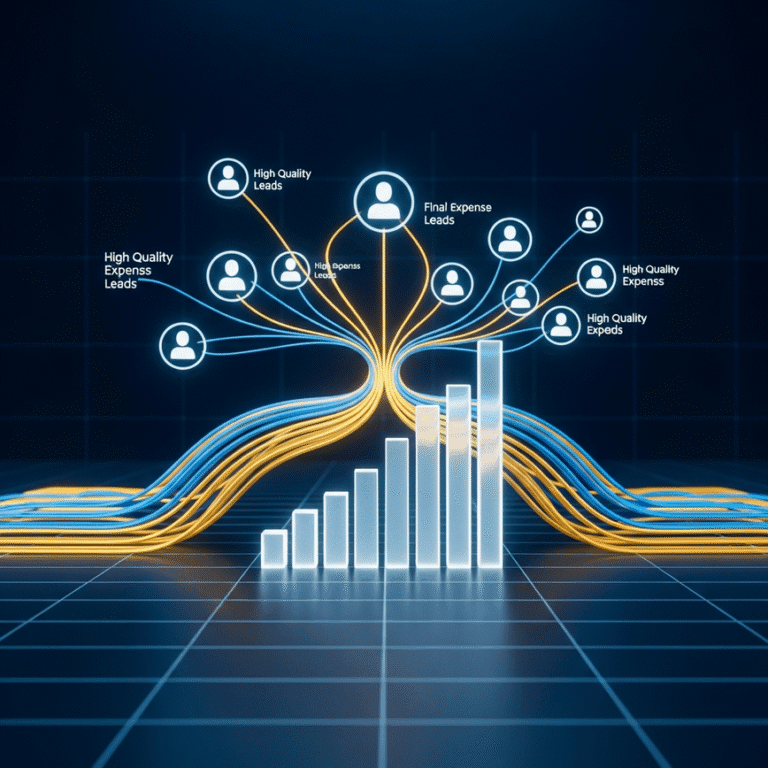

Even when you do make contact, the journey to a closed deal is fraught with challenges. Because the intent is low and competition is high, your appointment-setting rate and close rate will plummet. A great closer might convert 10% of premium, exclusive leads. On a list of cheap, shared leads, that number might fall to 1% or less.

Let’s compare two scenarios:

Scenario A: Agent Adams Buys Cheap Leads

- Investment: 100 leads @ $10/lead = $1,000

- Contact Rate: 15% (15 people spoken to)

- Appointment Rate: 20% of contacts (3 appointments set)

- Close Rate: 33% of appointments (1 policy sold)

- Result: Agent Adams spent $1,000 to acquire one new client.

Scenario B: Agent Bell Buys Quality Leads

- Investment: 30 leads @ $30/lead = $900

- Contact Rate: 70% (21 people spoken to)

- Appointment Rate: 50% of contacts (10 appointments set)

- Close Rate: 30% of appointments (3 policies sold)

- Result: Agent Bell spent $300 to acquire each new client.

Despite a higher upfront per-lead price, Agent Bell’s cost-per-acquisition is 60% lower than Agent Adams’. Agent Bell also wrote three times the business while spending far less time dealing with dead ends. This is the fundamental economic flaw in the $10 final expense leads model.

The Cost of Agent Burnout and Low Morale

Beyond the numbers, there is a significant human cost. Spending day after day facing rejection, frustration, and hostility is draining. It crushes morale and leads to burnout. Many promising agents leave the industry not because they can’t sell, but because they can’t handle the constant grind of prospecting with bad data. A steady flow of high-intent, exclusive prospects who are actually expecting your call transforms your work from a demoralizing grind into an exciting and rewarding career.

The Myth of ‘Final Expense Leads Free’

In your search for low-cost options, you will inevitably encounter offers for final expense leads free of charge. This is the most dangerous trap of all. In business, nothing of value is ever truly free. These offers are almost always a bait-and-switch designed to benefit the provider at your expense.

Offers of final expense leads free typically fall into one of these categories:

- A Lead Magnet for Another Service: A company will offer a small handful of “free” leads to get you on the phone and sell you an expensive CRM, a high-priced coaching program, or a recurring marketing service. The leads themselves are often the same low-quality, aged data you would otherwise pay for.

- Data Harvesting Scams: Some entities offer free leads in exchange for your personal or business information, which they then sell to other marketers. You become the product.

- Unsustainable Referral Models: These might be part of an IMO or FMO structure where leads are “free” but come with lower commissions or other contractual obligations. The quality is often inconsistent, and the volume is never enough to build a predictable business.

A professional agent’s goal is to build a scalable, predictable system for acquiring new clients. Relying on freebies and gimmicks is the antithesis of this approach. It creates dependency and inconsistency, preventing you from ever taking full control of your pipeline and your income.

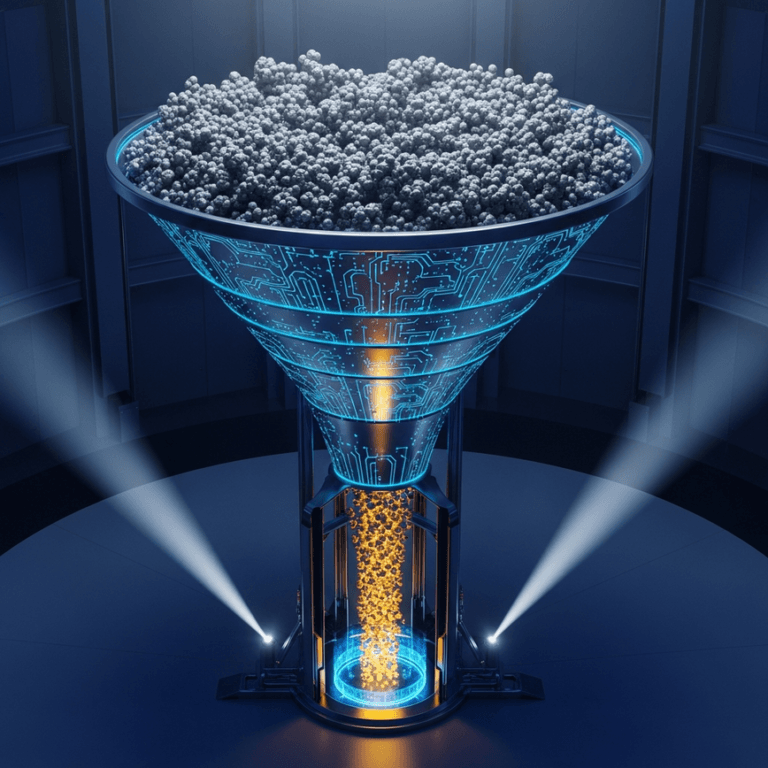

The Solution: Focus on Cost-Per-Acquisition, Not Cost-Per-Lead

The only metric that truly matters is your Cost-Per-Acquisition (CPA). The path to a lower CPA is not through cheaper leads, but through better, more efficient leads. A quality lead partner focuses on delivering prospects that maximize your chance of success at every stage of the sales funnel.

Here is what defines a high-quality lead that genuinely lowers your CPA:

- Exclusivity: The lead is sold once, to you and you alone. You never have to race against other agents. You can take the time to build rapport and properly serve the client.

- Real-Time Intent: The lead is delivered to you within seconds of the prospect submitting their request. Their interest is at its peak, and they are expecting a call from an expert.

- Verified Contact Information: The prospect’s phone number is verified via SMS one-time passcode. This simple step eliminates the vast majority of wrong numbers and fake submissions, ensuring your dialing time is spent talking to real people.

- Documented TCPA Consent: Every lead comes with a digital receipt of consent, including a timestamp, IP address, and a snapshot of the page where they agreed to be contacted. This protects your business from costly compliance violations.

When you invest in leads with these characteristics, your entire sales process becomes more efficient. Your contact rates skyrocket, your appointment-setting ratios improve, and your close rates climb. You spend less time prospecting and more time in qualified appointments, which is where you make your money. A transparent, pay-per-lead model with a predictable cost structure allows you to control your budget while maximizing your return. Learn more about a predictable lead cost structure and how it can transform your business.

How to Make the Switch from Cheap to Valuable

Transitioning away from the cycle of cheap final expense leads requires a shift in mindset and a commitment to a new process. Here is a simple action plan to get started.

- Audit Your True CPA: Before you make any changes, you need a baseline. Look at your last 30–60 days of activity with cheap leads. Calculate your total spend, the number of policies you wrote, and divide the spend by the number of policies. Be honest with yourself about this number. This is your true cost-per-acquisition.

- Partner with a Quality Provider: Find a lead generation partner who operates on a model of transparency and exclusivity. Ask them about their verification process, how they generate leads, and what compliance documentation they provide. A true partner will act as an extension of your business, focusing on delivering real, reachable prospects. They should offer flexible terms without long-term contracts, allowing you to start small and scale with confidence.

- Run a Small Pilot Batch: You don’t need to commit to a massive budget upfront. Start with a small, manageable block of premium, exclusive leads. This allows you to test the quality and see the difference in your results firsthand without significant risk.

- Commit to Speed-to-Lead: High-intent leads reward fast action. The most successful agents have a system to call a new lead within five minutes and send a text message within one minute. A quality lead partner will often provide you with proven scripts and a follow-up cadence to help you implement this strategy from day one.

- Track, Compare, and Scale: Meticulously track your metrics with the new leads: contact rate, appointment rate, and close rate. Calculate your new CPA and compare it to your baseline from the cheap leads. The results will speak for themselves. Once you have proven the superior ROI, you can confidently scale your investment to grow your income predictably.

Conclusion: Stop Buying Data, Start Investing in Conversations

The allure of $10 final expense leads is a powerful one, but it leads down a path of frustration, inefficiency, and burnout. These cheap final expense leads are not a shortcut to success; they are a roadblock that prevents you from building the sustainable and profitable business you deserve.

The true cost is not the price you pay for the lead, but the price you pay in wasted time, lost opportunities, and a cripplingly high cost-per-acquisition.

By shifting your focus to quality, exclusivity, and verification, you change the entire dynamic. You stop chasing dead-end data and start having meaningful conversations with genuinely interested prospects. This is the only way to lower your true acquisition costs, fill your calendar with quality appointments, and build a thriving final expense business for the long term.