The final expense insurance market is competitive. For independent agents and agencies, a steady flow of qualified leads is not just a goal; it’s the lifeblood of the business. In the search for that pipeline, agents inevitably face a critical decision: invest in fresh, exclusive leads or cut costs with cheaper, aged leads?

Table of Contents

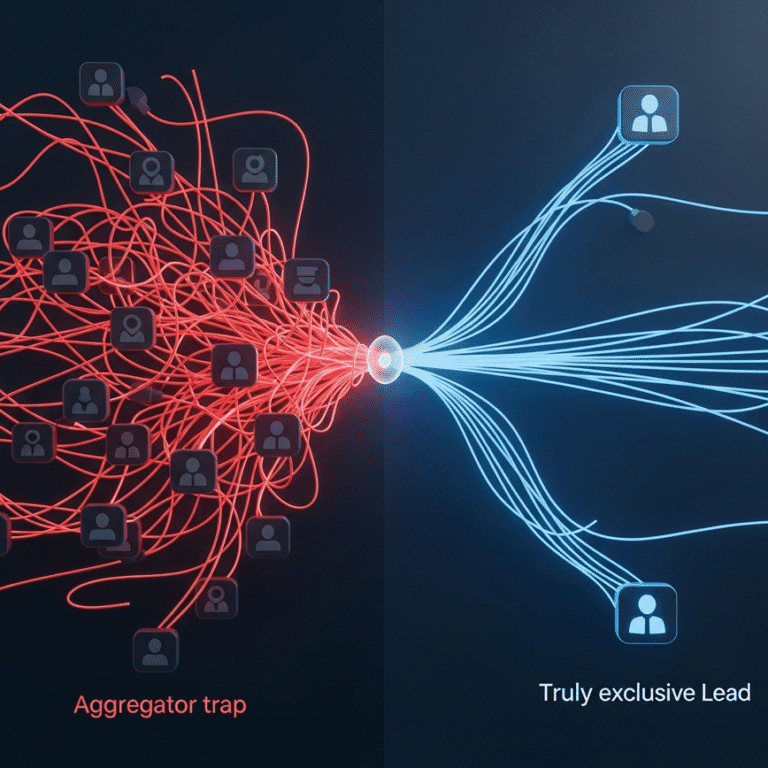

On the surface, the choice seems like a simple budget calculation. Aged leads are sold for pennies on the dollar, offering the illusion of massive volume for minimal investment. Exclusive leads command a premium, promising higher intent and better contact rates. But this simple cost analysis misses the most critical factor that can make or break an agency in today’s landscape: legal compliance.

The real difference between exclusive and aged final expense leads isn’t just about timing or price. It’s about risk. It’s about the Telephone Consumer Protection Act (TCPA), and understanding its nuances is the key to building a sustainable, profitable, and lawsuit-proof insurance business. This guide breaks down what you need to know, moving beyond the surface-level debate to explore the deep compliance and ROI implications of your lead-buying strategy.

What is the Difference Between Aged and Exclusive Final Expense Leads?

Before diving into the legal complexities, it’s essential to establish clear, functional definitions for both lead types. Many vendors use these terms loosely, so understanding the fundamental distinctions is the first step toward making an informed investment.

Defining Exclusive Final Expense Leads

An exclusive final expense lead is a real-time inquiry from a prospect who has actively requested information about final expense insurance. The key attributes are immediacy and exclusivity.

- Real-Time Generation: The prospect has just completed a form, quiz, or survey and hit “submit” seconds before the lead is delivered to you. Their interest is at its peak.

- One-to-One Delivery: The lead is sold to one and only one agent or agency. You are not competing with five other agents who bought the same contact information.

- High Intent: The prospect’s action of filling out a detailed form indicates a genuine, immediate need or curiosity about solving their end-of-life expense problem.

- Verifiable Consent: A reputable provider of exclusive leads will have a clear, documented trail of consent. The prospect knowingly and willingly asked to be contacted by an insurance professional.

The primary advantage is quality. You are engaging a motivated consumer at the exact moment they are seeking a solution. This translates to higher contact rates, more meaningful conversations, and a significantly higher chance of setting an appointment and closing a policy. While the cost per lead is higher, the cost per acquisition is often much lower due to superior conversion rates.

Defining Aged Final Expense Leads

Aged final expense leads are exactly what they sound like: old contact information. These leads can be anywhere from 30 days to over a year old. They are typically generated as exclusive leads, fail to convert for the original buyer, and are then repackaged and resold at a steep discount.

- Delayed Information: The prospect’s original inquiry happened weeks or months ago. Their initial interest has likely faded, they may have already purchased a policy, or their circumstances may have changed.

- Sold Multiple Times: The core business model for aged leads is volume. A single lead is often sold to dozens, if not hundreds, of different agents over time.

- Low Intent: By the time you receive the lead, the prospect has forgotten they ever filled out a form. They have likely been bombarded with calls from other agents, leading to frustration and low receptiveness.

- Murky or Non-Existent Consent: This is the most dangerous attribute. The original consent trail is often lost or obscured. You have no reliable way of knowing what the prospect agreed to, who they agreed to be contacted by, or if they have since revoked that consent.

The only perceived advantage of aged leads is the low upfront cost. Agents can buy thousands of them for the price of a small batch of exclusive leads. However, this volume is a mirage. The abysmal contact and conversion rates mean agents spend most of their day dialing dead numbers and facing angry rejections, leading to burnout and a shockingly low return on investment.

The Elephant in the Room: TCPA Compliance and Lead Generation

Now we arrive at the heart of the matter. The financial and operational inefficiencies of aged leads are bad enough, but the legal risks they carry can be catastrophic for an insurance agent. Understanding the TCPA is not optional for anyone who uses a phone or text message to contact prospects.

What is the TCPA and Why Should Insurance Agents Care?

The Telephone Consumer Protection Act (TCPA) is a federal law designed to protect consumers from unwanted telemarketing calls, robocalls, and text messages. For insurance agents, the most important part of the TCPA is its strict requirement for “prior express written consent” before you can contact a consumer using an autodialer (which includes most modern CRM and power dialing systems) or send them automated text messages.

The penalties for violating the TCPA are severe: $500 per call or text that violates the law, which can jump to $1,500 for willful or knowing violations. A single list of non-compliant aged leads could easily result in tens of thousands of dollars in fines and legal fees. Class-action lawsuits have resulted in multi-million dollar settlements, bankrupting businesses overnight.

This isn’t a distant threat; it’s a clear and present danger for agents who are careless about their lead sources.

The Compliance Black Hole of Aged Leads

Aged leads represent a massive TCPA liability precisely because their history is a mystery. When you buy a list of aged leads, you are inheriting an unknown level of risk. Here’s why they are a compliance nightmare:

- Untraceable Origin: You have no idea where the lead originally came from. Was it a legitimate website with clear consent language, or a misleading ad that tricked the consumer into submitting their information? Without knowing the source, you cannot prove consent.

- Ambiguous Consent Language: The TCPA requires “clear and conspicuous” disclosure that the consumer agrees to receive telemarketing calls from a specific seller. The consent obtained for the original buyer months ago almost certainly does not transfer to you. The prospect never agreed to be contacted by your agency.

- Revoked Consent: The consumer could have told one of the previous 10 agents who called them to “stop calling” or placed their number on the National Do Not Call Registry. That revocation of consent applies to everyone, but you have no record of it. Every call you make after that point is a potential TCPA violation.

- Stale Data: Phone numbers get disconnected or reassigned. Calling a reassigned number that now belongs to someone else is a surefire way to generate a TCPA complaint, as that new owner never gave you consent.

Buying aged leads is a gamble. You are betting your business on the hope that the anonymous original generator and every agent who used the lead before you followed compliance best practices. It’s a bet that rarely pays off.

How Exclusive Leads Mitigate TCPA Risk

High-quality, exclusive final expense leads are generated with compliance as a core component of the process. A reputable lead partner doesn’t just sell you contact information; they provide you with proof of compliance. This is where modern lead generation systems create a protective shield for agents.

At Stallion Leads, we build our entire infrastructure around delivering TCPA compliant insurance leads. This isn’t an afterthought; it’s the foundation of our model. Here’s what agents should demand from any exclusive lead provider:

- Traceable, Verifiable Consent: Every lead must come with a clear data trail. This starts with the conversion-optimized funnels where prospects are captured. The language on these forms must be unambiguous, explicitly stating that the user agrees to be contacted by an insurance agent.

- TrustedForm Certification: The gold standard for proving consent is a TrustedForm certificate. This technology independently captures the entire lead generation event, creating a shareable certificate that includes a timestamp, IP address, the exact URL where the prospect submitted their info, and even a video replay of the screen. It is irrefutable proof that the consumer asked to be contacted.

- Real-Time Data Verification: To combat fake information and ensure data accuracy, every lead should be validated in real time. We use systems like SMS verification, where a prospect must enter a one-time passcode sent to their phone. This confirms they have provided a real, accessible phone number and are actively engaged in the process, strengthening the evidence of their intent.

When you invest in an exclusive lead from a compliance-first provider, you are buying peace of mind. You receive a prospect who wants to talk to you, and you get the documentation to prove it.

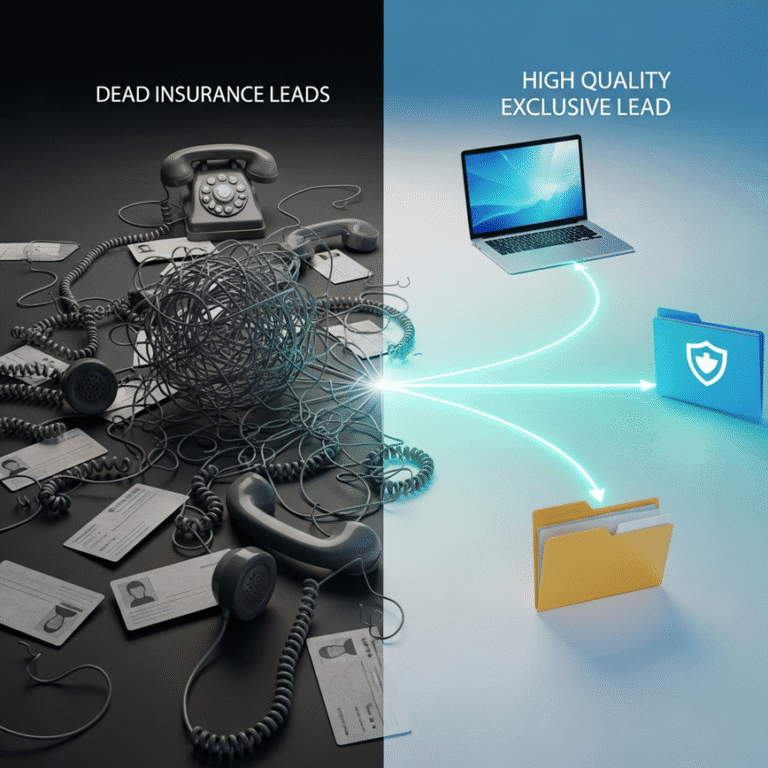

Beyond Compliance: A Head-to-Head ROI Comparison

While compliance is the most urgent reason to avoid aged leads, the financial argument for exclusive leads is just as compelling. To understand the true return on investment, you have to look beyond the initial cost per lead and calculate your final cost per acquisition.

The True Cost of Aged Final Expense Leads

The sticker price of an aged lead is deceptive. Let’s say you buy 1,000 aged leads for $1 each, for a total cost of $1,000. It seems cheap, but what do you get for that money?

- Wasted Time and Payroll: An agent might spend an entire day dialing 200 of these numbers. They may only have a handful of pickups, most of which are angry rejections or wrong numbers. If you pay your agent $25/hour, you just spent $200 on payroll for zero results. The cost of labor quickly eclipses the cost of the leads themselves.

- Agent Burnout and Turnover: Nothing crushes morale faster than constant rejection. Forcing talented agents to grind through dead-end lists is a primary driver of burnout and high turnover, which carries its own significant hiring and training costs.

- CRM and Dialer Expenses: You are paying for your CRM and dialing software to house and process thousands of useless contacts. This digital clutter slows down your systems and makes it harder to manage your actual, viable pipeline.

If that $1,000 list of 1,000 aged leads results in just one sale, your cost per acquisition is $1,000 plus the associated labor and overhead. The “cheap” leads suddenly become incredibly expensive.

The Compounding Value of Exclusive Final Expense Leads

Now, consider investing that same $1,000 into exclusive leads. Depending on the vendor, this might get you 20-30 high-intent, verified leads. The volume is lower, but the efficiency is exponentially higher.

- Exceptional Contact Rates: These prospects are expecting a call. It’s not uncommon for contact rates to be well over 50-60%. Your agents spend their time having productive conversations, not listening to dial tones.

- Higher Appointment and Close Rates: Because the intent is fresh, the prospect is ready to address their problem. They are more likely to agree to an appointment and are more receptive to your presentation. A skilled agent can often close 10-20% of high-quality exclusive leads.

- Predictable and Scalable Growth: With exclusive leads, you can build a predictable sales model. You know that for every X dollars you spend, you will generate Y appointments and Z policies. This allows you to scale your business confidently, adding agents and increasing your lead flow without wondering if your pipeline will dry up. Our performance-based model allows agents to start with small test batches and scale their orders weekly, removing the risk of long-term contracts.

If you invest $1,000 in 25 exclusive leads and close three of them, your cost per acquisition is just $333. The ROI is demonstrably superior, and your agents are happier and more productive.

How to Vet a Lead Vendor: A Compliance Checklist for Agents

The terms “exclusive” and “compliant” are thrown around loosely. It’s your responsibility to perform due diligence and ensure your lead partner is legitimate. Use this checklist to vet any potential vendor.

Questions to Ask About Their Lead Sources

- “Where and how do you generate your leads?” They should be able to tell you if they use social media ads, native advertising, or search engine marketing. A vague answer is a major red flag.

- “Are your ad campaigns and funnels built specifically for final expense insurance?” A generic lead vendor that serves 20 different industries is less likely to produce high-intent prospects than a specialist who understands the final expense niche inside and out.

Demanding Proof of Consent

- “Do you provide a TrustedForm certificate or another independent proof of consent with every lead?” If the answer is no, walk away. A simple timestamp and IP address stored in their own database is not enough.

- “Is the consumer’s phone number verified?” Ask if they use SMS or voice verification to confirm the data is accurate and the prospect is engaged. This is a key differentiator of top-tier lead providers.

Understanding Their Exclusivity Guarantee

- “What is your definition of ‘exclusive’?” The lead should be exclusive to you, forever. Some vendors define exclusive as “exclusive for 48 hours” before they resell it. Clarify this upfront.

- “What systems do you have in place to prevent selling me a duplicate lead?” A sophisticated vendor will use automation and AI-powered lead scoring to filter out duplicates and ensure every lead delivered meets strict quality standards.

Making the Smart Choice for Your Agency’s Future

The choice between exclusive and aged final expense leads is not a choice between a premium product and a budget alternative. It is a choice between a professional, sustainable business strategy and a high-risk, low-efficiency gamble.

Aged leads drain your most valuable resources: your time, your team’s morale, and your capital. Worse, they expose your agency to devastating legal risks that can erase your hard work overnight.

Exclusive, compliant leads are an investment in predictability, efficiency, and safety. They empower your agents to do what they do best: build relationships and sell policies. By partnering with a lead generation agency that prioritizes compliance and verification, you are not just buying leads; you are building a scalable pipeline for long-term success. If you are ready to stop wasting time and money on dead ends, it’s time to invest in a system that delivers measurable results. Get exclusive, SMS-verified final expense leads that actually convert and discover how a true performance partnership can transform your agency’s growth.