In the world of final expense insurance, telesales is a game of speed, precision, and endurance. Unlike face-to-face appointments where you can build rapport through body language, your voice is your only tool. Every minute spent dialing a wrong number, talking to an uninterested prospect, or chasing a lead that five other agents are already calling is a minute you’re not closing a policy. This is why finding the best final expense leads for telesales isn’t just a priority; it’s the foundation of your entire business.

Table of Contents

- Why Telesales Demands a Different Breed of Lead

- The Anatomy of the Perfect Telesales Final Expense Lead

- How Do You Find Good Leads for Life Insurance? A Breakdown of Common Sources

- Building a Winning Telesales Workflow with High-Quality Leads

- Key Questions to Ask Any Lead Vendor Before You Buy

- Conclusion: Stop Dialing, Start Connecting

The challenge is that not all leads are created equal. A lead that might work for a field agent with a flexible schedule can be a complete waste of time for a telesales professional who relies on volume and efficiency. You need leads that are not just interested, but ready to engage over the phone, right now.

This guide is designed for the modern telesales agent. We will break down what makes a final expense lead truly valuable for a phone-based sales process. We’ll explore the different sources available, expose the common traps that drain your marketing budget, and provide a clear framework for identifying high-intent prospects who are expecting your call. By the end, you’ll understand exactly how to find good leads for life insurance that are tailor-made to fuel a high-performance telesales operation.

Why Telesales Demands a Different Breed of Lead

The unique structure of telesales amplifies the impact of lead quality, for better or for worse. While a field agent might only work a handful of leads in a day, a telesales agent needs a steady stream of opportunities to hit their numbers. This high-volume environment creates specific pressures that low-quality leads exploit.

The Speed Imperative: Real-Time is Non-Negotiable

A prospect’s interest in final expense insurance has a short half-life. The moment they submit a form requesting a quote, their intent is at its absolute peak. Research consistently shows that the odds of making contact with a lead drop dramatically after the first five minutes. For telesales, this isn’t just a statistic; it’s a fundamental law of physics.

If you are buying leads that are hours or even days old, you are starting every conversation at a disadvantage. The prospect’s memory has faded, another agent may have already called them, or their initial curiosity has been replaced by daily distractions. Real-time leads, delivered to your CRM or dialer the instant they are generated, are the only way to capitalize on that peak moment of intent.

The Compliance Minefield: TCPA and DNC Risks

Telesales agents operate under a microscope of regulatory scrutiny. The Telephone Consumer Protection Act (TCPA) carries severe penalties for calling consumers without their express written consent. A single violation can cost you hundreds or thousands of dollars.

Many cheap lead providers play fast and loose with compliance. They might use vague language on their forms or lack the proper infrastructure to document consent. For a telesales agent, using these leads is like walking through a legal minefield. You need leads that come with an ironclad, verifiable record of consent, such as a TrustedForm certificate. This documentation proves the prospect agreed to be contacted, protecting your business and your license.

The Intent Gap: Separating Casual Shoppers from Serious Buyers

How was the lead generated? This is one of the most critical questions a telesales agent can ask. Was it from a misleading ad promising free groceries? Or was it from a clear, straightforward funnel that asked qualifying questions about their needs for final expense insurance?

The difference is what we call the “intent gap.” A low-intent lead might have clicked a button without fully understanding what they were signing up for, leading to confused or hostile conversations. A high-intent lead, on the other hand, has been pre-qualified through a series of thoughtful questions. They have actively provided their information after learning about final expense coverage. This process, often managed through conversion-optimized funnels, ensures the person you are calling has a genuine interest and is expecting a conversation about insurance.

The Burnout Factor: How Bad Leads Destroy Morale

Dialing hundreds of numbers a day only to be met with disconnected lines, angry prospects who never requested a call, or people who have already been called ten times is incredibly demoralizing. Agent burnout is a real and costly problem in the insurance industry, and it’s driven primarily by poor lead quality.

Investing in high-quality telesales final expense leads is an investment in your own motivation and longevity. When you know that each name on your list has been verified, is expecting your call, and has expressed genuine interest, your entire mindset shifts. You move from a place of cold calling to a place of warm, consultative selling, which is more effective and infinitely more sustainable.

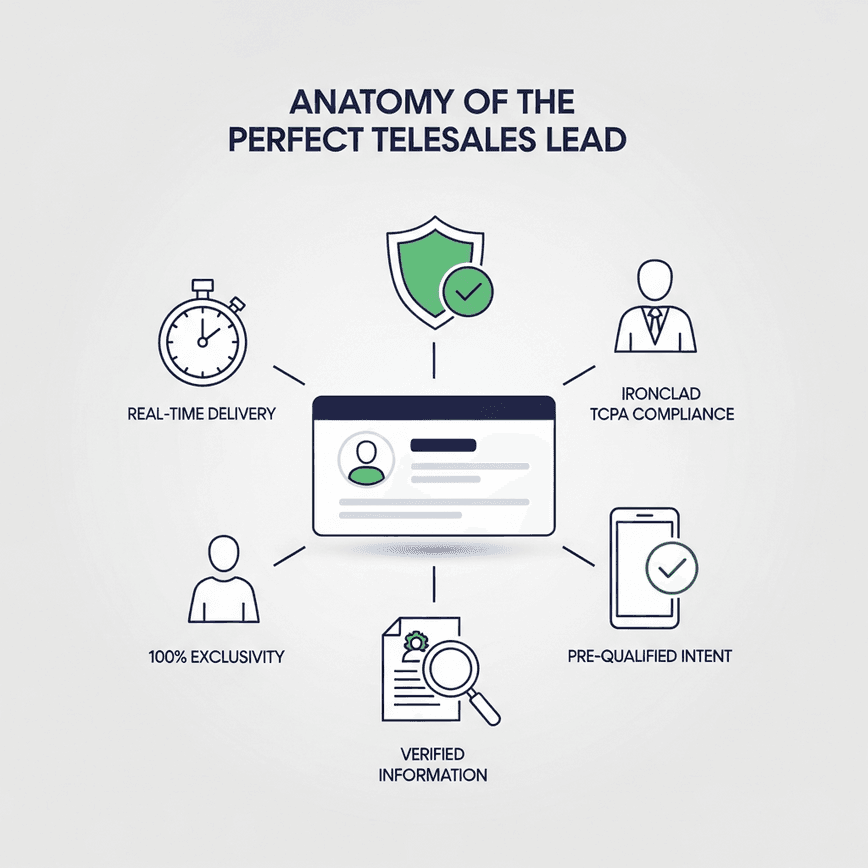

The Anatomy of the Perfect Telesales Final Expense Lead

Now that we understand the unique challenges, let’s define the solution. The ideal lead for a telesales agent isn’t a magical unicorn; it’s a product of a meticulous, data-driven system. Here are the five essential criteria that separate the best from the rest.

- Real-Time Delivery: As we’ve established, speed is everything. A perfect telesales lead is generated and delivered to you in seconds, not minutes or hours. This requires a lead generation partner with a sophisticated automation stack that can instantly capture, process, and route the lead to your system. This immediate transfer allows you to be the very first agent to make contact, dramatically increasing your chances of setting an appointment and closing a sale.

- Verified Contact Information: How much time do you waste each day on bad phone numbers? A disconnected line or a number that goes to the wrong person is a complete stop in your workflow. Top-tier lead generation systems solve this problem by integrating real-time verification. Using services like Twilio, they send a one-time password (OTP) via SMS to the prospect’s phone before the lead is ever finalized. This simple step confirms that the phone number is active, accurate, and in the possession of the person submitting the form. It’s a quality control filter that eliminates one of the biggest time-wasters in telesales.

- Ironclad TCPA Compliance: A high-quality lead is a compliant lead. There are no exceptions. The gold standard for proving consent is a TrustedForm certificate. This technology captures the entire lead generation event, creating a video-like replay of the prospect’s interaction with the form. It records the exact moment they provided consent, along with a timestamp and IP address. When your lead provider includes a TrustedForm certificate with every single lead, you have undeniable proof of compliance, giving you the confidence to dial without fear.

- 100% Exclusivity: An exclusive lead is sold to one and only one agent. This is a critical distinction. Many vendors sell the same lead to three, five, or even ten different agents. This creates a frantic race to be the first to call and results in the prospect being bombarded with calls. They become annoyed and frustrated, making it nearly impossible for anyone to make a sale. Exclusive telesales final expense leads ensure that you are the only agent building a relationship with that prospect. It protects your investment and preserves the prospect’s positive experience.

- Demonstrated, Pre-Qualified Intent: The best leads come from marketing funnels designed to educate and qualify. Instead of a simple “name and number” form, these funnels ask a series of questions that prime the prospect for a productive conversation. They might ask about their age, whether they have existing coverage, and what their primary goal is for securing a policy. This multi-step process does two things: it filters out low-intent individuals who aren’t serious, and it provides you with valuable context you can use to tailor your opening script and build instant rapport.

How Do You Find Good Leads for Life Insurance? A Breakdown of Common Sources

With a clear picture of what a great lead looks like, the next question is, where do you find them? The lead generation market is vast, and it’s important to understand the pros and cons of each source, especially through the lens of a telesales agent.

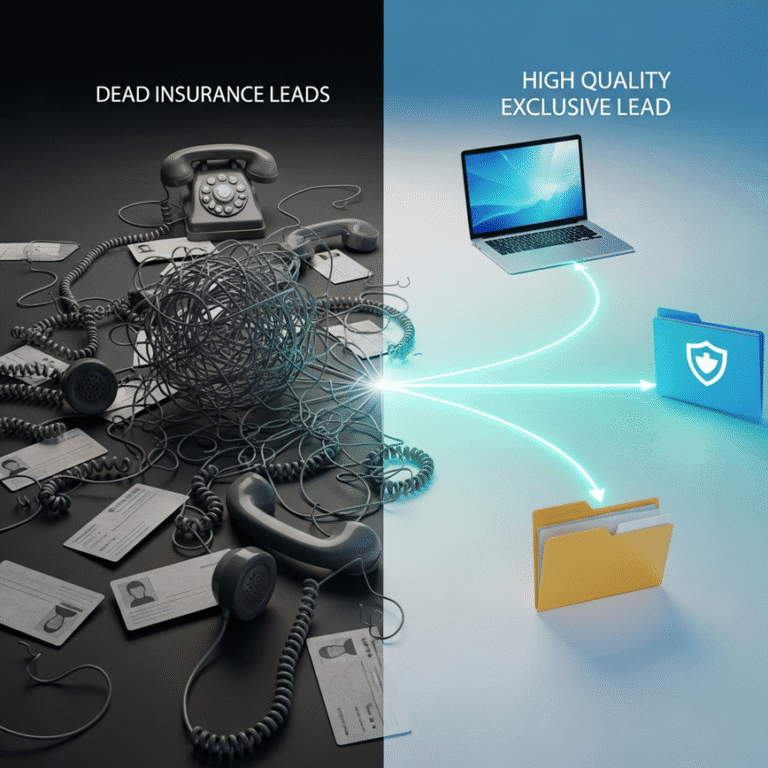

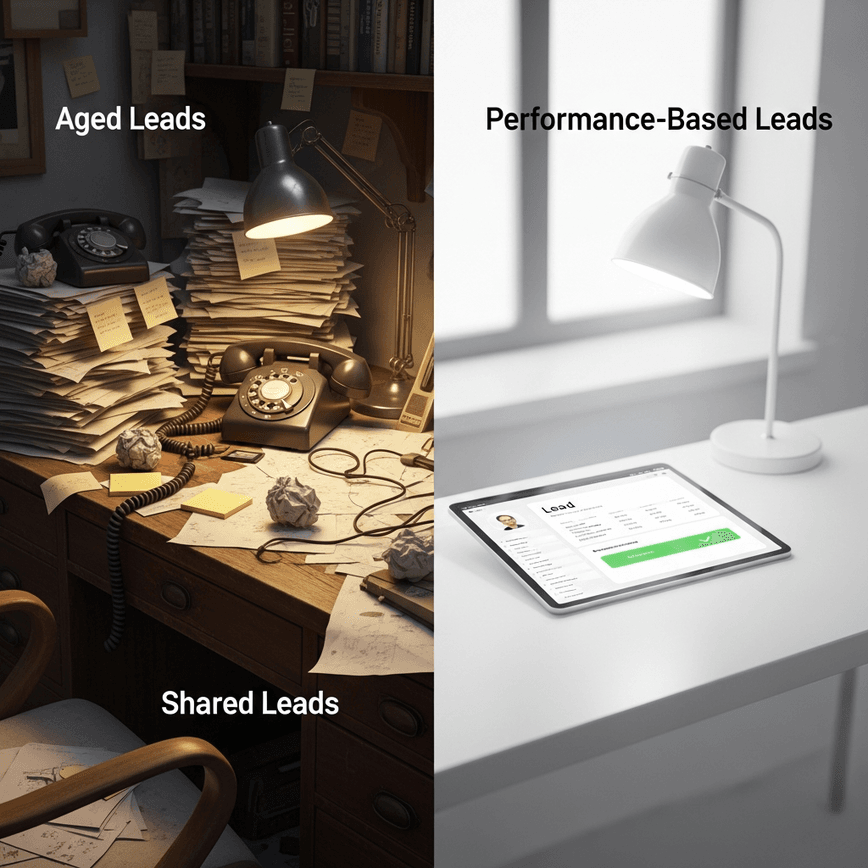

Aged Leads: The Low-Cost Trap

Aged leads are old leads that were unsold or unworked, now being resold at a steep discount. The appeal is obvious: you can buy a large volume of data for a very low price.

- Pros: Extremely cheap.

- Cons for Telesales: The cons are overwhelming. Contact rates are abysmal because the data is old and the prospect’s intent is long gone. These leads have likely been called by countless other agents. You’ll spend most of your day navigating disconnected numbers and hearing “I’m not interested anymore.” For a high-efficiency telesales model, aged leads are a recipe for failure.

Shared Leads: A Race to the Bottom

Shared leads are sold to multiple agents at the same time. They are cheaper than exclusive leads but present a significant challenge.

- Pros: Less expensive than exclusive leads.

- Cons for Telesales: You are in a direct race with several other agents to make first contact. This environment destroys any chance of a consultative sale. Even if you are the first to call, the prospect will likely receive follow-up calls from your competitors, creating confusion and commoditizing the sales process. It’s a high-pressure, low-margin approach that rarely works for building a sustainable business.

Direct Mail Leads: The Old Guard

Direct mail has been a staple of final expense marketing for decades. It involves sending physical mailers to a targeted demographic and waiting for them to fill out and return a business reply card.

- Pros: Can generate high-intent prospects, as it requires significant effort from the consumer.

- Cons for Telesales: The process is slow, expensive, and difficult to scale. The feedback loop is measured in weeks, not minutes. By the time you receive the card, the prospect’s urgency may have waned. While effective for some field agents, the lack of speed and real-time data makes direct mail a poor fit for a dynamic telesales operation.

Self-Generated Leads (DIY): The Control vs. Cost Dilemma

Many ambitious agents decide to run their own ads on platforms like Facebook or Google. The appeal is total control over the marketing message and lead quality.

- Pros: You control the creative, the targeting, and the lead experience. You aren’t reliant on a third-party vendor.

- Cons for Telesales: The learning curve is incredibly steep. You must become an expert in media buying, copywriting, funnel building, and compliance. It requires a significant upfront investment in ad spend with no guarantee of results. Managing TCPA compliance, data verification, and real-time routing is a full-time job in itself. For most agents, the time and money spent trying to master this is better spent on what they do best: selling insurance.

Performance-Based Lead Partners: The Modern Solution

A performance-based lead partner operates on a Pay-Per-Lead model. You don’t pay for clicks, impressions, or management fees. You only pay for a qualified, verified lead that meets a strict set of quality criteria.

- Pros: This model aligns the incentives of the lead provider with your own. They only succeed if they deliver leads that you can actually work and close. The best partners specialize exclusively in insurance and handle all the complexities of ad management, funnel optimization, SMS verification, and TCPA compliance. You get the quality of a DIY setup without the risk, cost, or headache.

- Cons for Telesales: The cost per lead is higher than aged or shared leads. However, the ROI is exponentially greater because you are investing in results, not just data. Your contact rates, quote rates, and close rates are all significantly higher, making the total cost of acquisition far lower in the long run.

Building a Winning Telesales Workflow with High-Quality Leads

Getting the right leads is only half the battle. To truly maximize your ROI, you need a workflow that is optimized to handle high-intent, real-time prospects.

- Automate Your Speed-to-Lead: Your system must be set up to engage a new lead instantly. This means integrating your lead source directly with your CRM and dialer. When a new lead arrives, it should automatically trigger a call. Manual data entry is too slow. The goal is to be on the phone with the prospect within 60 seconds of them hitting the “submit” button on the form.

- Refine Your Opening Script: With a high-quality lead, you don’t need a generic, cold-call opener. You have context. Your script should immediately reference the action they just took. For example: “Hi [Prospect Name], this is [Your Name]. You just filled out a request on our website for some information about new state-regulated final expense programs. I just got your request and wanted to get that information over to you. Did you have a quick minute?” This approach is respectful, relevant, and immediately establishes a warm connection.

- Leverage the Pre-Qualification Data: If your lead provider uses multi-step funnels, you will receive more than just contact information. You might know the prospect’s age range or their primary motivation. Use this information to personalize the conversation. It shows you were paying attention and allows you to tailor your presentation to their specific needs right from the start.

- Implement a Structured Follow-Up Cadence: Even the best final expense leads for telesales won’t all answer on the first call. A persistent, multi-channel follow-up strategy is essential. This should be a mix of phone calls, text messages, and emails spaced out over several days. A good lead partner will often provide proven scripts and follow-up templates to help you convert more leads over time. Remember, you’ve invested in an exclusive, high-intent prospect; don’t give up after one or two attempts.

Key Questions to Ask Any Lead Vendor Before You Buy

To protect your investment and ensure you’re partnering with a quality provider, you need to ask the right questions. A reputable vendor will have clear, confident answers to these queries.

- “Are your leads 100% exclusive and delivered in real time?” If the answer is anything but an immediate “yes,” you should be cautious.

- “How do you verify the prospect’s contact information?” Look for an answer that includes SMS or phone verification to ensure data accuracy.

- “Can you provide proof of TCPA consent, like a TrustedForm certificate, for every lead?” This is non-negotiable for protecting your business.

- “What is your business model? Do I pay for clicks and impressions, or do I only pay for a verified lead?” A performance-based, Pay-Per-Lead model is the safest and most ROI-focused option.

- “Do you specialize in final expense and life insurance leads?” A specialist will always outperform a generalist. A vendor who understands the nuances of the final expense market will generate higher-quality, higher-intent prospects.

Conclusion: Stop Dialing, Start Connecting

The success of your telesales business is a direct result of the quality of the conversations you have each day. Chasing aged data, competing with other agents for shared leads, or wrestling with the complexities of DIY marketing are all distractions from your primary goal: helping families and writing policies.

By focusing your efforts on acquiring the best final expense leads for telesales, you transform your operation. You replace cold, frustrating dials with warm, productive conversations. You spend your time talking to verified, compliant, and genuinely interested prospects who are expecting your call. This is not only a more profitable way to work; it’s a more sustainable and enjoyable way to build your career.

When you’re ready to stop chasing dead ends and start building a predictable sales pipeline, the solution is clear. It’s time to invest in a partner who is as committed to your success as you are. Get exclusive, SMS-verified insurance leads and experience the difference that true quality makes.